Why a flexible investment approach may make all the difference when simply being invested is no longer enough.

There are times when markets do all the hard work. In the past few years, for example, abundant liquidity has driven asset prices higher, and even the most non- discriminating investor has made positive returns. It has been enough simply to be invested. However, there are times when the market doesn’t help investors, and today may be one of those times. If valuations are stretched – as they appear to be in equity markets – investors are not sufficiently compensated for the risk of taking exposure. At this point, it is important not to be dependent on beta or market risk, but to look beyond directional long-only strategies to generate returns.

Option 1 – Rely on alpha generation or non-directional strategies

It makes more sense to rely more on alpha generation – or non-directional strategies. This means holding less in market-driven strategies, or duration-linked strategies, and more in strategies that look at the relative attractiveness of different asset classes. Over time, there are a number of consistent return drivers: They can be value – the relative cost of an asset; or momentum – focusing on market trends; or carry – the amount investors are paid to hold an asset; or it can be macro – what macro indicators say about certain asset classes. It may also be asset class-specific indicators. In commodities, for example, it might be whether the commodity curve is in contango or backwardation. In fixed income, it can be the yield curve. It is possible to invest in these five return drivers in a non-directional way. In this way, they are not correlated with conventional long-only equity and bond strategies. At times when valuations are stretched, it makes sense to raise the alpha part of the portfolio to continue to achieve the long-term objective.

Option 2 – Position your portfolio for rising markets

Of course, it can also work the other way. There are times when it is absolutely right to position a portfolio for rising markets. When there are lots of opportunities and attractive valuations, investors don’t have to rely as much on non-directional or alpha strategies. In late 2015/early 2016, there was a significant sell-off in energy markets all around the world and emerging market currencies experienced significant volatility. We took positions in emerging market debt at that point. It made sense to allocate to ‘beta’. The widely-used 60/40 blend of equities and bonds first became popular in the 1980s. Our research suggests that over the past 100 years, this was the best time possible for this type of allocation because equity markets were very cheap and interest rates were very high. Investors received the benefit of having high yields on their fixed income holdings and buying into a cheap equity market. Fixed income provided good protection during equity market sell-offs, because yields collapsed at times of economic stress. While this could happen again, it would be on a much smaller scale and the protection provided by this blend is far less. In our mind, investors need to look elsewhere to lower the risk in portfolios, rather than rely on this type of static allocation.

Option 3 – Do both

Our flexible and dynamic process aims to adapt to different environments rather than assuming that a static allocation will bail us out. We try to look at ways that the portfolio would have behaved in a historic ‘stress’ scenario.

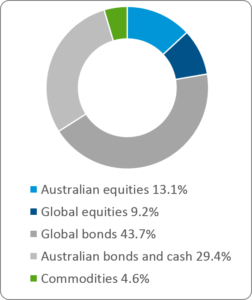

The Colonial First State Real Return Fund asset allocation as at 31 March 2018:

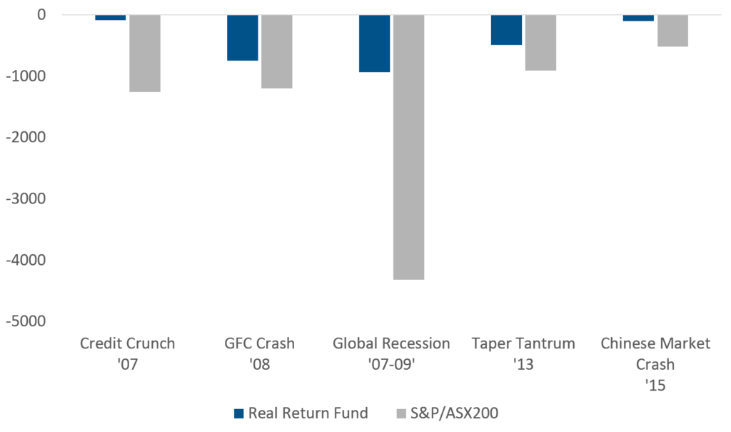

The below Colonial First State Real Return Fund stress scenarios looks at the impact of events such as the credit crunch in 2007, the GFC in 2008, the global recession in 2007-2009, the taper tantrum in 2013, or the Chinese market crash in 2015 on the Fund.

Data: CFSGAM, S&P/ASX 200 data as at 31 Marc 2018. Credit Crunch August 2007, GFC Crash September 2008, Global Recession December 2007-June 2009, Taper Tantrum May 2013, Chinese Market Crash June 2015.

For each of these scenarios, we look at the main risks in the portfolio. It is a good way to work out the hidden risks in our portfolios and to ensure the risks within the portfolio are there because certain markets are attractive. We look at how asset markets behaved in historical periods when inflation rose and growth was healthy. How would the portfolio have performed? We also incorporate protection strategies, depending on the implied volatility in the market and how expensive it is to achieve this protection.

In this way, by being flexible and dynamic we adapt our portfolio to the prevailing market environment. We want to make sure that we only take risk where it is worth taking. In today’s climate, many asset classes are expensive, and investors are poorly compensated. It is time to look beyond beta to non-directional strategies to defend returns.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom