Portfolio Manager Sophia Li shares her analysis of key positions from the FSSA IM Japan portfolio, and how they have fared through the pandemic so far. Looking to the future, she looks at the companies positioned to benefit from long-term trends such as the 5G revolution.

Sophia Li, Portfolio Manager, joined FSSA Investment Managers as a graduate in 2009. Over the years, she developed an extensive coverage of companies in North Asia, leading to the launch of the team’s dedicated Japan strategy in 2015.

Japan has fallen into a recession, doubling on the consumption tax hike Q4 last year. How is the strategy positioned to navigate these headwinds?

It was a mistake to increase the consumption tax in the first place. This year, the net interest payments of the Japanese government would probably turn negative regardless of the consumption tax hike.

The equity correction in the first quarter of the year was mainly due to concerns about the COVID-19 outbreak, followed by the global pandemic. In anticipation of this, we have actually taken advantage of the market volatility to consolidate our portfolio into high conviction names and buy high quality companies at a bargain.

A large part of our portfolio today is invested into purely domestic companies with high earnings visibility. This includes drugstore operators and discounted retailers that offer daily necessities, and software and IT solutions providers that generate a recurring annual income.

Most of these companies have actually benefited from tailwinds brought forward by the pandemic, which has accelerated the adoption of their products and services.

Among the companies with high global exposure, we have been investing in strong Asian consumer companies that would benefit from local demographics and the increasing middle classes in the long run. We have also invested in factory automation companies that would benefit from the global supply chain diversification post-pandemic and global technology and semiconductor leaders. Most of these companies have dominant market share in their respective industries and command very strong pricing power.

Could you share some examples?

A company that we have added to recently is GMO Payment Gateway, the largest online payment processing company.

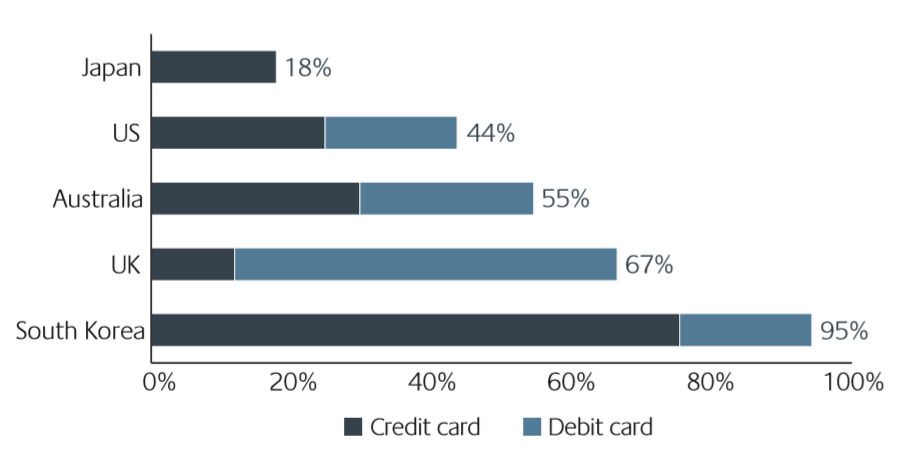

There is a lot of room to grow for this company, especially with the low e-commerce penetration rate in Japan, which is about 7% but has been accelerating. Not only that, the cashless payment penetration in Japan is also quite low, at about 18% compared with the United States at 44% and South Korea at 95%.

Penetration Rate of Cashless Payment Card Usage Rate to Private Final Consumption Expenditure

Source: GMO Payment Gateway, First State Investments as at May 2020

The recent policies initiated by the government, including merchant subsidies and consumer rewards, are expected to accelerate the rise of digital payments. This would benefit GMO Payment Gateway, which has been actively providing these solutions for offline vendors. Besides that, they have also been building the next-generation payment infrastructure with SMBC in Japan as well as VISA.

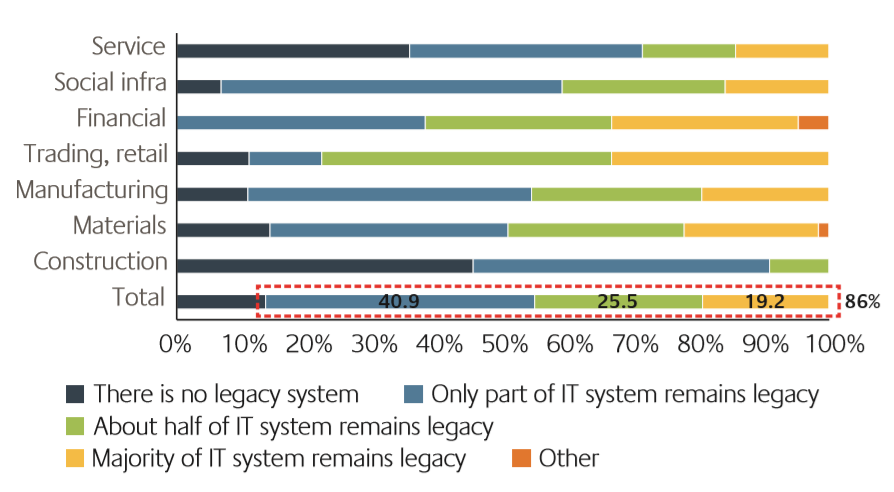

Another company that we added to is OBIC, the largest Japanese Enterprise Resource Planning (ERP) software company. There is a strong case for IT spending to accelerate in Japan in the coming years. A recent government survey showed that 80% of large Japanese enterprises are still using custom-made, legacy IT systems, of which 70% are too old and costly to be maintained.

Proportion of Legacy IT Systems in Use at Japanese Companies

Source: Japan Users Association of Information Systems (JUAS), CLSA as at January 2020

That would bring strong long-term replacement demand to OBIC, which is the industry leader in the ERP industry. Another reason we like this company is the strong financial track record. It has delivered consistent profit growth over the past 15 years even during the 2008 Global Financial Crisis. The strong management team has led to consistent improvement of its operating margin by more than 55% this year - the most profitable among all of the Japanese peers.

What about structural tailwinds around the 5G revolution? Does that provide any opportunities for you?

In my view, 5G is simply a tool to enable a number of secular technological trends such as A.I., Internet of Things, smart factory and cloud penetration.

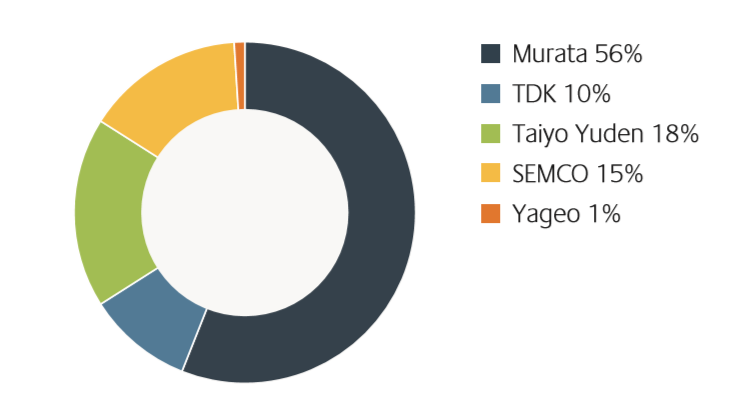

I believe that the leading global electronic components and semiconductor equipment manufacturers would benefit by selling the picks and shovels in this gold rush. There are a number of examples in Japan. One of them is Murata Manufacturing, which is the world’s largest multi-layer ceramic capacitor (MLCC) manufacturer with more than 50% global market share.

High-end MLCC Global Market Share

Source: CLSA, as at 31 December 2019

According to our research, the number of MLCCs used in high-end 5G phones is estimated to be at least 30% higher than in an LTE or 3G phone.

Other examples include Hoya and Lasertec, which would benefit from the increasing adoption of extreme ultraviolet (EUV) lithography in the semiconductor manufacturing process. Hoya has close to 100% market share for the mask blanks used for EUV and Lasertec is a monopoly in the EUV mask inspection system.

Japanese companies have gained a reputation of being great hoarders of cash. How has this benefited the companies in your portfolio, especially in the current environment?

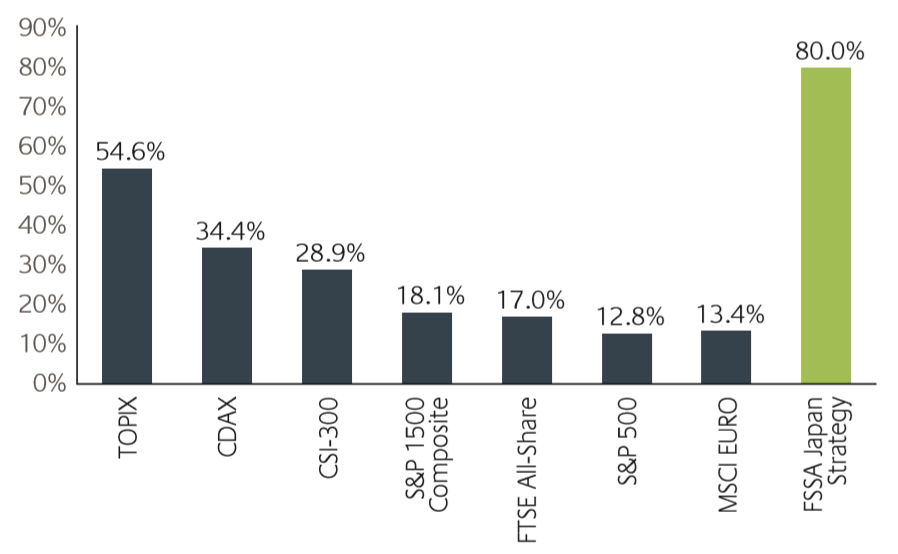

After years of criticism, the habit of hoarding cash may just pay off. Japanese companies have very strong balance sheets and that should allow them to emerge even stronger post COVID-19. More than 50% of the companies in TOPIX are in a net cash position, compared to only 13% in the S&P 500 and approximately 18% in FTSE All-Share.

% of Companies in Net Cash Position

Source: CLSA, Bloomberg as at September 2019

My investment style is to look for companies that generate very high return on invested capital, which truly reflects the strength of business itself. More than 80% of the companies in the strategy are in net cash position, which is simply a result of their asset-light business model and very strong free cash flow generation.

I believe the strong cash position of Japanese companies will not only allow them to maintain or increase the shareholder return post COVID-19, but also provide them with a very big war chest to make acquisitions at attractive valuations. For the next few years, I believe the strong Japanese companies are better positioned for industry consolidation opportunities and they should be able to deliver higher growth than their global peers, who will be constrained by high debt levels.

Company and onsite meetings are an integral of part of FSSA’s investment process. With the team based in Hong Kong and travel grinding to a halt, has it been a challenge to stay connected with the companies in Japan?

Despite being based in Hong Kong, we have never had any problems maintaining close relationships with companies in Japan. Every year, I would travel to Japan twice a quarter and spend almost one third of my time on the ground meeting the companies.

During the pandemic, we have stayed connected with companies by either speaking over Zoom meetings or via teleconference.

Important Information

References to “we” or “us” are references to First Sentier Investors, a global asset management business operating in Australia as First Sentier Investors and as First State Investments (FSI) elsewhere. FSI and First State Stewart Asia (FSSA) are business names and divisions of First State Investments (Hong Kong) Limited (FSI HK) and First State Investments (Singapore) (FSIS), both of which form part of First Sentier Investors. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. In Hong Kong, this document is issued by FSI HK and has not been reviewed by the Securities & Futures Commission in Hong Kong. First State Investments (Hong Kong) Limited is exempt from the need to hold an Australian financial services licence under the Australian Corporations Act (Cth) 2001. It is regulated by the Securities and Futures Commission of Hong Kong under Hong Kong laws, which are different to Australian laws. In Singapore, this document is issued by FSIS whose company registration number is 196900420D. In Australia, this information has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI). A copy of the Financial Services Guide for FSI is available from First Sentier Investors on its website. This document is directed at persons who are professional, sophisticated or wholesale clients and has not been prepared for and is not intended for persons who are retail clients. The information herein is for information purposes only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Some of the funds mentioned herein are not authorised for offer/sale to the public in certain jurisdiction. Reference to specific securities (if any) is included for the purpose of illustration only and should not be construed as a recommendation to buy or sell the same. All securities mentioned herein may or may not form part of the holdings of First Sentier Investors’ portfolios at a certain point in time, and the holdings may change over time. Please refer to the relevant offering documents in relation to funds mentioned in this material for details, including the risk factors and information on requirements relating to investor eligibility before making a decision about investing in such funds. The offering document is available from First Sentier Investors and FSI on its website. Neither MUFG, FSI HK, FSIS, FSI nor any of affiliates thereof guarantee the performance of any investment or entity referred to in this document or the repayment of capital. Any investment in funds referred to herein are not deposits or other liabilities of MUFG, FSI HK, FSIS, FSI or affiliates thereof and are subject to investment risk, including loss of income and capital invested. To the extent permitted by law, no liability is accepted by MUFG or any of its affiliates for any loss or damage as a result of any reliance on this information. This information is, or is based upon, information that we believe to be accurate and reliable, however neither MUFG nor any affiliates thereof offers any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI. Copyright © First Sentier Investors (Australia) Services Pty Limited 2020 All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom