Listen to the episode

RQI Investors Real Insights: Lessons from the Quant Winter

In this episode we explore RQI Investors' latest research “Lessons from the Quant Winter”, a comprehensive report that examines the challenging period from 2018 to 2020 when quant strategies faced significant headwinds. We unpack the causes behind this underperformance, the impact on markets (especially in Australia and other developed economies), and the surprising rebound post-COVID. We explore the intersection of human expertise and advanced technology, brought to life through an AI-generated voice.

Summary

The quant winter was a two‑year period from 2018 to 2020 when quant funds underperformed. This was largely a Developed Markets effect, with Australia also affected, and Emerging Markets showed a different profile (shorter and sharper).

The main culprit was Value, which performed poorly (and progressively worse) as the period went on. Other factors like Growth and Momentum – which usually compensate for Value underperformance – and Low Volatility did not. Quality performed relatively well.

The “why” is not clear. Low inflation and the growth of big tech from about 2015 are certainly contributors, but the lack of performance of Growth and Momentum is still a puzzle.

By using a perfect forecast or “oracle” approach, we see that it would have been difficult to position a quant factor model any differently.

The last few years have shown strong quant factor performance and have raised questions of whether a quant winter could recur. We believe this period is more of a recovery from the winter than a precursor to another factor drought.

A value story

What became known as the quant winter was a period of a little over two years, from early 2018 to mid-2020. Nomura, in a private research note, found that only 15% of quant funds beat their benchmarks in 2018 and 2019.1

Could it happen again? A recent bounce back in performance has raised this question.

We look at factor performance during this period and whether we would have done anything differently if we had known in advance of this period.

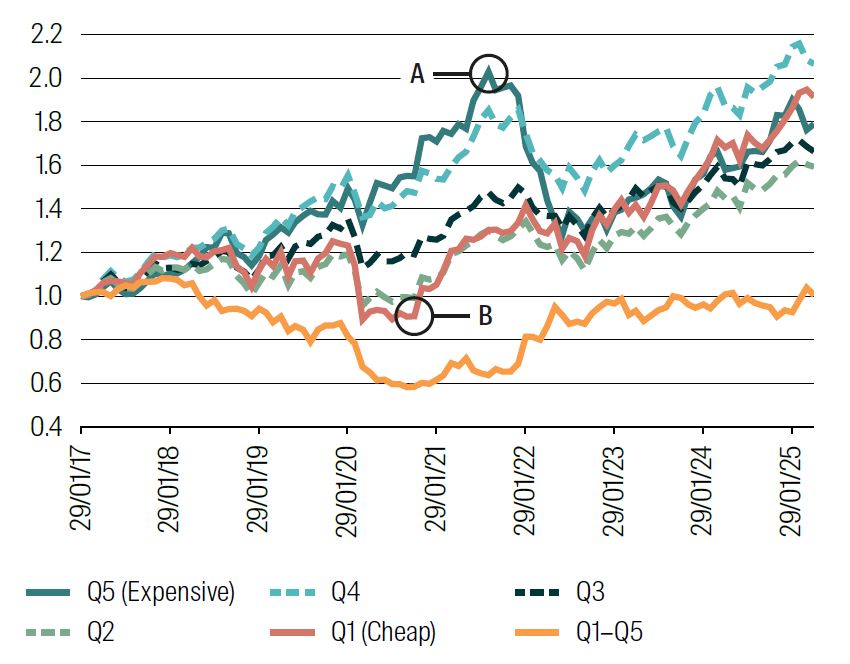

We find that the main driver of this poor performance was the Value factor. The orange line on Chart 1 below shows the performance of Value from 1 Jan 2017 to 1 May 2025. It fell sharply from about early 2018 until mid‑2020, when it rebounded. The best Value stocks (Q1, red line) were flat until early 2020, when their performance fell and then sharply rose (point B).

The most expensive stocks (Q5, dark green line) ran very strongly until late 2021, when they fell sharply (point A).

Chart 1: Performance of Value quintiles (measured as EY_NTM)

1 Jan 2017 to 1 May 2025.

Source: RQI Investors, MSCI, 2025.

1 See for example https://www.ft.com/content/8666e64a-357f-11ea-a6d3-9a26f8c3cba4

Potential causes?

Isolating a single cause of the quant winter is probably impossible. At first blush there are a number of possible explanations which, in combination, led to this period of factor underperformance.

Below we list some likely culprits.

1. Growth and valuation multiple expansion of big US tech

In our opinion, this is the main driver of the underperformance of Value during this period. The growth in the largest stocks in the US has been dramatic since about 2015, as we saw in our recent paper on Market Concentration.1

The weight of the top 10 names in MSCI World steadily increased from about 10% in 2015 to more than 25% by late 2024, and these stocks trade at much higher multiples than the market, with the spread widening very sharply, from late 2018.

2. Crowding of factors or increased correlation through quant fund growth

Factor crowding has been a problem in the past, with the GFC being the prime example, where many quant fund returns were highly correlated and negative during the market sell‑off.

The correlation of Value with other factors was highly variable and not increasing as crowding would suggest. We do see Value becoming much less negatively correlated with Momentum and Growth at the start of the quant winter, before reverting. Quality and Growth correlation also varied sharply over the period, although is positive overall.

3. Academic data mining/overfitting

The idea here is that quant investor models closely followed the publication of academic research papers, and that academic research has had poor performance out of sample, either due to overfitting in sample or seeing the idea priced out immediately. We dispute this: (a) quant funds do not blindly adopt these newly released ideas directly into their models, (b) it is the behaviour of more standard or generic factors that seem to be at the heart of the quant winter, and (c) the behaviour of these factors is not uniform, and so does not point to a central all‑encompassing factor driver like research overfitting.

4. Low interest rates and inflation

Characteristics of the approximately 10 years between the GFC and Covid were low interest rates and low inflation. We already know that this led to a period which provided strong support for Growth as a style, evidenced by the underperformance of the Value style for most that period.2 In some ways, government or political policy encouraged a type of Growth bubble and supported the dramatic emergence of the tech giants.

5. Natural cyclicality in quant factors?

Different types of quant factors work at different stages of the economic cycle. There are also examples of “seasonality” rather than cyclicality. (for example, momentum in Australia tends to work especially well in June and then badly in July, due to tax loss selling and then repurchase).

Detectable quant behaviour can be attached to certain market regimes, but we could not call it cyclicality. Its contribution to the quant winter was probably very muted.

1 Walsh, D, RQI Investors, 2025, Extreme concentration and its implications for equity investors. https://www.firstsentierinvestors.com.au/au/en/institutional/insights/latest-insights/extreme-concentration-and-its-implications-for-equity-investors.html

2 Artificially low interest rates provide a stimulus for Growth as long dated cash flows are inflated in Present Value calculations.

A second-rate oracle

How should we have been positioned if we wanted to avoid underperformance during this period? In other words, if we have access to an oracle, who could tell us what was about to happen, how would we act? What would pay off?

We propose a second‑rate oracle, rather than a first‑rate all‑ seeing oracle. This second‑rate oracle can only tell us in which quintile of future returns a stock belongs today. For example, by visiting our second‑rate oracle we will get to know today if stock ABC will be in the top quintile of returns in (say) 12 months’ time. Our obvious investment strategy is then to go long quintile 1 and short quintile 5.1

What are the characteristics of the stocks in these quintiles?

This helps us pose the entirely hypothetical question – how would we be positioned (that is, what factor exposures would we have) to capture the return spread between best value and most expensive (Q1–Q5)?2 Our universe is again MSCI World ex Australia.

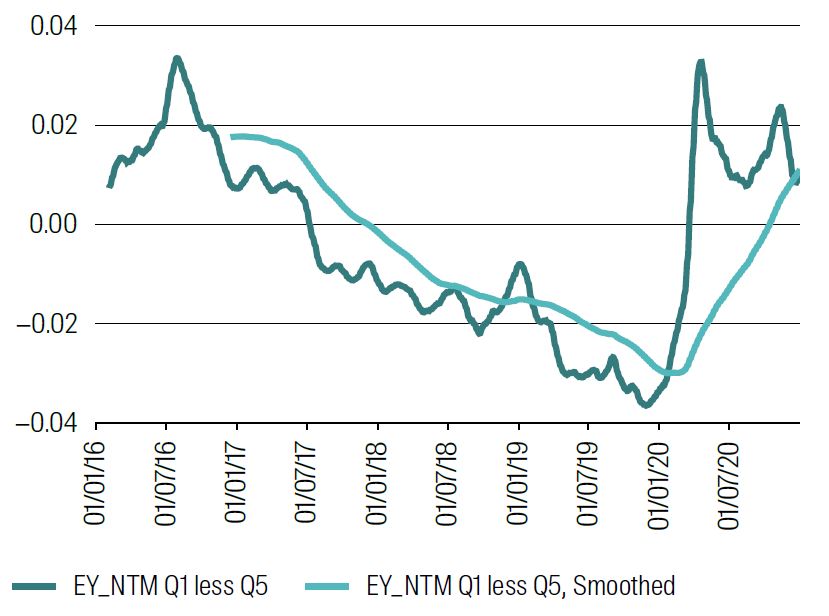

Chart 2 plots the optimal positioning during the quant winter period – from the start of Jan 2016 to the end of Dec 2020.3 Recall that each point in the chart is the Value tilt that will maximise returns over the next 250 days.

We see the essence of the quant winter here. At the beginning of 2016, we would want to hold a positively tilted Value portfolio to get the best return over the following 250 days. But this tilt rapidly declined, went negative and remained strongly negative for the quant winter period. In other words, we would want to tilt aggressively away from Value for perhaps two years to take advantage of our oracle’s knowledge of the future, and that tilt became stronger as the period went on. This tilt only rebounded back to value during late 2020.

Chart 2: Value exposure in oracle quintile spread Q1–Q5

1 Jan 2016 to 1 Jan 2021.

Smoothing is via 25 day and 250 day rolling averages.

Source: RQI Investors, MSCI, 2025

1 Note the convention that Q1 is good value and Q5 is expensive.

2 This is not a ground-breaking idea, but it does quantify the potential benefits (or losses) and shows the time varying exposure required to achieve those benefits.

3 We start one year earlier than in the first paper to allow us to calculate a 250-day future window and to see the runup to the quant winter.

Is another quant winter likely?

We would say this is very unlikely as the circumstances which led to it were very unusual both in scale and confluence.

Value significantly underperformed due to a combination of low interest rates (supporting growth) and an apparent generational step change in technology, which is highly concentrated in a few stocks. Quality (measured as ROE) paid off, but it was expensive. Momentum did not pay off – the move may have been too concentrated. Growth did not pay off because it was not growth in earnings but a growth in multiples that was behind it. In summary, the set of circumstances leading to this period was unusual and seems to have a low probability of being repeated.

We would make two recommendations to help mitigate the impact of future signal vacuums like this. They seem obvious in hindsight but are critical to a high‑quality quant process.

- Avoid overuse of generic quant factors and diversify your inputs.

- Diversify the output factor exposures through better portfolio construction.

Recovery

In the first two chapters, we looked at the origins of what became known as the quant winter, how it played out and what might have caused it. We also looked at how we might have been positioned (theoretically only) if we had known something of this in advance.

In this final chapter, we look at the period from the end of this quant winter to today (actually, end of April 2025), which has been a time of strong quant alpha performance, perhaps stronger than we might have expected. Is this an unusual period, or is it a snapback of the alpha drag we have seen, or something else? To try to answer these questions, we look to contemporaneous factor returns and their correlations.

We title this chapter “Recovery” rather than something like “Quant Spring” quite deliberately, as we want to avoid this interpretation that quant is somehow seasonal.

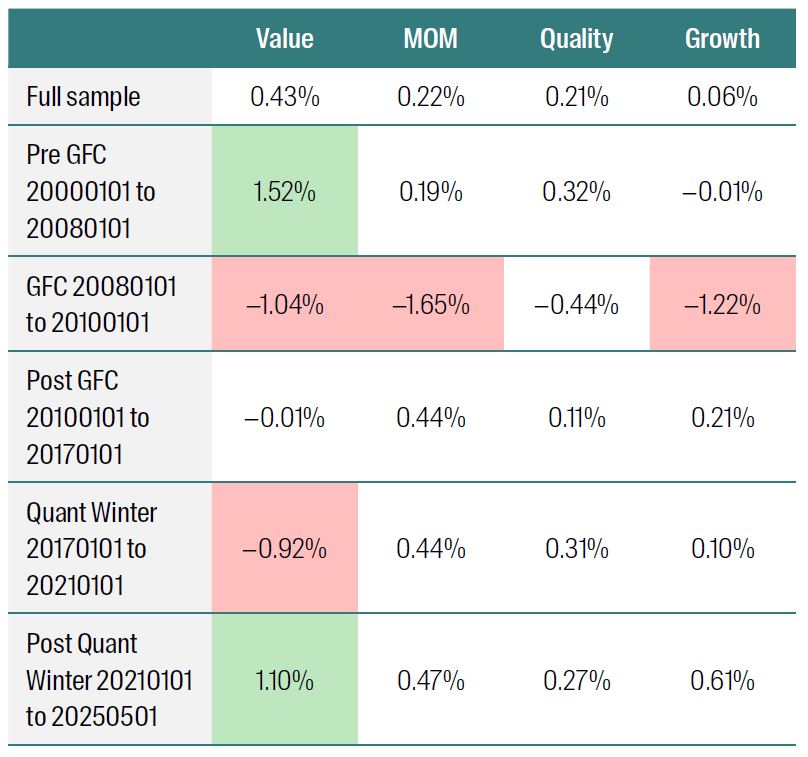

Table 1 summarises our results. We see that this recovery period for each factor is no stronger than other periods in the past, except perhaps for the growth factor. This is almost certainly due to ongoing performance of tech. Less common is seeing Value, Momentum and Growth all performing at the same time. Unusually, Quality has been positive but lower than in the past, suggesting that the strong return to earnings growth has been at the expense of ROE.

Table 1: Average monthly Q1–Q5 return spreads for each factor at different periods

Source: RQI Investors, MSCI, 2025

Read our latest insights

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Group, a global asset management business. First Sentier Group is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. References to “we” or “us” are references to First Sentier Group. Some of our investment teams use the trading names First Sentier Investors, FSSA Investment Managers, Stewart Investors, Albacore Capital, Igneo Infrastructure Partners and RQI Investors. Not all brands are available in all jurisdictions or to all audiences. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its Australian website.

This material is directed at persons who are wholesale investors or wholesale clients (as defined under the Corporations Act 2001 (Cth) (Australia) or Financial Markets Conduct Act 2013 (New Zealand)) and is not intended for persons who are retail clients. This material is general information only. It does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. The information in the material does not constitute an offer of, or an invitation to purchase or subscribe for any securities.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Group.

Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. Any securities mentioned herein may or may not form part of the holdings of a First Sentier Group portfolio at a certain point in time, and the holdings may change over time.

We have taken reasonable care to ensure that this material is accurate, current, complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated gross or net of management fees (where indicated) and net of transaction costs. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Group, 2025

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom