Fortunately it’s possible to anticipate the future return profile of short-dated global credit with a reasonable degree of confidence. Doing so is certainly less complicated than predicting economic conditions and movements in interest rates and, in turn, forecasting possible returns from aggregate-style fixed income alternatives and other asset classes.

To help explain why that’s the case and what we’re anticipating for the year ahead, it’s worth taking a minute to review the year that’s passed.

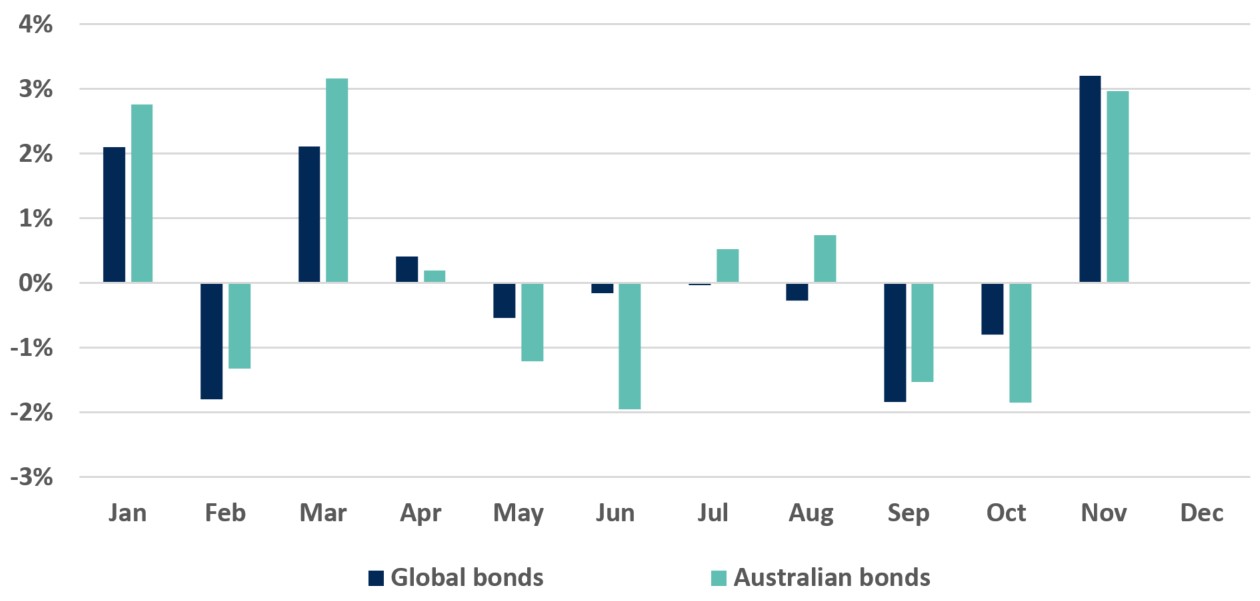

Monthly returns from fixed income alternatives, calendar year 2023

Source: Bloomberg

The blue bars show returns of the Bloomberg Global Aggregate Index, hedged into Australian dollar terms to approximate the returns from global bonds for Australian investors. The green bars show returns of the Bloomberg AusBond Composite 0+ Year Index, a commonly-used reference index for traditional Australian fixed income funds investing predominantly in government and government-related securities.

Returns from global and Australian bonds were fairly volatile during the year, owing to fluctuations in interest rates. The Bloomberg Global Aggregate Index generated negative returns in seven of the 11 months up until the end of November, while the Bloomberg AusBond Composite 0+ Year Index fell in five of the 11 months.

Forward-looking expectations for official cash rates moved quite significantly as investors digested the latest economic indicators – particularly inflation data – and tried to predict how the Reserve Bank of Australia and other central banks around the world might react. These evolving expectations resulted in a fair amount of volatility in interest rates.

The duration profiles of the indices contributed meaningfully to the volatility. The duration of the Bloomberg Global Aggregate Index is currently around 6.6 years1. Other things being equal, this means the Index will rise or fall in value by around 6.6% following a -/+ 1% move in interest rates. Similarly, with a duration of around 5.0 years2, we can expect the Bloomberg AusBond Composite 0+ Year Index to appreciate or depreciate by around 5.0% following a -/+ 1% move in interest rates.

Nobody knows for sure how interest rates will move in 2024 and how traditional, aggregate-style fixed income funds might perform as a result. What we do know is that the return volatility during 2023 was unpalatable for investors seeking stability and, ideally, capital preservation from the defensive component of their investment portfolios.

In contrast, our flagship global credit strategy – the First Sentier Global Credit Income Fund – enjoyed a much smoother return profile over the year.

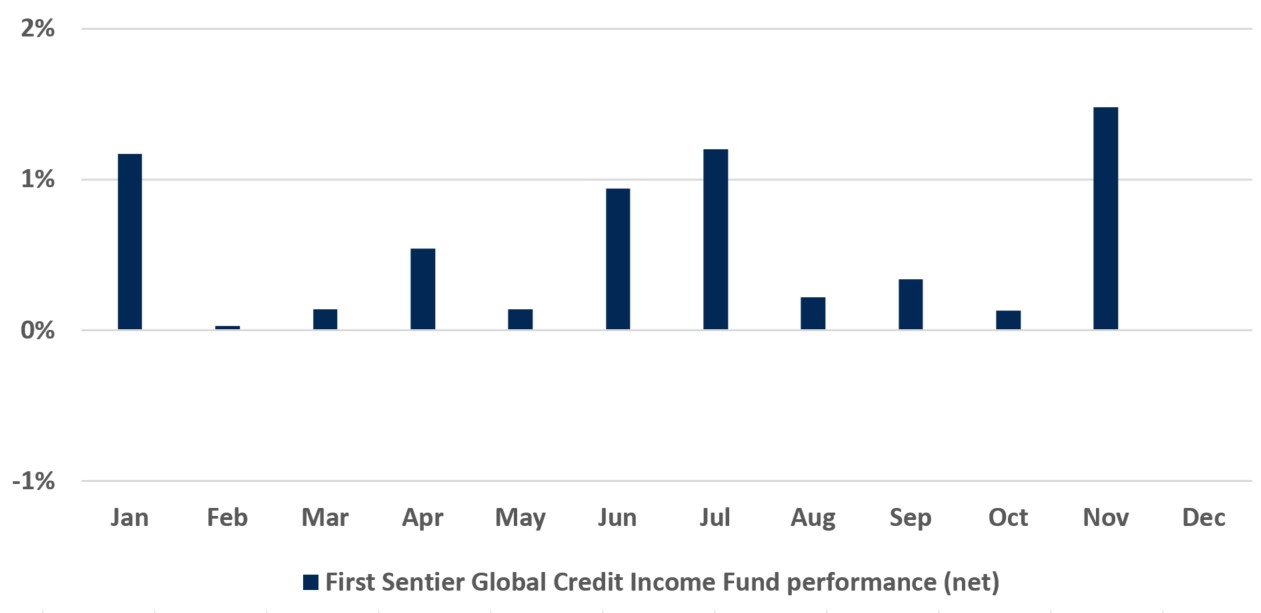

Monthly returns from First Sentier Global Credit Income Fund, after fees, calendar year 2023

Source: First Sentier Investors

At the time of writing at the end of November, the Fund had generated positive returns in all 11 months of the year, after fees. Based on our conversations, this type of consistency and durability is exactly what risk-averse, income-oriented investors are looking for.

The Fund appreciated even during periods of weaker market sentiment, such as in March and October, for example, when credit spreads widened. This acted as a headwind for performance, but was not sufficient to drag monthly returns into negative territory.

Boosted by higher interest rates globally, the running yield of the portfolio has risen to nearly 6.0%3. Essentially this means the Fund is earning at a run rate of around 0.5% per month. Credit spreads would have to widen quite meaningfully to offset this income and result in negative returns owing to mark-to-market revaluations of the underlying bonds held. This is not impossible, but we are not anticipating a significant deterioration in market conditions or a substantial widening in spreads.

This Fund also has a very short duration profile, which is important to bear in mind. At the time of writing the Fund’s duration was just 0.69 years4, meaning the Fund is substantially less sensitive to changes in interest rates than aggregate-style bond funds.

All of this is important, because a combination of relatively low interest rate sensitivity and the receipt of regular income from bond coupon payments suggests short-dated global credit should continue grinding out positive returns in the year ahead. We are reasonably confident that the Fund will continue to generate returns over and above comparable aggregate-style fixed income funds, as well as comfortably beating the returns currently on offer from cash and term deposits.

As a reminder, the First Sentier Global Credit Income Fund aims to return 2% p.a. above cash (represented by the Bloomberg AusBond Bank Bill Index). For some, this kind of return profile may be insufficient to get the pulse racing. But for others a high likelihood of positive returns month in, month out is likely to remain appealing. We have seen good inflows into global credit over the past 12 months and expect to see further interest in 2024. For the reasons outlined above, we believe short-dated global credit products such as the First Sentier Global Credit Income Fund will continue to generate steady positive returns in 2024 and remain appealing for income-oriented investors with a low tolerance for volatility.

1 Source: Bloomberg, as at 30 November 2023.

2 Source: Bloomberg, as at 30 November 2023.

3 Source: First Sentier Investors, as at 30 November 2023.

4 Source: First Sentier Investors, as at 30 November 2023.

Important information

This material is for general information purposes only. It does not constitute investment or financial advice and does not take into account any specific investment objectives, financial situation or needs. This is not an offer to provide asset management services, is not a recommendation or an offer or solicitation to buy, hold or sell any security or to execute any agreement for portfolio management or investment advisory services and this material has not been prepared in connection with any such offer. Before making any investment decision you should conduct your own due diligence and consider your individual investment needs, objectives and financial situation and read the relevant offering documents for details including the risk factors disclosure.

Any person who acts upon, or changes their investment position in reliance on, the information contained in these materials does so entirely at their own risk.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material.

To the extent this material contains any expression of opinion or forward-looking statements, such opinions and statements are based on assumptions, matters and sources believed to be true and reliable at the time of publication only. This material reflects the views of the individual writers only. Those views may change, may not prove to be valid and may not reflect the views of everyone at First Sentier Investors.

Past performance is not indicative of future performance. All investment involves risks and the value of investments and the income from them may go down as well as up and you may not get back your original investment. Actual outcomes or results may differ materially from those discussed. Readers must not place undue reliance on forward-looking statements as there is no certainty that conditions current at the time of publication will continue.

References to specific securities (if any) are included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities referenced may or may not form part of the holdings of First Sentier Investors' portfolios at a certain point in time, and the holdings may change over time.

References to comparative benchmarks or indices (if any) are for illustrative and comparison purposes only, may not be available for direct investment, are unmanaged, assume reinvestment of income, and have limitations when used for comparison or other purposes because they may have volatility, credit, or other material characteristics (such as number and types of securities) that are different from the funds managed by First Sentier Investors.

Selling restrictions

Not all First Sentier Investors products are available in all jurisdictions.

This material is neither directed at nor intended to be accessed by persons resident in, or citizens of any country, or types or categories of individual where to allow such access would be unlawful or where it would require any registration, filing, application for any licence or approval or other steps to be taken by First Sentier Investors in order to comply with local laws or regulatory requirements in such country.

This material is intended for ‘professional clients’ (as defined by the UK Financial Conduct Authority, or under MiFID II), ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) or Financial Markets Conduct Act 2013 (New Zealand) and ‘professional’ and ‘institutional’ investors as may be defined in the jurisdiction in which the material is received, including Hong Kong, Singapore, Japan, and the United States, and should not be relied upon by or be passed to other persons.

The First Sentier Investors funds referenced in these materials are not registered for sale in the United States and this document is not an offer for sale of funds to US persons (as such term is used in Regulation S promulgated under the 1933 Act). Fund-specific information has been provided to illustrate First Sentier Investors’ expertise in the strategy. Differences between fund-specific constraints or fees and those of a similarly managed mandate would affect performance results.

About First Sentier Investors

References to ‘we’, ‘us’ or ‘our’ are references to First Sentier Investors, a global asset management business which is ultimately owned by Mitsubishi UFJ Financial Group. Certain of our investment teams operate under the trading names FSSA Investment Managers, Stewart Investors and Realindex Investments, all of which are part of the First Sentier Investors group.

We communicate and conduct business through different legal entities in different locations. This material is communicated in:

- Australia and New Zealand by First Sentier Investors (Australia) IM Ltd, authorised and regulated in Australia by the Australian Securities and Investments Commission (AFSL 289017; ABN 89 114 194311)

- European Economic Area by First Sentier Investors (Ireland) Limited, authorised and regulated in Ireland by the Central Bank of Ireland (CBI reg no. C182306; reg office 70 Sir John Rogerson’s Quay, Dublin 2, Ireland; reg company no. 629188)

- Hong Kong by First Sentier Investors (Hong Kong) Limited and has not been reviewed by the Securities & Futures Commission in Hong Kong. First Sentier Investors, FSSA Investment Managers and Stewart Investors are the business names of First Sentier Investors (Hong Kong) Limited.

- Singapore by First Sentier Investors (Singapore) (reg company no. 196900420D) and this advertisement or material has not been reviewed by the Monetary Authority of Singapore. First Sentier Investors (registration number 53236800B), FSSA Investment Managers (registration number 53314080C) and Stewart Investors (registration number 53310114W) are the business divisions of First Sentier Investors (Singapore).

- Japan by First Sentier Investors (Japan) Limited, authorised and regulated by the Financial Service Agency (Director of Kanto Local Finance Bureau (Registered Financial Institutions) No.2611)

- United Kingdom by First Sentier Investors (UK) Funds Limited, authorised and regulated by the Financial Conduct Authority (reg. no. 2294743; reg office Finsbury Circus House, 15 Finsbury Circus, London EC2M 7EB)

- United States by First Sentier Investors (US) LLC, authorised and regulated by the Securities Exchange Commission (RIA 801-93167)

- other jurisdictions, where this document may lawfully be issued, by First Sentier Investors International IM Limited, authorised and regulated in the UK by the Financial Conduct Authority (FCA ref no. 122512; Registered office: 23 St. Andrew Square, Edinburgh, EH2 1BB; Company no. SC079063).

To the extent permitted by law, MUFG and its subsidiaries are not liable for any loss or damage as a result of reliance on any statement or information contained in this document. Neither MUFG nor any of its subsidiaries guarantee the performance of any investment products referred to in this document or the repayment of capital. Any investments referred to are not deposits or other liabilities of MUFG or its subsidiaries, and are subject to investment risk, including loss of income and capital invested.

© First Sentier Investors Group

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom