This Rmarkdown workbook steps through some of the modeling we have done in relation to assessing some of aspects of the ‘Your Future Your Super’ (YFYS) proposal by the Treasury. It is intended to be illustrative. The assumptions are general, and can be adjusted by the user.

Assumptions

We impose some high-level assumptions on the asset allocation bands of a balanced fund (default MySuper option). These assumptions are largely consistent with the assumptions provided by the modeling conducted by the Conexus working group. We have used 7 asset classes, and for simplicity without a loss of generality, we have ignored sector tilts such as broad caps vs small caps or developed vs. emerging markets. This is also consistent with APRA’s benchmarking, which does not distinguish for small caps or emerging markets.

Table 1 shows our mean SAA assumptions for the 7 asset classes and our asset allocation band deviation assumptions. Asset allocation deviations can be due to changes to a fund’s SAA or shorter term TAA / DAA positioning. In these simulations below, we don’t make further assumptions for distinguishing between the two with AA deviations. That is, we assume fund risk comes from three sources: i) SAA, ii) AA deviations and iii) manager selection. However, we note that AA deviations due to changes in long term SAA will be incorporated in the APRA benchmarks, and thus not assessed for under-performance, but shorter term TAA will be assessed.

Table 1. Generic Asset Allocation Bands for MySuper default option

We make some long-term mean variance assumptions. These assumptions are based on long term views of growth assets, mid-risk assets and defensive assets.

Table 2. Asset class mean variance assumptions

We have simplified asset class correlations into the following five categories.

- Growth assets: Equities

- Mid assets: Property and Infrastructure

- Credit

- Govt Bonds (FI)

- Cash

We assume asset classes with categories, such as Australian vs International Equities, have a correlation of 0.8.

Table 3. Asset class correlation matrix

Furthermore, we have made some assumptions on manager selection tracking error. We have assumed no correlation between manager alpha and asset class beta, i.e. alpha is orthogonal to beta. We have assumed a small level of correlation between cross-asset manager alpha, between say Australian Equities and International Equities.

Table 4. Generic Manager Tracking Error Assumptions

Internal Functions

Here lies some internal functions we will use for our analysis.

###########################

# Functions

###########################

# Generate a random MySuper balanced fund

# check weights add to 1 and satisfies constraints

.genBalancedFund <- function(bfAssumptions) {

wts <- apply(bfAssumptions, 1, function(x) { runif(1, min = x[5], max = x[4]) })

wts <- wts / sum(wts)

# check to see if weights satisfy lower-upper bounds

if(sum(bfAssumptions$lower < wts) == nrow(bfAssumptions) && sum(bfAssumptions$upper > wts) == nrow(bfAssumptions))

return(wts)

else

.genBalancedFund(bfAssumptions)

}

# Calculate Marginal Contribution to Total Risk and Tracking Error

# notes: http://webuser.bus.umich.edu/ppasquar/shortpaper6.pdf

calcMarginalRisk <- function() {

fundWgts <- .genBalancedFund(bfAssumptions)

SAAWgts <- bfAssumptions$meanWts

names(SAAWgts) <- rownames(bfAssumptions)

# totWgts = static SAA + TAA + Manager Selection

totWgts <- c(SAAWgts, fundWgts - SAAWgts, fundWgts)

relWgts <- c(rep(0, length(SAAWgts)), fundWgts - SAAWgts, fundWgts)

# calculate total fund risk and tracking error

totalRisk <- sqrt(t(as.matrix(totWgts)) %*% covAssetMgr %*% as.matrix(totWgts))[1,1]

trackingError <- sqrt(t(as.matrix(relWgts)) %*% covAssetMgr %*% as.matrix(relWgts))[1,1]

# marginal contribution to total risk and relative risk

mcTR <- totWgts * t(as.matrix(totWgts)) %*% covAssetMgr / totalRisk

mcTE <- relWgts * t(as.matrix(relWgts)) %*% covAssetMgr / trackingError

return(list(mcTR=mcTR, mcTE=mcTE))

}

# Generate MySuper balanced fund returns

# where AA deviations to static SAA is randomized

.genReturns <- function(yearsToRetirement, alphaAssumption=rep(0,numAssets)) {

fundWgts <- sapply(1:yearsToRetirement, function(x) .genBalancedFund(bfAssumptions))

rets <- mvrnorm(n=yearsToRetirement, mu=meanAsset, Sigma=covAsset)

mgrAlpha <- mvrnorm(n=yearsToRetirement, mu=alphaAssumption, Sigma=covMgr)

fundRets <- diag(rets %*% fundWgts)

fundAlpha <- diag(mgrAlpha %*% fundWgts)

return(fundRets + fundAlpha)

}

# Calculate the dollar value at the end of the accumulation stage

# i.e. total amount for retirement

calcRetirement<- function(contributions, alphaAssumption=rep(0,numAssets)) {

rets <- .genReturns(length(contributions), alphaAssumption = alphaAssumption)

cumrets <- cumprod(1 + rets)

accum <- sum(contributions * rev(cumrets))

return(accum)

}

# The Probability of Failure in the Annual Performance Test

.pFailHurdle <- function(IR, TE, years, hurdle= -0.005) {

alpha <- IR * TE

alpha_se <- sqrt(TE^2/ years)

pnorm(hurdle, mean = alpha, sd = alpha_se, lower.tail = T)

} Modeling 1. The marginal contribution of Asset Allocation vs Manager Selection in Absolute Total Risk and Relative Tracking Error

We simulate 10,000 balanced funds based on the asset allocation bands in our assumptions. For each balanced fund, we estimate it’s total risk, tracking error and marginal contributions to total risk and tracking error.

We show that:

- Asset allocation contribution dominates Total Risk. Hence member outcomes is largely driven by a super fund’s asset allocation decisions.

- On average, manager selection accounts for 60% of peer risk (aka Tracking Error).

nsims <- 10000

# run simulations

sims <- lapply(1:nsims, function(x) calcMarginalRisk())

TR <- sapply(sims, function(x) x$mcTR)

TE <- sapply(sims, function(x) x$mcTE)

rownames(TR) <- colnames(covAssetMgr)

rownames(TE) <- colnames(covAssetMgr)

# average marginal contribution to risk

mcTable <- data.frame(`Marginal Contribution to Total Risk (%)` = round(apply(TR, 1, mean)*100, 2),

`Marginal Contribution to Tracking Error (bps)` = round(apply(TE, 1, mean)*10000,2))

kable(mcTable, caption = "Marginal Contributions to Risk")

# % of the marginal contribution from SAA, AA deviations and Manager Selection

row.idx <- lapply(c("SAA", "AA Deviations", "Mgr Selection"), function(x) grep(x, rownames(TE)))

pctTR <- apply(TR, 2, function(x) sapply(row.idx, function(y) sum(x[y]) / sum(x)))

pctTE <- apply(TE, 2, function(x) sapply(row.idx[-1], function(y) sum(x[y]) / sum(x)))

rownames(pctTR) <- c("SAA", "AA Deviations", "Mgr Selection")

rownames(pctTE) <- c("AA Deviations", "Mgr Selection")

# plot the distributions

# marginal contributions of total risk

pctTR_l <- melt(t(pctTR))

colnames(pctTR_l) <- c("sims", "source", "contribution")

ggplot(pctTR_l, aes(x = contribution *100, fill = source)) +

geom_histogram(aes(y=..density..), bins = 100) +

geom_density(alpha=.2) +

facet_free(source~. , scales = "free") +

xlab("Percentage contribution to Total Risk (%)") + theme_classic() +

ggtitle("The Percentage Marginal Contribution of Total Risk")

# marginal contributions of tracking error

pctTE_l <- melt(t(pctTE))

colnames(pctTE_l) <- c("sims", "source", "contribution")

ggplot(pctTE_l, aes(x = contribution *100, fill = source)) +

geom_histogram(aes(y=..density..), bins = 100) +

geom_density(alpha=.2) +

facet_free(source~. , scales = "free") +

xlab("Percentage contribution to Tracking Error (%)") + theme_classic() +

ggtitle("The Percentage Marginal Contribution of Tracking Error (Peer Risk)")

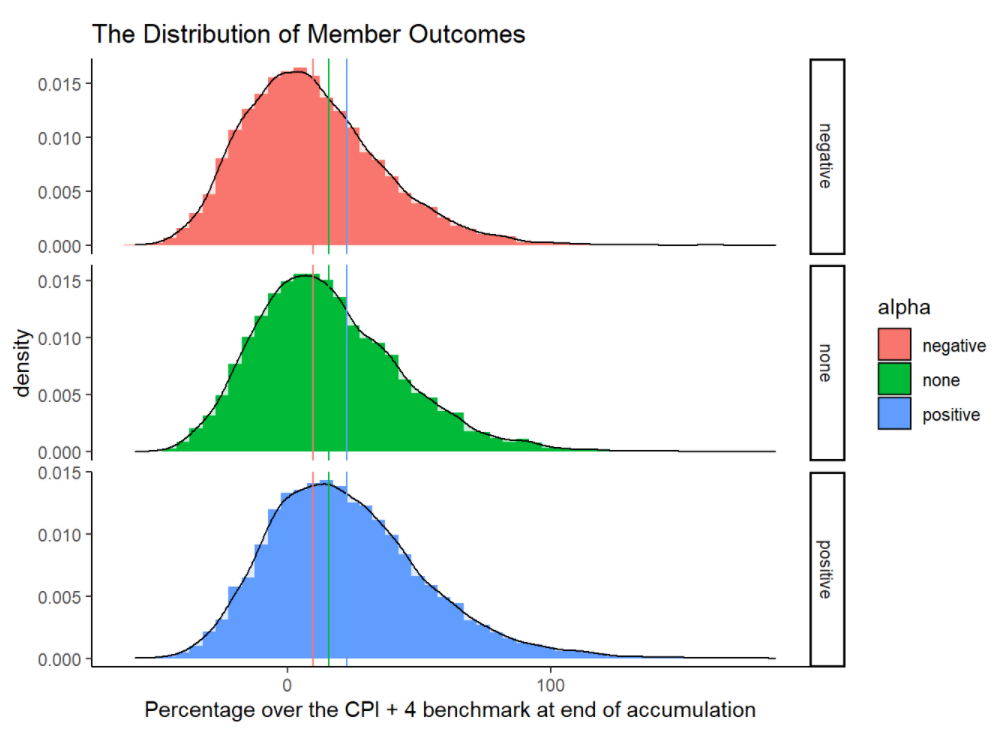

Modeling 2. On the probabilities of meeting member retirement outcomes

Here, we examine the impact of asset allocation and manager selection in meeting member retirement outcomes. We make a simplistic assumption that a member meets their retirement outcomes if they are able to accumulate their contributions under an annual return of CPI + 4% consistently. For instance, a women earning $100,000 pa with 2% wage growth and 9.5% super contributions over a period of 20 years should accumulate up to $441,975 for her super. Let’s assume this to be the retirement goal.

We look at the probability our ‘generic balanced plans’ misses these objectives.

- Manager selection is not a key driver of member outcomes.

- Asset allocation drives whether a member meets its retirement outcomes.

# sample member information

salary <- 100000L

annualContributions <- salary * 0.095

wageGrowth <- 0.02

yearsToRetirement <- 20

contributions <- annualContributions * cumprod(rep(1+wageGrowth, yearsToRetirement))

# CPI + 4% benchmark

# where CPI assumed to be circa 2% pa

bench <- rep(0.06, length(contributions))

cumbench <- cumprod(1 + bench)

accumbench <- sum(contributions * rev(cumbench))

print(paste0("For an annual salary of ", salary, " with 9.5% super contribution and wage growth of ", wageGrowth, " over ", yearsToRetirement, " years, the benchmark accumulation is: ", accumbench))## [1] "For an annual salary of 100000 with 9.5% super contribution and wage growth of 0.02 over 20 years, the benchmark accumulation is: 441975.280155874"# simulate retirement outcomes under 3 manager selection scenarios

nsims <- 10000

outcomes <- list()

outcomes[["none"]] <- sapply(1:nsims, function(x) calcRetirement(contributions))

outcomes[["negative"]] <- sapply(1:nsims, function(x) calcRetirement(contributions, rep(-0.005, numAssets)))

outcomes[["positive"]] <- sapply(1:nsims, function(x) calcRetirement(contributions, rep(+0.005, numAssets)))

outcomes <- as.data.frame(outcomes)

pctOutcomes <- outcomes / accumbench - 1

# plot simulations

pctOutcomes_long <- gather(pctOutcomes, alpha, outcome, 1:3)

ggplot(pctOutcomes_long, aes(x = outcome * 100, fill = alpha)) +

geom_histogram(aes(y=..density..), bins=50) +

geom_density(alpha=.2) +

facet_free(alpha~., scales = "free_y") +

geom_vline(aes(xintercept=mean(pctOutcomes$positive)*100, col="red"), show.legend = F) +

geom_vline(aes(xintercept=mean(pctOutcomes$none)*100, col="green"), show.legend = F) +

geom_vline(aes(xintercept=mean(pctOutcomes$negative)*100, col="blue"), show.legend = F) +

xlab("Percentage over the CPI + 4 benchmark at end of accumulation") + theme_classic() +

ggtitle("The Distribution of Member Outcomes")

# percentage of outcomes that underperformed the CPI+4% benchmark

apply(pctOutcomes, 2, function(x) sum(x< 0) / length(x) )## none negative positive

## 0.3107 0.3952 0.2347Modeling 3. The Probability of Failure increases with Tracking Error

In this section, we examine how the annual performance test may incentivize index herding. We find that the probability of failure is reduced if funds choose to take less tracking error to the APRA benchmark returns. We show that at lower levels of tracking error, poor performance cannot be detected.

trackingErrors <-seq(0, 0.10, 0.001)

informationRatios <- seq(-0.5, +0.5, 0.01)

results <- matrix(0, length(trackingErrors), length(informationRatios))

rownames(results) <- trackingErrors * 100

colnames(results) <- informationRatios

for (i in 1:length(trackingErrors)) {

results[i, ] <- sapply(informationRatios, function(x) .pFailHurdle(x, TE = trackingErrors[i], years = 8))

}

levelplot(results,ylab = "Information Ratio", xlab = "Tracking Error (%)",

main = "Probability of Failure",

scales=list(x = list(at=seq(1, nrow(results),10)), y = list(at=seq(1, ncol(results),10))),

col.regions = colorRampPalette(rev(brewer.pal(4, "RdBu"))))

Modeling 4. Impact of Time Frame (Assessment Length) on False Positives

We test to examine if 8 years enough to assess a good fund from a bad fund. We find that at 8 years, most super funds would need to run at tracking errors of circa 1% or lower to be reasonably confident in not being accidently tested as an underperforming fund.

years <- seq(1,20, 1)

trackingErrors <- seq(0, 0.10, 0.005 )

results <- matrix(0, length(trackingErrors), length(years))

rownames(results) <- trackingErrors * 100

colnames(results) <- years

for (i in 1:length(trackingErrors)) {

results[i, ] <- sapply(years, function(x) .pFailHurdle(IR = 0, TE = trackingErrors[i], years = x))

}

levelplot(results,ylab = "Years", xlab = "Tracking Error (%)",

main = "Probability of Failure",

col.regions = colorRampPalette(rev(brewer.pal(4, "RdBu"))))

Disclaimer

This Workbook has been prepared by First Sentier Investors Realindex Pty Limited (ABN 24 133 312 017, AFSL 335381) (FSI RP) as a supplement to the publication titled “Addressing the Underperformance in Superannuation: Concerns around the Your Future, Your Super proposal” (Publication) and should only be read together with the Publication. The purpose of this Workbook is to illustrate the assumptions and the basis for the calculations that have been summarised in the Publication. It is not intended to provide financial product advice. The information, assumptions and the basis for the calculations herein are in the opinion of FSI RP accurate, reliable and reasonable, however neither FSI RP, Mitsubishi UFJ Financial Group, Inc (MUFG) nor their respective affiliates offer any warranty that such assumptions will eventuate or that the information or calculations contain no factual errors. To the extent permitted by law, no liability is accepted by MUFG, FSI RP nor their respective affiliates for any loss or damage as a result of any reliance on the information, assumptions or calculations in this Workbook.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom