Fund Manager Q&A

Martin Lau, Managing Partner, has been with the FSSA Investment Managers for more than 18 years, starting with the firm as Director, Greater China Equities in 2002. Martin is the lead manager of a number of FSSA strategies such as the FSSA Greater China Growth Strategy and FSSA Asian Equity Plus Strategy, to name a few.

What are your thoughts on the increasing regulation risk of investing in China?

Firstly, regulations are nothing new — it has always been a part of the investment equation. If we look at Hong Kong or Singapore for example, the government would introduce new regulations on the property market from time to time; and in China, the government has introduced a number of new regulations for banks and insurance companies over the years. In fact, last year the government changed the pricing policy on automobile insurance, affecting quite a few Chinese general insurers. Therefore, regulation risk is always something to consider.

Secondly, we believe the Chinese government has indeed changed — in terms of their priorities and focus — over the last three to four years. China was particularly focused on economic growth previously; and by all accounts, China has been a major economic miracle. From poverty, it has become the second-largest economy in the world. However, in recent years under the leadership of President Xi Jinping, the Chinese government has started to focus much more on social stability and equality.

Thus, the underlying spirit of the recently announced regulations seems to be targeting wealthy entrepreneurs and conglomerates. The goal is to help improve the lives of workers, for parents to ease their burden with children, and so forth. Then, there is the environmental aspect too, with the Chinese government increasingly focused on pollution and carbon neutrality.

From that perspective, it certainly looks like the Chinese government is becoming more socialist than it was before. I think that is the trend and to some extent, investors will need to acknowledge and accept it when investing in China.

Do you think that the increasing regulation risk has affected China’s opportunity set?

It is interesting to note how market sentiment has changed, driven by this regulation change. A few months back, investors might say: Buy more Meituan, Tencent, Alibaba or Pinduoduo — the more the better. Now, sentiment has changed; and investors are rushing to offload sectors that are vulnerable to government policies (such as after-school tutoring, internet platform companies, property, medical equipment and drugs) and buying into sectors that they think the government will continue to support (such as renewable energy, sportswear and manufacturing).

Whether a good or a bad thing, we need to accept that economic growth levels will no longer be as high as they were before and certain sectors will only become more regulated.

On the other hand, for many years we have been saying that China is not just about Tencent, Alibaba or Pinduoduo. Rather than narrowly defining “innovation” in terms of internet platforms, biotech firms or food delivery applications, we believe it should be more broadly defined.

As a team, we like to invest in innovative companies, or companies that are able to leverage technology to improve their products and services. For example, we own a company called Techtronic Industries, which recently announced good results with H1 2021 revenue and profit increasing by more than 50%. One of the reasons for its performance is that they have made use of the advancements in lithium technology to improve the efficiency of their power tools. They have also expanded their range of products to include cordless equipment and power tools. For example, Techtronic’s lawnmowers are powered by battery, unlike traditional models which are powered by gas.

In other words, we believe the investment theme of Chinese innovation and technology is still intact. There is more to it than just internet platforms or e-commerce sites.

I would also add that we feel quite positive that the market is now talking about these risks, as the best time to enter the market is often when everyone is overly focused on the negatives. During last year’s sell-off in March for example, when the market was worried about the pandemic it was a great buying opportunity for us.

Overall, we also believe that the new measures will raise the bar and open up opportunities for industry consolidation. In China, there are thousands of players in almost every industry. Country Garden, the largest property company in China, has only 5% market share (as at 31 December 2020). With more regulations and stricter financing guidelines, we believe that high-quality companies with strong management teams will prevail and emerge stronger than before.

What was the impact on FSSA’s China strategies?

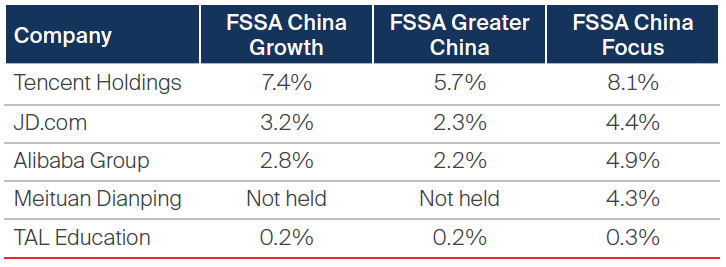

As a whole, we have an approximately 15% exposure to internet companies, with the largest positions being Tencent and JD.com. We have never had more than 10% exposure to either company and have kept the exposure relatively limited. Over the last couple of months as the market pulled back, we added to both Tencent and JD.com as we believe there is still room to grow and both have a reasonably low profile with less regulatory risks.

We have a small exposure to education companies. When the sector fell by approximately 70%, we thought that it was overdone and initiated a small position in TAL Education. In our view, the company has high quality management with a proven track record. However, we underestimated the government’s power in clamping down on the sector. We have not added to our position due to the increased uncertainties.

Portfolio Impact

As at 31 July 2021

Source: First Sentier Investors, as at 31 July 2021.

Overall, the impact on our portfolios has been relatively limited. As a rule of thumb, we are reasonably balanced in our investment strategies and when compared to our peers we have been more conservative, which has helped in this instance.

Are there any opportunities in the Chinese electric vehicle (EV) battery sector?

We think the EV battery sector is over-hyped at the moment. We looked into a company called CATL (Contemporary Amperex Technology), which is one of the largest EV battery manufacturers globally (and in China) with about 25% market share. However, we struggled with its valuations and were concerned about strong competition within the industry. Some may argue that these concerns are unfounded (or maybe ahead of its time), but because of our conservative nature, we did not find enough reasons to own the company.

We have exposure to EV, but in companies along the supply chain that are less hyped up. For example, we own a company called Hongfa Technology, which produces electrical relays — 20% of their revenue comes from the EV market. The valuations seem reasonable and the management team has a strong track record. We also own Shenzhen Inovance, which produces controllers for EVs and have been performing well in this space. We also have exposure to a company called Minth Group, which produces battery cases for EV — 25% of the company revenue comes from this area.

Overall, we believe that EV is a major trend and the penetration rate in China will increase over the years. However, we find more comfort in owning the “picks and shovels” companies that are not so inflated.

Do you think investing in China is gradually become more top-down driven?

Would the increasing uncertainties change the way the team constructs portfolios?

Investing in China has always been somewhat top-down driven in terms of market sentiment, and for that reason it is a bit of a black box. It is a challenge to understand how policy decisions are made, for example, or how the GDP growth rate is always around the same range.

Sentiment on China usually fluctuates depending on the market cycle — whether the market believes that revenue will depreciate or appreciate, or whether China’s inflation rate is too high, or if the market is overheating. Some years, it depends on whether the recovery is believed to be “W-shaped” or “L-shaped”.

As a team, we believe that this kind of market turbulence presents great buying opportunities. As active, bottom-up investors, our established investment process — and the discipline to stick to it — helps us to stay focused on the long term and not be swayed by top-down views or market sentiment.

For example, over the past year or so, we have added to some property names, despite the negative market consensus. The market believed that the sector would be under pressure with property prices heavily regulated. We had a different perspective — in our view these concerns have already been priced in. We added to a company called China Overseas Grand Ocean, a relatively small property company in China that is now trading on approximately 2-3x price-to-earnings (P/E).

As a team, we think about what could go wrong, we tend to be more conservative, and we do things in moderation. That is not to say that we do not make mistakes; we have made plenty. But when things do go wrong, we usually have some room to manoeuvre. For example, we rarely initiate a position with a 10% exposure, no matter how much we like a company.

That gives us room to add to our position if there is any pull-back, which is what happened with Tencent and JD.com. We also added to TAL Education when it declined as we did not have any exposure previously. While this was rather unfortunate in hindsight, if we had started with a 10% exposure to TAL Education or a 10% exposure to New Oriental Education, our hands would have been tied. This is why as a team we have always encouraged a diversified and balanced portfolio.

Ultimately, I believe strongly that earnings or profit growth is what drives company valuations. If you believe Tencent is a great company and that profits are going to be higher in the next three years, then to a certain extent you believe that the share price will follow the profits higher. As stewards of our clients’ capital, I believe it is important to think about what has been priced in rather than just following the market consensus.

Have the travel restrictions over the past 18 months affected the team’s bottom-up investment approach?

Previously, the team would travel to China and meet companies every month. It was an enjoyable experience and useful to do on-the-ground visits to meet with company management teams face-to-face. Over the past 18 months it has not been impossible, but it certainly has not been easy to continue doing so. Some of our team members have travelled to China for company meetings, but it has not been very efficient with quarantine requirements in both directions.

We have been conducting company meetings through Tencent Meeting instead (companies in China do not use Zoom) and it has proven to be much more efficient. When we travel to China, we usually spend a lot of time on the road going from destination to destination as China is such a big country. In one day, we would only meet with two to three companies at most.

Last year, we conducted approximately 1,500 company meetings, which is around the same number as the year before. In other words, we still interacted with companies as much as we did previously, but in a different format. Moreover, I think we have been quite fortunate in the sense that out of the 1,500 meetings, around half are with companies in which we have been shareholders for many years. As such, we are quite comfortable to interact over the phone or on video calls. We do not feel the need to meet face-to-face.

Over the years, do you see Chinese companies making much progress from an environmental, social and governance (ESG) perspective?

It has always been a dream of mine that Chinese companies could one day be as advanced and sophisticated as Western companies in terms of ESG. However, in reality most companies are still rather primitive in their ESG thinking.

You would not find a Microsoft equivalent in China, issuing “Zero Carbon Emission” statements, with big plans to build solar panels or wind turbines to offset their carbon footprint. That simply does not happen in China and there is no system for that to happen.

However, over the years we have seen some companies making real progress. Much of our focus is on the direction of travel and the marginal changes underway. Anta Sports for example, recently appointed a female director who was the top management of Chanel. It is not just about gender diversity, but also that a local Chinese consumer company hired someone from a reputable global brand like Chanel. It tells us that the company is really thinking about improving the brand and is receptive to change. Perhaps it may seem like a small step, but to us such developments are more important than applying fancy metrics. We will continue to engage actively with investee companies and grow with them.

While China might not be as “good” in terms of ESG as people may have thought in the past, it is probably also not as bad. If we compare China to other Emerging Market peers, I think China should be proud of what has been achieved — the country has come a long way.

Source: Company data retrieved from company annual reports or other such investor reports. Financial metrics and valuations are from FactSet, Lipper and Bloomberg. As at 31 August 2021 or otherwise noted.

Important Information

References to “we” or “us” are references to First Sentier Investors (FSI). The FSSA Investment Managers business forms part of First Sentier Investors, which is a global asset management business that is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

In Hong Kong, this document is issued by First State Investments (Hong Kong) Limited (FSI HK) and has not been reviewed by the Securities & Futures Commission in Hong Kong. In Singapore, this document is issued by First State Investments (Singapore) (FSIS) whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM).

This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time.

Any opinions expressed in this material are the opinions of the individual authors at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individuals within First Sentier Investors.

Please refer to the relevant offering documents in relation to any funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website and should be considered before any investment decision in relation to any such funds.

Neither MUFG, FSI HK, FSIS, FSI AIM nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested.

To the extent permitted by law, no liability is accepted by MUFG, FSI HK, FSIS, FSI AIM nor any of their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that we believe to be accurate and reliable, however neither the MUFG, FSI HK, FSIS, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI.

Total returns shown for the funds are gross returns and do not take into account any ongoing fees. Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited 2021.

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom