Many investors are questioning how rising interest rates will affect corporate borrowers. Will their financing costs rise significantly and, from a credit investors’ perspective, do higher rates elevate default risk?

Consensus forecasts indicate default rates could rise from current low levels, but a closer look at the data suggests any increase could be relatively modest. The reason is that many corporate borrowers have already locked in low borrowing costs, which should help mitigate the impact of rising interest rates.

All of this is important for credit investors. With fewer companies at risk from credit default than would normally be expected at this stage of a rate hiking cycle, the additional return offered by global credit should remain attractive when compared to comparable government bonds.

Long-dated debt issuance provides some protection

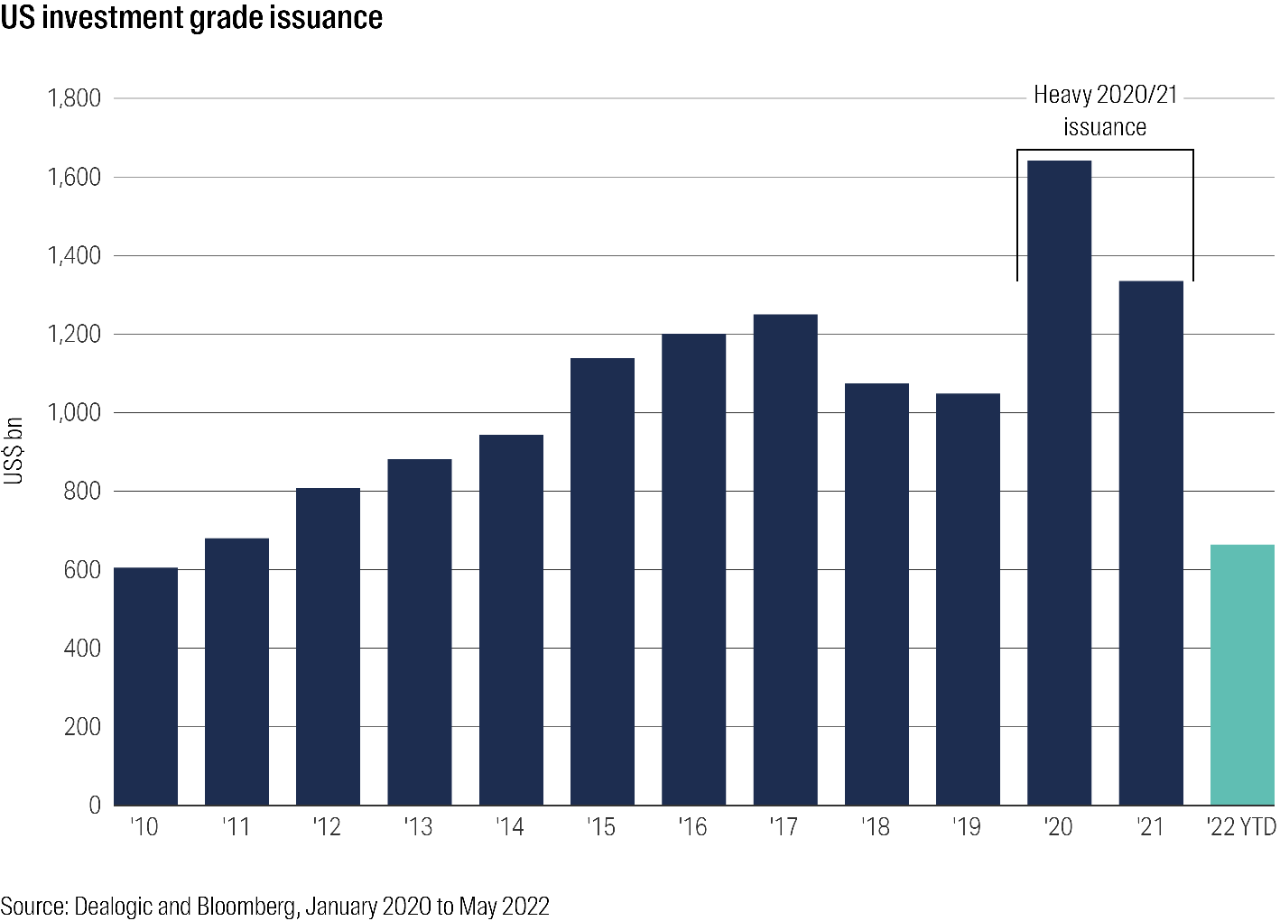

A high level of corporate debt issuance during the Covid crisis has bolstered the liquidity position of many firms. The chart below highlights the record levels of investment grade debt issued during 2020/21:

During this period, a large number of corporates in different countries and in various industry sectors locked in their financing needs at low rates. Interest coverage – a metric that measures how comfortably companies can service their debt repayment obligations – has risen following these capital raisings, suggesting default risk is not unduly concerning at this point.

Moreover, the recent trend in corporate bond issuance has been towards longer-dated securities. While the average lifespan of corporate bonds was previously around eight years, research now suggests this has risen to between nine and ten years1.

As a result, companies have greater flexibility and could come to the market for refinancing less frequently. Many are unlikely to require fresh debt capital for several years, in our view. In turn, higher official interest rates may not necessarily be an immediate concern for many companies.

And rating agencies have noticed

This favourable backdrop has not gone unnoticed by the major rating agencies. In fact, rating agency upgrades have outpaced downgrades in 2022 to date2. This might provide investors with some additional reassurance that default risk remains relatively low. If so, the higher prospective returns from credit securities following recent spread widening could be increasingly appealing for long-term investors.

Will higher inflation make a difference?

The impact of current high inflation levels globally will not affect all firms equally. There is likely to be a divergence in operational performance across the corporate sector between companies operating in different regions and industries.

Those with strong market positions may be able to pass through higher costs to customers relatively easily, while others will find it more challenging to do so. As a result, the performance from credit securities in coming years will almost certainly vary.

Overall, the inflationary environment seems likely to make corporate earnings less predictable and will reward those investors able to differentiate between the winners and the losers.

1 Source: Bloomberg, as at 31 July 2022

2 Source: Moody’s, to 31 July 2022

Important information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information is gross performance and does not take into account any ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom