First Sentier Investors has been managing Global Credit strategies for more than 25 years and has the expertise and know-how to manage portfolios through full credit cycles. The asset class has generated returns consistently above those on offer from cash and comparable government bonds, and may be an option for income-oriented investors to consider.

We understand that many investors are unfamiliar with the asset class and have prepared this paper as an introduction to credit securities and the factors that influence their performance.

Fixed income 101 – what is a bond?

Bonds are issued by a wide range of borrowers, with the proceeds of the bond sales used as a source of funding. Bonds have a fixed face value (or par value) and a predetermined maturity date. A new 5-year bond issued in January 2024, for example, will mature in January 2029. At that time, the face value of the bond, the $100 – known as the principal – is repaid in full to the bondholder.

Like shares, bond ownership is transferable. Bonds are bought and sold on the open market, providing live pricing transparency. Prices can fluctuate during the life of the bond, but will generally gravitate towards the par value as the maturity date approaches.

Most bonds also make income payments – known as coupons – at regular intervals during their life, often twice a year. These coupons provide investors with stable and predictable sources of income. This helps explain why bonds are popular among investors with known cash flow requirements, as they can match their liabilities with income received from coupons and bond maturities.

Historically, the performance of bonds has had a relatively low correlation with the performance of growth assets, like equities. Bond prices are also typically less volatile than shares. Most investors with well-diversified portfolios therefore maintain an allocation to bonds, which can help preserve capital during periods of equity market weakness.

The risk-free rate

The yield on government bonds in developed markets is known as the risk-free rate – essentially, it is the rate of interest that can be earned from the most secure investments. No investment is entirely risk free, but bonds issued by governments in developed countries are about as close as we can get.

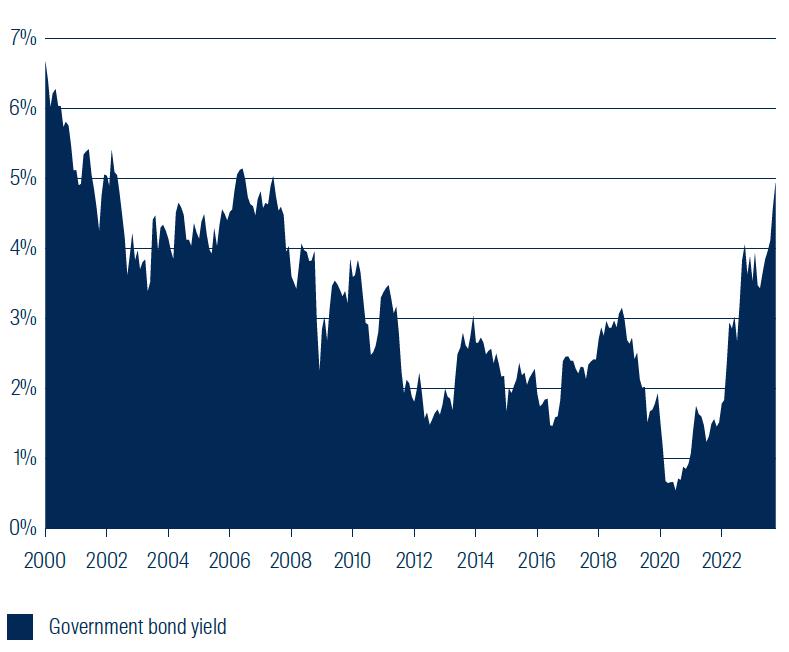

For simplicity and consistency, investors use the current yield on government bonds as the risk-free rate. As we can see in Figure 1 below, government bond yields fluctuate over time. In this case, we have shown the yield on 10-year US Treasuries – a commonly-used yardstick for the performance of government bonds globally.

Figure 1: Risk-free rates

Source: Bloomberg. Government bond yield = 10-year US Treasury yield.

Data shown 1 January 2000 to 31 October 2023.

Higher yielding bonds

Bonds issued by entities other than governments in the developed world are commonly referred to as credit. Credit issuers include:

- Corporates: Selling corporate bonds provides companies with an alternative to equity-based funding. The corporate bond market is huge: investors can access bonds issued by a very wide range of firms, in most parts of the world and in almost all industry sectors. Corporates can issue bonds denominated in their home currency, or in international currencies to help diversify their investor base.

- Quasi-Government or Government Related Issuers: As well as governments, various government-related entities also issue bonds. Local examples include Export Finance Australia and National Housing Finance and Investment Corporation. Bonds issued by State Governments like New South Wales and Victoria are also classified as quasi government entities, as are government-related companies like Australia Post. These bonds are generally perceived to be a little more risky than comparable securities issued by governments themselves, but still tend to be regarded as relatively secure due to implicit government support.

- Emerging markets: Governments in developing countries can issue bonds, normally in their local currency or in US dollars. These are categorised as credit securities, because they are riskier than bonds issued by governments in developed countries.

- Securitised: These are essentially pools of other underlying financial assets, which are combined to create new securities. Thousands of residential mortgages, for example, can be pooled together and carved up to form new securities, which are then sold to investors.

Credit cycles refer to the availability of credit for borrowers based on fluctuations of interest rates and economic expansion and contraction. This results in phases of tight or easy borrowing and lending in the economy.

In the remainder of this paper we focus primarily on corporate bonds, because our Global Credit strategies are predominantly focused on this part of the market.

Default risk

Lending to companies and other credit issuers is generally perceived to be riskier than lending to governments in developed countries. Companies, for example, are more likely to experience cash flow difficulties and may struggle to meet their repayment obligations. They might miss a scheduled coupon payment, or be unable to repay the bond principal in full at maturity. A failure to fulfil either of these obligations is known as a default.

All credit securities have some level of embedded default risk. To entice investors and to compensate them for this default risk, credit securities offer yields over and above the risk-free rate. This premium is known as the credit spread. The size of the spread differs among individual issuers and can vary over time as the perceived level of risk changes.

Credit Ratings

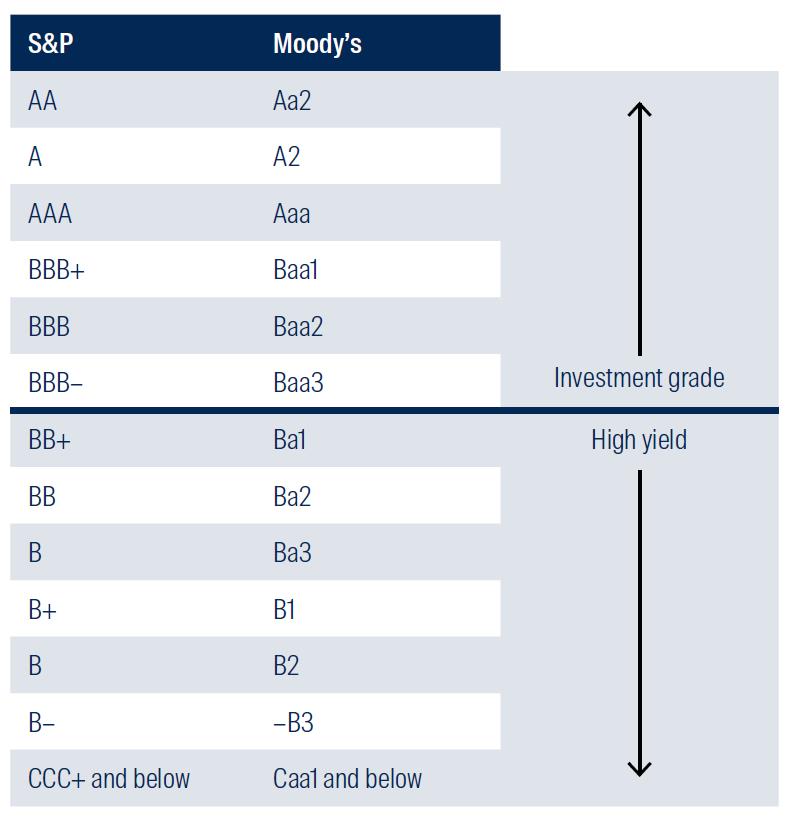

To help investors approximate the level of risk inherent in each, credit securities are assigned ratings by independent agencies like Standard & Poor’s and Moody’s. Credit ratings are determined by the perceived risk of the issuing entity defaulting on its debt. There is a further segregation between investment grade issuers (higher quality) and high yield issuers (more speculative).

Figure 2: Credit ratings and quality bands

Within the corporate bond space, credit spreads are typically lowest among the most highly-rated firms, and tend to be higher for less mature, more speculative companies. The higher yields are required to attract investors. As a rule of thumb, the lower the credit rating, the higher the yield, and vice versa.

Credit ratings and spreads are important, as they influence a corporate bond’s overall yield and, in turn, its price.

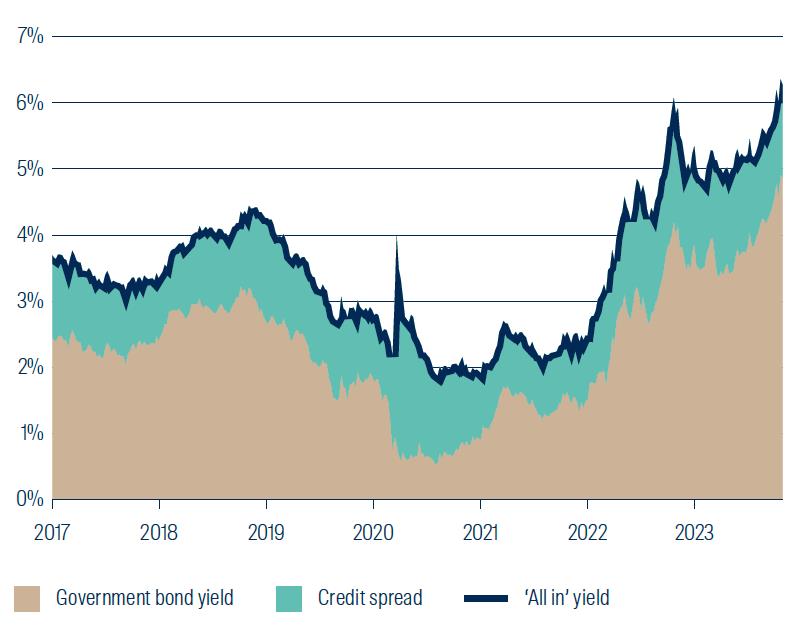

As shown in Figure 3 below, a corporate bond’s ‘all in’ yield is comprised of the risk-free rate and the credit spread.

Figure 3: Deconstructing corporate bond yields

Source: Bloomberg. Government bond yield = 10-year US Treasury yield.

Credit spread = Bloomberg Barclays Global Aggregate Corporate Average Option Adjusted Spread.

Data shown 1 January 2017 to 31 October 2023.

As we mentioned earlier, the size of the credit spread fluctuates over time, influenced by the evolving level of perceived default risk. In Figure 3 above we can see a spike in credit spreads – the green shaded area in the chart – in early 2020, for example, when the Covid pandemic started to dominate attention and influence asset valuations.

Remember, bond yields and prices are inversely correlated, so the rise in corporate bond yields at that time due to the higher credit spread saw bond prices fall. In a nutshell, the perceived risk of owning corporate bonds increased and prices moved accordingly.

Credit spreads quickly narrowed again, as the initial virus-related panic abated and as investors looked forward towards a normalisation in activity levels and company profitability. ‘All in’ yields from investment grade credit – the dark blue line on the chart – fell, owing to the drop in both credit spreads and risk-free rates. Government bond yields – the tan shaded area in the chart – fell to record lows as central banks slashed official interest rates to help economies withstand virus-related slowdowns.

Both risk-free rates and, in turn, ‘all in’ yields from investment grade credit have risen sharply over the past two years as official interest rates have been increased in key regions. Combined with relatively stable credit spreads, rising risk-free rates have pushed ‘all in’ yields from investment grade credit up above 6%; the highest level for more than a decade1 .

These higher prospective returns are increasing the appeal of credit among income-oriented investors.

Types of credit funds

Investors keen to generate income through credit can choose between many different strategies. People generally obtain exposure to credit through a professionally managed fund, most of which allocate capital across a broad range of credit securities to help diversify risk. Only large, institutional investors tend to own individual credit securities directly.

Like equity funds, credit funds can be managed either actively or passively. In the active space, managers buy and sell individual credit securities aiming to outperform a particular credit benchmark, or to achieve a particular return target; perhaps 1.5% above the risk-free rate. Passive managers aim to match the performance of a benchmark through index replication. There is likely to be some performance dispersion between regions, industry sectors, and among individual issuers. That is completely normal and, in our view, supports the case for active management in this asset class. In fact, a degree of performance variation is welcome, as it provides opportunities to add value to credit portfolios through diligent credit research and active issuer selection.

Some credit funds have an explicit sustainability bias, where Environmental, Social and Governance issues are considered within the investment process. These products might choose not to invest in securities issued by firms in particular industry sectors, for example, or employ some kind of screening process to identify companies with particular ethical characteristics.

Funds can focus on investment grade securities only, or can have the flexibility to invest in both investment grade and high yield bonds. An allocation to the high yield sub-sector can potentially broaden the overall diversification of a credit portfolio, providing exposure to issuers in niche industry sectors that may not be well represented in the investment grade universe. The higher prospective yields in this part of the market can improve potential returns, but also increase the overall risk profile. The higher default risk inherent in high yield credit can also result in more volatile performance outcomes.

There is one more important distinction between different credit funds.

The performance of some is driven by changes in ‘all in’ yields, comprised of movements in government bond yields as well as credit spreads. These funds have typically fared quite poorly over the past couple of years as government bond yields have risen. A fall in risk-free rates over time could potentially act as a tailwind in the future, although any further increases in risk-free rates would be a headwind.

Other funds aim to remove interest rate risk, either focusing on floating rate securities2 or hedging through the use of derivatives. This means movements in risk-free rates have a limited bearing on performance outcomes. Our flagship global credit strategy is managed in this way. With interest rate risk hedged, movements in credit spreads are the primary driver of returns.

More than two decades of expertise

First Sentier Investors has been constructing global credit funds for more than 25 years, so we have the expertise and know-how to manage investment risks over the full credit cycle.

While we are always looking for value-adding opportunities within the asset class, we believe First Sentier Investors is among the most conservative credit investors in the Australian peer group. We understand that a credit allocation sits within the defensive component of most investors’ portfolios, and is intended to provide some offset to potential volatility in growth assets. Accordingly, capital preservation is of paramount importance in our Global Credit strategy. We invest a lot of time and energy researching issuers and monitoring their performance, to help detect any early signs of stress. The intention is to remove deteriorating issuers from portfolios before valuations are meaningfully affected.

Responsible investment considerations also form an important component of the research and investment processes. Environmental, Social and Governance risks and how they are being managed by issuers help influence the assignment of internal credit ratings, which in turn drive portfolio construction decisions.

More information on our credit research process is available here.

1 As at 31 October 2023, source: Bloomberg

2 Floating rate securities are debt securities with interest payments that vary according to a short-term benchmark interest rate.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors, 2023

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom