10 Investment themes to watch in 2022

As the curtain closes on another year of surprises, investors are hoping for smoother sailing next year. But with inflation on the rise and a new Omicron variant in the mix, the outlook is far from clear. Against this backdrop, we asked some of our leading Portfolio Managers what issues will be on their watchlist as 2022 unfolds.

1. Diversification remains the key to remaining invested

Although financial markets have stabilised from the extreme movements seen following the initial phase of the pandemic, new risks have emerged in the system, according to Kej Somaia, Co-Head of Multi-Asset Solutions.

“While continued economic growth suggests equities may have further to run as we approach 2022, stretched valuations, spiking inflation, and potentially tighter monetary policy mean that asset allocators must draw on a variety of levers to navigate what promises to be a volatile year ahead. Static allocations to passive exposures in fixed income and equities are not advisable in this environment, while expanding your portfolio toolkit to include inflation sensitive assets such as commodities and property are recommended, given their inflation linkages.”

In recent months, his team’s portfolio positioning has focused on the balance between equities and bonds, with a focus on reducing the allocation to growth. “We have made a marginal increase to fixed income exposures allocated to shorter-dated rather than longer-dated bonds to reduce the portfolio’s sensitivity and risk to rising yields. We have also retained all the global equity exposures in foreign currencies to provide a buffer in an environment where the Australian dollar falls,” Mr Somaia said.

2. Value investing may continue its comeback

Over the past decade we have witnessed an unprecedented level of divergence between Growth and Value stocks*.

David Walsh, Head of Investments at Realindex, said, “Beginning in January 2021, we witnessed the start of a reversion of this trend, with Value outperforming Growth in the first half of 2021. However, this trend hasn’t been sustained in recent quarters, and the market’s enthusiasm for growth stocks has returned.”

But will this last? Dr Walsh says this is where inflation comes in. “Many commentators are now speculating that inflation will boost the fortunes of Value-style stocks. We don’t believe it’s quite as simple as that, but we are watching this unusual confluence of events and think there may be some positive impact on Value stocks.”

3. Investors rethinking risk assets

Craig Morabito, Senior Portfolio Manager for Global Credit, said central bank policy settings - and their potential changes – will likely remain a key focus in 2022.

“Officials are now conceding that inflation could be more persistent than previously forecast, which could mean monetary policy settings start tightening at a time when economic growth rates are coming off the boil.

“Interest rates have not been raised at any time in the past three years in the US – or for more than a decade in Australia – so the possibility of rising borrowing costs will require a change in mind-set among investors. More importantly, the prospect of higher interest rates could have implications for bond valuations, and affect appetite for risk assets including global credit,” Mr Morabito said.

4. Logistics assets in hot demand

Stephen Hayes, Head of Global Property Securities said that after a strong year for global property securities, the outlook for 2022 remains solid.

“In particular, we expect the logistics sector to continue to grow in 2022. Growth in e-commerce sales has provided a strong tailwind to the logistics sector in recent times as many retailers have had to adapt to an omni-channel strategy capturing the online marketplace. We believe this trend will continue to direct large inflows of capital to upgrading supply chains leading to continued strong tenant demand for logistics facilities.

“Whilst global trade tensions will most likely persist for the foreseeable future, we believe that the supply chain bottlenecks seen in 2021 will subside in 2022 as economies further reopen.”

5. Decentralisation reshaping cities

COVID’s impact on where people live and work will continue to play out, according to Mr Hayes.

“The residential housing sector has been a major beneficiary of the decentralisation of cities via de-urbanisation. The further adoption of flexible work practices has given more choice on the location of where people choose to live. Many gateway cities have experienced population outflows in 2021, due to affordability concerns or the desire for improved lifestyle,” he said.

In terms of office real estate, the office sector will also set to follow this path of decentralisation.

Mr Hayes said, “We expect to see a continued split between heavily disrupted sky rise office towers, in favour of modern ‘A’ grade city fringe and suburban office buildings. That split between the city fringe and city centre used to be based on industry sectors, with traditional professional services in the centre, and ‘new’ sectors like technology, media and IT sectors further out. However, we believe there will be greater convergence between the new and old sectors going forward.”

6. Volatility still playing out

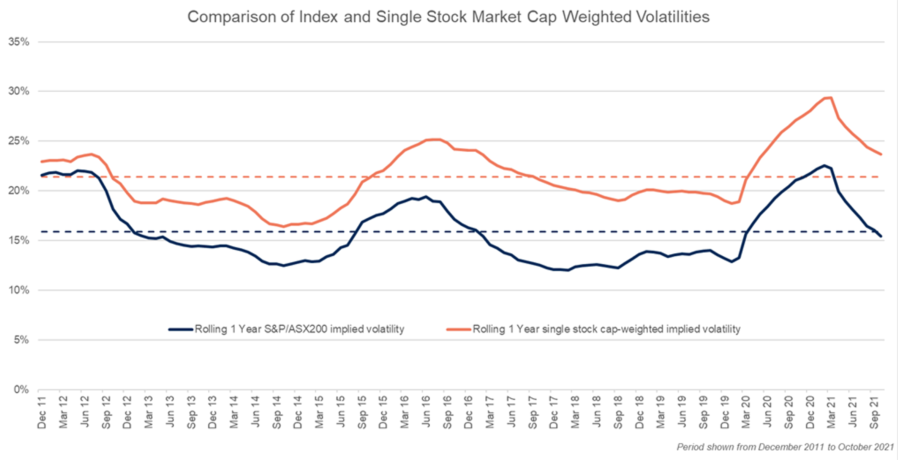

“When most investors think about market volatility they typically only think about the market as a whole, by looking at index level data. But this aggregate data can often hide what is going on beneath the surface”, said Rudi Minbatiwala, Head of Equity Income.

The chart below shows that at the index level, the Australian equity market volatility has recently fallen below the recent history average. However, when volatility is analysed on a stock-by-stock basis, volatility remains at above average levels.

“As an equity income manager whose process actively uses equity options to deliver a higher income and lower volatility outcome from Australian shares, we will be keeping a close eye on the level of single stock volatility, for opportunities to convert this volatility into an attractive income stream,” Mr Minbatiwala said.

Sources: First Sentier Investors, UBS. Single stock cap-weighted volatility based on 3-month ATM implied volatility, December 2021

7. Reopening happening, but timing uncertain

The Global Listed Infrastructure team said that while new variants may impact timing, they are confident that the recovery will come.

Peter Meany, Head of Global Listed Infrastructure, said, “There remains scope for a recovery in traffic / passenger volumes across coronavirus-impacted infrastructure sectors such as toll roads, airports and passenger rail, following the rollout of vaccine programs. Toll road traffic volumes have proved more resilient than those of other transport infrastructure assets; and operators such as Transurban and Vinci are leading the way towards a return to normal demand levels.”

The Global Property Securities team expects the hotel sector to continue seeing lower levels of international and business travel in 2022.

“Assets located in global gateway cities that traditionally catered to international tourists and business travellers, will likely continue to suffer in the short to medium term. However, we believe that investment opportunities exist within domestic leisure assets, as local tourism fundamentals are expected to remain strong into 2022,” Mr Hayes said.

8. Decarbonisation driving infrastructure

The global listed infrastructure asset class is positioned to benefit from a number of positive drivers over the course of the next 12 months, according to Mr Meany.

“Government attempts to bolster economic fundamentals through infrastructure and green energy stimulus plans are likely to prove supportive of many global listed infrastructure firms. In particular, the ongoing repair and replacement of old energy transmission and distribution grids, along with the accelerating build-out of renewables, should represent a steady source of utility earnings growth over many years.

“The 2021 United Nations Climate Change Conference (COP26) highlighted the scale of the work required to successfully transition away from fossil fuels. Large-cap, listed electric utilities such as NextEra Energy, Iberdrola and SSE will be at the heart of this vital transformation,” he said.

9. Hunger for data growing

Mr Meany said that ever-increasing demand for wireless data and connectivity is set to underpin steady earnings growth for Towers and Data Centres including American Tower and SBA Communications, insulating them from the ebbs and flows of the broader global economy.

“The changes required during the coronavirus pandemic have already led to a greater reliance on wireless data in many people’s everyday lives. The adoption of 5G technology over the medium term will require networks to handle increased data speed, and a much higher number of connected devices. Reflecting this, global mobile data traffic is expected to grow by a compound annual growth rate of 28% between 2021 and 2027**. Tower infrastructure will be essential to support this growth,” Mr Meany said.

10. A patchwork of company performance

In credit markets, Mr Morabito expects to see a ‘patchwork’ effect, with varying performance from individual issuers.

“The outlook for profitability differs regionally, by industry, as well as at the company level. Careful security selection and monitoring will therefore remain critical. At a high level, we typically favour companies with pricing power and manageable supply chains; these should be best placed to withstand any further virus-related disruptions.

“An ongoing focus on evolving Environmental, Social and Governance (ESG) issues will also remain very important, as these factors can affect the creditworthiness of companies over time. That’s why we maintain formal ESG Risk rating for every security held in Global Credit portfolios. These assessments influence the assignment of Internal Credit Ratings, which in turn drive security selection and position sizing decisions,” he said.

References

* As measured by Price-to-Book in the MSCI All Cap Weighted Index. A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. A value stock is a security trading at a lower price than what the company's performance may otherwise indicate.

** Ericsson Mobility Report, November 2021

Important Information

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same.

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM. Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom