Prospective returns over and above fixed income alternatives could potentially benefit global credit in the year ahead.

1. Appealing prospective returns from the asset class

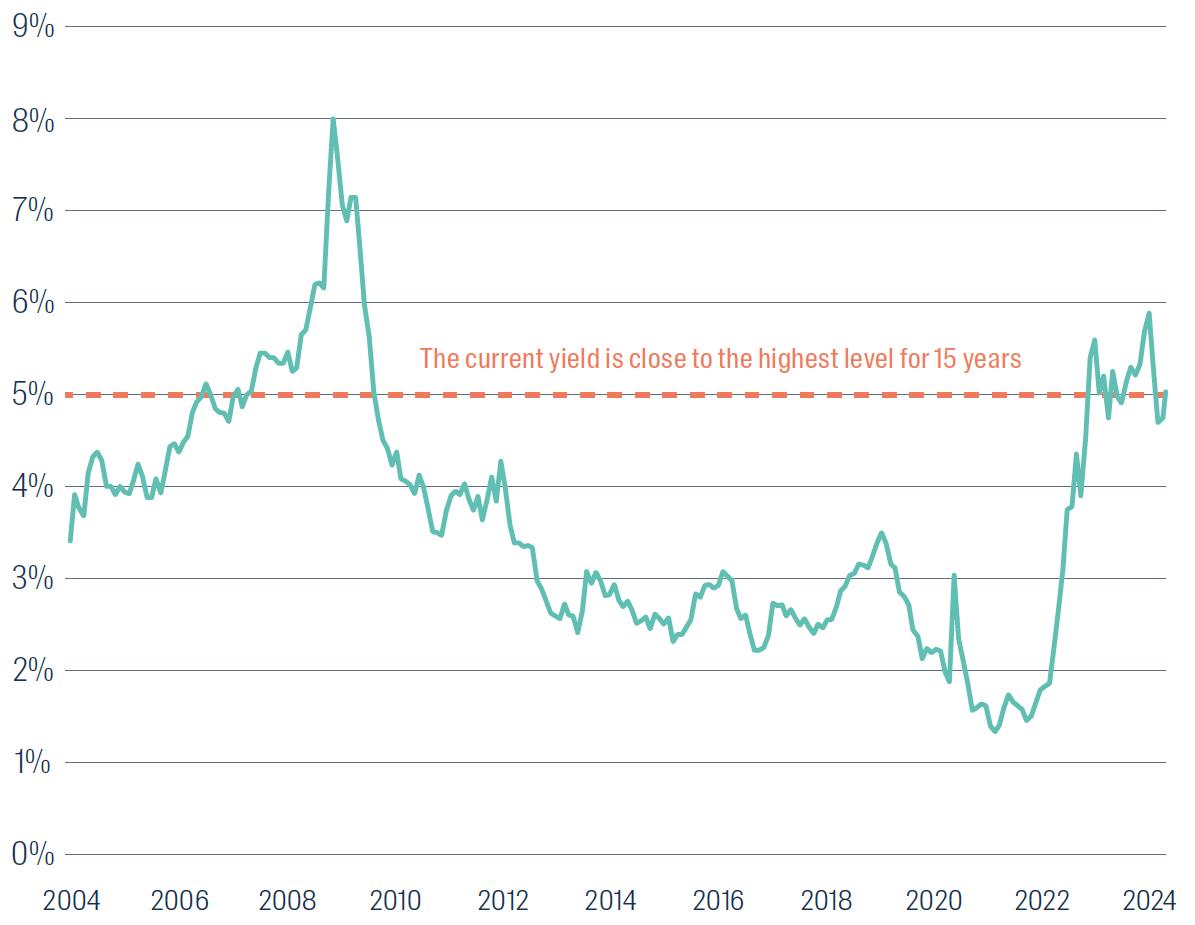

The uptrend in bond yields globally in 2022 and 2023 has pushed the prospective yield of credit portfolios close to the highest level in around 15 years1. More importantly, we expect global credit yields to remain elevated throughout this year, which could prove enticing for income-oriented investors in particular.

Figure 1: Bloomberg Global Aggregate Corporate Index yield

Source: Bloomberg. Data shown 1 January 2004 to 14 February 2024

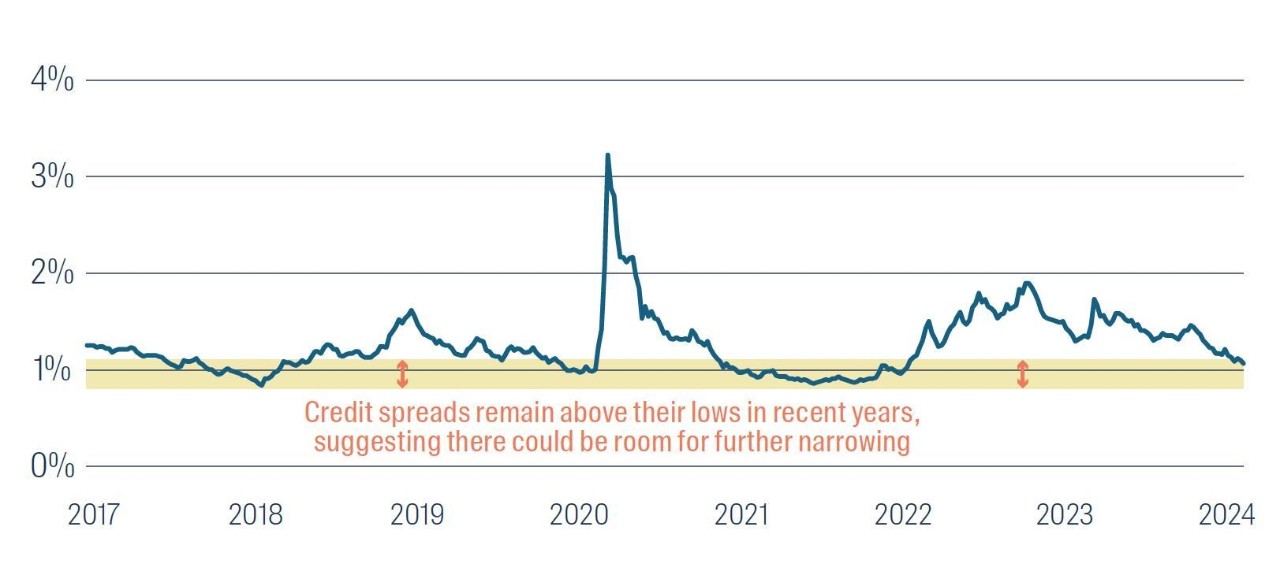

Separately, despite a steady and persistent narrowing in 2023, there is still scope for credit spreads to tighten further from current levels in our view. This would further enhance returns, adding to the return expectations from the asset class.

Figure 2: Bloomberg Global Aggregate Corporate Index – spread over and above 10-year Treasury yields

Source: Bloomberg. Data shown 1 January 2017 to 14 February 2024

Following increases in interest rates globally over the past year or two, a meaningful proportion of corporate bonds are trading well below their par value. At the end of January 2024, around a quarter of all bonds in the Bloomberg Global Aggregate Corporate Index were trading below 90 cents on the dollar2.

Securities trading well below their par value tend to have relatively narrow credit spread premiums, due to the perceived negligible credit risk of buying a bond at, say $80, but being entitled to the repayment of the bond’s face value of $100 at maturity. There is scope for meaningful capital appreciation from these bonds as they approach maturity and the prices pull towards par. It is also worth considering, however, that the narrow credit spreads on these bonds is likely pulling the overall market average down. Excluding this cohort would therefore suggest the average spread of other index constituents is somewhat higher, arguably providing even more scope for spread tightening.

2. Credit fundamentals remain supportive, in our view

Looking ahead, the latest forecasts from the International Monetary Fund3 suggest major economies will remain quite resilient this year, despite headwinds from higher interest rates. Any recessions in individual countries are expected to be short and shallow in nature, such as those recently reported in Japan and the UK for the second half of 2023. Credit investors should be reassured by these latest projections, as there is typically quite a strong correlation between economic activity levels and company profitability.

In fact, listed companies worldwide are currently in the process of announcing their financial results for the December quarter and for the 2023 calendar year as a whole. Releases to date suggest most firms remain in healthy shape financially, particularly in the US.

After peaking just below the long-term trend in 2023, we do not anticipate a meaningful pickup in default rates among corporate issuers in the foreseeable future. Remember, as long as companies can service their debt repayment obligations and do not default, the regular income stream provided by their coupon payments will continue to support returns from global credit portfolios.

3. An uptick in activity among institutional investors

Institutional investors seem to be sitting up and taking notice of the higher prospective returns on offer and we have seen increased interest from institutional investors in the US, Europe and elsewhere. This uptick in enquiries suggests sophisticated investors – including pension funds and sovereign wealth funds – are considering increasing their allocations to corporate credit. This could be a useful tailwind, as sizeable inflows into the asset class typically help support valuations.

In the early part of 2024, we have also seen a good level of new corporate bond issuance as companies have looked to tap into the healthy demand and raise fresh capital. More than US$160 billion of new investment grade corporate bonds were issued in the US alone in January alone4, for example, which ranks among the highest January totals on record.

Encouragingly, all of this new issuance has been comfortably digested by the market. This underlines the appetite for credit worldwide and suggests there could still be large amounts of money sitting on the sidelines ready to be deployed in high quality, yielding investments. In turn this could help ensure new issues are well-supported, as well as potentially boost the valuations of existing securities trading in secondary markets.

Finally, it is worth noting that around 70% of USD-denominated corporate bonds in the Bloomberg Global Aggregate Corporate Index are currently trading with yields below the Federal Funds rate – i.e. the cash rate in the US5. This is partly because bond yields have fallen recently as investors have priced in the likelihood of the Federal Funds rate being lowered this year. This is important because either way, the ‘all-in’ yields on these bonds will look increasingly attractive relative to cash rates if the Federal Funds rate is lowered as anticipated, or if bond yields rise as the market starts to price in a lower probability of interest rate cuts. These relative valuations could be important as influential investors review and amend their asset allocation mix.

1 Source: Bloomberg, as at 14 February 2024

2 Source: Bloomberg, as at 31 January 2024

3 International Monetary Fund World Economic Outlook Update, published January 2024

4 Source: Bloomberg, as at 31 January 2024

5 Source: Bloomberg, as at 31 January 2024. The mid-point of the Federal Funds Target Rate range of 5.25% to 5.50% has been used for comparative purposes.

Read our latest insights

Important Information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should consider, with the assistance of a financial advisor, your individual investment needs, objectives and financial situation.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers, Stewart Investors, RQI Investors and Igneo Infrastructure Partners are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C), Stewart Investors (registration number 53310114W), RQI Investors (registration number 53472532E) and Igneo Infrastructure Partners (registration number 53447928J) are the business divisions of First Sentier Investors (Singapore).

- Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611)

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom