Not all investment alternatives1 are created equal, just as some alternatives might not provide the portfolio diversification qualities the name suggests.

It’s no surprise alternatives have gained a mainstream foothold after 15 years of quantitative easing (QE)2, taking up increasingly large portions of portfolios, in many cases at the expense of traditional bond and equity holdings.

But with printing presses at Central Banks now cooling3, it’s timely to revisit the purpose of alternative assets, how alternatives perform in different market scenarios, and whether their inclusion continues to stack up as we enter a new cycle.

Dipping into the alternatives bucket

The value of the alternatives industry remains small compared to traditional investment markets which combined was valued at US$230 trillion in 2020; in January 2020 the value of the alternatives industry set a new high at $US10 trillion4.

Despite being in its infancy compared to traditional asset classes, cryptocurrency is possibly the biggest headline grabber of the group, with currency debasing QE programs making the case for high profile speculators to step in and support any number of wild and weird crypto names.

Bitcoin became the retail poster child for the crypto hedge against extraordinary measures employed by Central Banks since 2008, but analysis of this crypto’s performance shows a significant beta with US equity markets5.

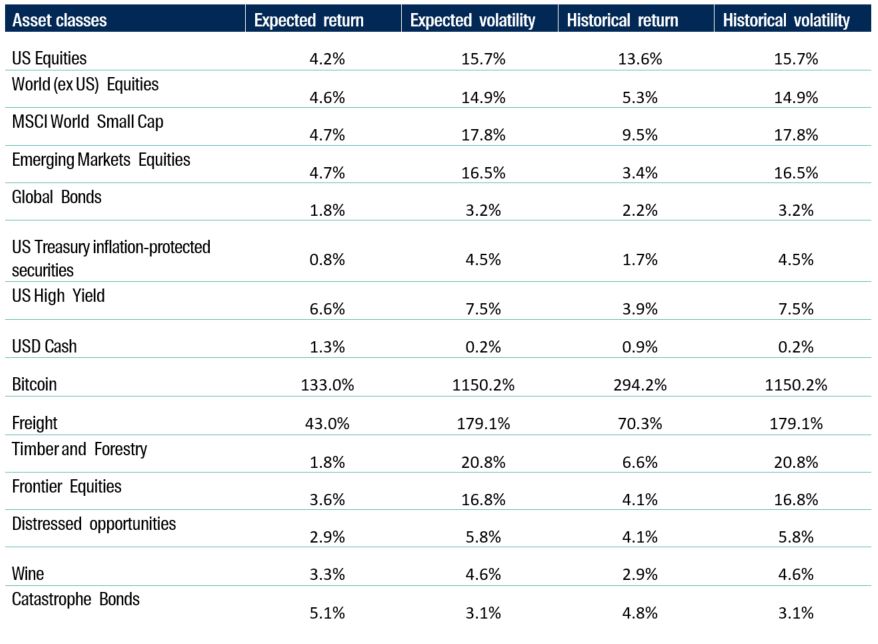

Freight is another alternative considered in our analysis with similar diversification characteristics to Bitcoin. The analysis – a snapshot of the findings provided in the table below – considers seven asset categories, including: cryptocurrencies, freight, timber & forestry, frontier equities, distressed opportunities, fine wine and catastrophe bonds.

Freight showed significantly higher returns than traditional assets, albeit with exceptionally high volatility. While both Freight and Bitcoin tend to have low correlations to traditional assets, the significant volatility we believe also means they would only be appropriate as a small allocation within a portfolio

Source: First Sentier Investors, Bloomberg, Datastream, Internal Proprietary Models as at 30 June 2022, covering the period 28 February 2013 to 30 June, 2022. Returns and volatility data are calculated using monthly data.

Past performance is not indicative of future performance.

Volatility in freight reflects the exposure to the mostly commodity-linked Baltic Exchange Panamax index, an over the counter derivative index that provides a benchmark for the price of moving the major raw materials by sea.

Our analysis shows that fine wine, for instance, has a low correlation with traditional assets. Investors can get access to fine wine (the derivatives, not the liquid itself) through an index that includes 50 out of the 100 top wine labels. The index reflects the returns of the wines bought and stored in a cellar over a period of time.

Meanwhile, the analysis also highlights that timber and forestry, and frontier equities6, which have high correlations with equities are largely driven by systemic risks and would be expected to deliver similar performance to US equities.

Do alternatives still fit?

The holy grail of asset allocation is to find positively compounding real return assets that are negatively correlated. Historically, the pre-eminent asset classes to provide this outcome were equities and bonds.

Going forward, achieving that outcome is likely to be a more difficult task. As the return outlook is uninspiring7, we have explored a possible framework for the addition of alternative investments to portfolios. Given the diversity of alternative investment strategies, it is not possible to unequivocally determine whether they may be suitable for a portfolio without a robust understanding of investors’ return requirements, investment horizon, risk tolerance and liquidity needs.

It is clear based on the analysis of alternative assets that adding alternative assets to a portfolio of traditional assets provide benefits in overall risk-return portfolio characteristics.

However, investors should be aware that not all alternatives are created equal. The significant amount of Bitcoin beta highlighted by the analysis shows that it is strongly influenced by US equity risk, but the low correlation indicates that idiosyncratic factors are driving the returns.

We acknowledge these investments have idiosyncratic risks and operational requirements due to their highly bespoke nature and underlying illiquidity. Implementation considerations in achieving and managing an optimal exposure should therefore not be underestimated.

1 An alternative investment is a financial asset that does not fit into the mainstream equity (corporate stocks), income (debt issued by corporations or governments) or cash (low-risk deposits) investment categories. (Hereafter referred to as alternatives or alternative assets)

2 Central bank purchasing of longer-term financial assets, also known as quantitative easing (QE) was first introduced by the Bank of Japan in 2001 and adopted by other major developed country central banks in response to the global financial crisis in 2008-2009. United Nations Department of Economics and Social Affairs - https://www.un.org/development/desa/dpad/publication/un-desa-policy-brief-no-129-the-monetary-policy-response-to-covid-19-the-role-of-asset-purchase-programmes/

3 The initial phase in which the Bank built up its stock of bond holdings is often referred to as ‘quantitative easing’, or QE for short. That phase ended in February this year. - https://www.rba.gov.au/speeches/2022/sp-ag-2022-05-23.html

4 https://docs.preqin.com/reports/Preqin-Alternatives-in-2020-Report.pdf

6 https://www.spglobal.com/spdji/en/index-family/equity/frontier-equity/#overview

7 https://www.imf.org/en/Publications/WEO/Issues/2022/07/26/world-economic-outlook-update-july-2022

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information is gross performance and does not take into account any ongoing fees. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom