Prices & performance

Show fund factsheets & data

Strategy Overview

Key Facts

Exit Price:

Price Date:

Issuer:

* This is an annualised interest rate from the past seven days. For actual performance for our Cash Funds, please view the performance page.

Issuer:

Strategy Overview

Key Facts

A broader, all-weather approach to equity income

Recognising that retirees need an approach that can reliably deliver income through tougher market conditions, our team pioneered a defensive equity strategy in 2005 that could provide income and some capital growth with low volatility through the cycle. The same team manage the equity income strategy today.

Why invest

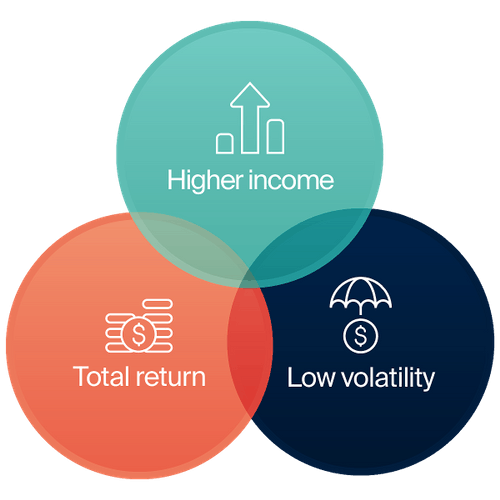

Aligned to the needs of conservative equity investors, the strategy is designed to provide a smoother return profile than the share market and a higher income stream over the long term.

Managed by recognised leaders in objectives-based equity strategies, with a proven track record through the cycle.

The strategy identifies stocks across the broader share market likely to outperform. It does not rely on high dividend, low growth stocks to generate income.

A conservative options strategy generates income in the short term, while allowing the strategy to focus on investing in high conviction ideas for the long term.

Since inception in 2008, the strategy has historically proven defensive in down markets and a stable income generator through all market conditions.

The strategy draws on the ESG research of First Sentier Investors’ equities analysts and portfolio managers, who identify ESG issues throughout their rigorous company meeting programs.

What if I want more income now?

Our strategy is designed to balance short-term income needs with the generation of long term total returns – delivered with smoother returns through the market cycle.

In addition to the two traditional streams of income generated from dividends and franking credits, our options strategy exploits share price volatility to generate a third stream of income called option premium income.

This additional stream generates a higher income when the market is experiencing elevated volatility – particularly through the tougher periods where companies are forced to cut dividends.

These three sources of income allow us to generate above market income distributions through all market conditions.

Case studies

REA Group: Don’t miss out on Australia's long term growth stories

We focus on long term total returns and dividend growth

Structurally supported by Australia's population growth and property market, digital property advertisement company REA Group has accrued strong earnings growth, dominant market share and strong pricing power. Despite being what many would consider an attractive investment, it is excluded from most equity income portfolios because it pays a low dividend yield.

When we analyse stocks, we prioritise company earnings over a high dividend yield. REA Group's dividend yield has rarely surpassed 2% over the past decade, but through this period, the stock has delivered strong earnings per share – and consequently – strong dividend growth from 10 cents in FY09 to 158 cents in FY23. Investors that focus on high dividend yields in the short term often miss out on the income that follows long term capital growth. Equity income investors should focus on accessing a growing dividend stream rather than focus on the dividend yield paid today.

Company profits

Source: First Sentier Investors

We focus on delivering consistent income through the cycle

Investing in a small universe of high yield stocks irrespective of market conditions does not protect a portfolio from significant market declines. The ability to search a broader universe for companies that are better suited to the prevailing market conditions can help manage risk.

As a growing company, REA Group experiences a higher level of volatility than many high dividend yield stocks. Our options strategy creates an opportunity to convert some of this volatility into an income stream. Higher volatility means a higher level of option premium income and provides an important downside cushion during periods the share price falls.

For a stock like REA Group, we would expect a greater proportion of the income to be delivered by option premium income.

How we use this stock to generate income

Source: First Sentier Investors

Why an income strategy holds a stock that pays Xero dividends

We focus on long term total returns and dividend growth

Accounting software company Xero has moved from strength to strength for investors, with strong subscriber growth, growing average revenue per user and low customer churn. Rather than paying out dividends to shareholders, it has reinvested in its business to increase its market share and global footprint. This represents an opportunity for a greater total return over time. While Xero doesn’t pay a dividend today, we believe its dividend will be more valuable to shareholders if it is paid out in future.

Company profits

Source: First Sentier Investors

We focus on delivering consistent income through the cycle

Options give our strategy the flexibility to generate income from attractive, high growth stocks that fall outside of the typical equity income investment universe.

We use options to generate income from a stock that pays no dividend by converting share price volatility into an additional income stream. Alongside more traditional income stocks, stocks like Xero position the strategy to deliver income through all market conditions.

Xero highlights how we focus on generating attractive long-term total returns, delivered with lower volatility and tilted towards consistent income through the cycle.

How we use this stock to generate income

Source: First Sentier Investors

Striking gold for equity income investors with Northern Star

We focus on long term total returns and dividend growth

We all know about the defensive characteristics of gold – but it is often overlooked by income investors who are deterred by its low dividend yield. Its fundamentals are strong; its proven track record extending the life of its mining assets has translated into stronger returns on invested capital for shareholders. Northern Star also provides an important diversifying role in a portfolio through its low correlation to other equities. Rather than investing in a small group of high dividend yielding stocks, the ability to search a broader universe for companies that can help diversify a portfolio help manage overall portfolio risk.

Company profits

Source: First Sentier Investors

We focus on delivering consistent income through the cycle

Options can be used to include stocks like Northern Star that help diversify risk in a portfolio, taking back control of the investment universe for income investors. While it does not pay an attractive dividend today, its higher share price volatility creates an opportunity for our strategy to secure an option premium income. This generates income today while also providing a downside cushion in falling markets.

How we use this stock to generate income

Source: First Sentier Investors

Commonwealth Bank Australia: Commonly bought by income investors

We focus on long-term total returns and dividend growth

The CBA is a stock familiar to most equity income investors. As a mature company, it pays a high dividend yield today, providing an immediate source of income for investors.

We are not against owning stocks that have higher dividend yields. Rather, our approach is based on evidence that shows higher dividend yields does not always deliver higher dividend income. We continue to assess and include high yield names as part of investing across a broad opportunity set.

Company profits

Source: First Sentier Investors

We focus on delivering consistent income through the cycle

While the immediate dividend and franking income stream is attractive today, the CBA’s low share price volatility means there is less potential for income generated through the use of options.

How we use this stock to generate income

Source: First Sentier Investors

Podcast: How to generate income from your best investment ideas

Join Head of Equity Income, Rudi Minbatiwala, as he explains how low dividend yield, high growth stocks can be used in an equity income portfolio.

Meet the investment team

Rudi Minbatiwala

Jason Moodie

Marlon Chan

Read our latest insights

Want to know more?

Contact your Key Account Manager

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom