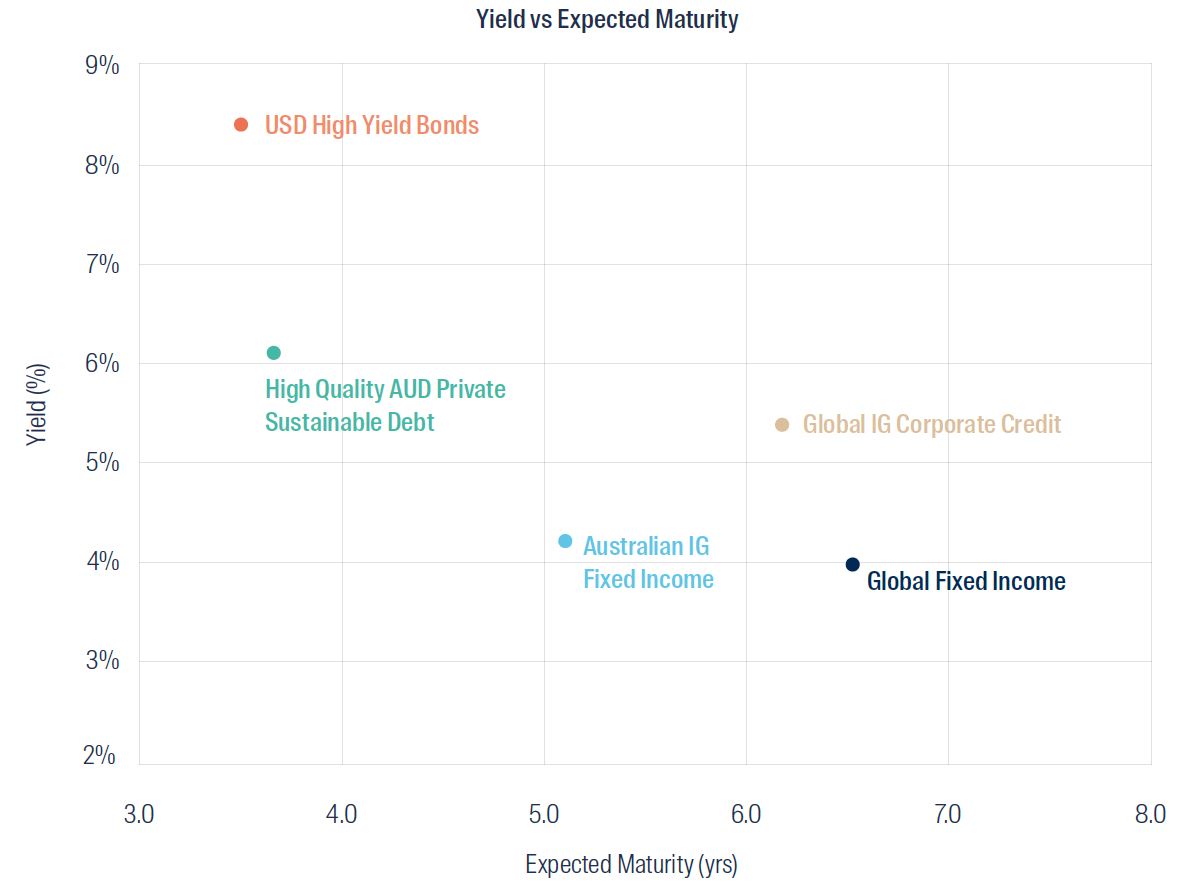

With the all in yield on high quality Australian sustainable loans the highest it has been in a decade, it may now be a good time for investors to consider an allocation to this area of the market.

Source: Bloomberg as at 30 August 2023. Indices used are: Australian Composite Bond: Bloomberg AusBond Composite 0+ Year Index, Corporate Credit (Global IG): Bloomberg Global Aggregate Corporate Index, Global Fixed Income: Bloomberg Global Aggregate Index, USD High Yield Bonds: Bloomberg US Corporate High Yield Index, High Quality AUD Private Sustainable Debt: FSI Sustainable Debt Fund.

Value for risk

High quality Australian sustainable loans are loans made to projects or companies that positively contribute to an environmental or social objective. The sustainable objectives can include climate change mitigation, environmental protection, or good health. Specific operations include smart meters, wind farms, waste management, and aged care facilities.

For years there has been strong growth in investing in the equity of these high quality sustainable operations, like wind farms, but now we believe that the return differential between being a lender and shareholder is at its lowest in years. There might therefore be some merit in investors considering being lenders rather than shareholders, particularly on a risk-adjusted basis.

High-quality Australian sustainable loans typically provide investors with beneficial terms which gives investors reasonable assurance in earning the stated yield, these include including:

- Cash flow superiority (first ranking) Ability to stop cash flows to shareholders if operational cash flows are below expectations

- Cash flow forecasts sculpted to lender requirements, with shareholders taking cash flow volatility risk

- Projects often benefiting from long term fixed revenues, with operational risk born by shareholders

- Rolling maturities provide lenders with opportunities to reprice and adjust terms

- Shareholders require lender approval to any action that will materially impact cash flows

- Restriction on asset sales, asset purchases, and shareholder dividends

- Restrictions on borrowers acquiring more senior secured debt

- First ranking security over all assets in the event of default

- Receipt of upfront fees and commitment fees

- Legal fees, expert due diligence, tax advice, insurance advice paid for by the borrower (and therefore effectively shareholders)

- Ability to access sectors not traditionally available in public markets, like government projects

Syndicating lending involves a group of lenders providing a single loan to borrowers. The Australian syndicated loan market is quite unique versus global loan markets, in that the Australian major banks continue to dominate the market. This dominance ensures loan structures have continued to contain very strong standards, unlike offshore loans which covenants and terms have slowly disappeared overtime.

This is different to bonds, which typically have standardised terms and little to no limitation on shareholders except to repay the principal and interest in most cases. These high quality Australian sustainable loans are also different to loans available in what people refer to as the ‘Private Debt’ market. Loans in the ‘Private Debt’ market tend to have less robust cash flows, subordination, or other aspects that can result in a markedly higher risk profile making it more aligned to sub investment grade debt.

One way to compare credit risk is to map the credit spread return by the Expected Credit Loss of each market. The Expected Credit Loss is a combination of the Probability of Default for the loan/bond and the Loss Given Default for the loan/bond. The reason we believe using this measure above any other is due to the significant contractual differences across markets, which can materially impact both the Probability of Default and Loss Given Default. There are also significant differences in the way loans/ bonds are valued, reducing the usefulness of traditional volatility measures.

Source: Bloomberg as at 30 August 2023. Indices used are: Australian Composite Bond: Bloomberg AusBond Composite 0+ Year Index, Corporate Credit (Global IG): Bloomberg Global Aggregate Corporate Index, Global Fixed Income: Bloomberg Global Aggregate Index, USD High Yield Bonds: Bloomberg US Corporate High Yield Index, High Quality AUD Private Sustainable Debt: FSI Sustainable Debt Fund. Expected Credit Loss – S&P Historical probability of default. For bond funds this includes 50% recovery expectation and for the High Quality AUD Private Sustainable Debt this includes 10% recovery expectations.

Sizeable market opportunity

The Australian syndicated loan market increased from about $10 billion in 1995 to about $140 billion in 20221. With large loan average size of around $300 million and the significant funding need as Australia rebalances to a more sustainable future, the investment universe is vast.

For example if we just focus on the energy industry, renewable energy only accounted for around a third of Australia’s total electricity generation in 20222. Reaching the government’s target of 82 per cent of electricity generation being from renewable energy by 2030 will require significant investment.

In dollar terms, large-scale clean energy investment reached $6.2 billion in 2022; a 17 per cent increase from 2021. Crudely, this cost to output gain ratio would indicate that almost another $120 billion will be required to achieve 100% of total electricity generation. Moreover, this does not include energy use growth, energy stability, storage, or safety.

Indeed, Transgrid, which runs the NSW electricity transmission and is Australia’s largest electricity transmission company is preparing to spend $16.6 billion over the next decade upgrading the east coast power grid, to keep the lights on when the country transitions to 100 per cent renewable energy3.

Since Australia has an ageing population, Aged Care is another industry that seems likely to require significant funding over coming decades. Already 15% of Australians are aged 65 and over – a figure that’s expected to rise to 22% by 20574. According to the Aged Care Financing Authority, the combined total investment for new and rebuilt residential care places over the next decade will be about $55 billion.

It’s important to mention that projects and corporates typically require more debt than equity funding, so if we include other key industries – like waste management, infrastructure, property and manufacturing – the total funding requirement is truly massive. This was underlined recently in Commonwealth Bank of Australia’s 2023 Annual Report, which showed a year on year increase of $14.1 billion in Sustainable funding, to $44.7 billion as at 30 June 20235.

Access to these opportunities has also started to open up, with banks increasingly seeing the benefits of working with non-bank institutional investors with the right credentials.

When originating banks work with one another, ancillary activities like managing the interest rate swap or being the facility agent – both of which attract fees from the borrower – are in play to be won by the completing banks, which can cause friction. Alternatively when an originating banks work with institutional investors, there are no such conflicts as institutional investors are not interested in managing the swap or being facility agents.

Consequently over time we are seeing institutional investors with the right credentials being presented with a very wide range of loans compared to competing banks and also have a more open dialogue regarding the loan terms so that they better meet the needs of institutional investors and their clients.

FSI has developed strong relationships with originating banks and advisers, successfully deploying over $400m towards high quality sustainable loans in recent years. FSIs conservative credit risk oversight and monitoring, combined with market leading ESG credentials leave us well placed to help our clients take advantage of this opportunity.

1 Source: RBA Syndicated Lending Bulletin, June 2023

2 Source: Clean Energy Council, April 2023

3 Source: Transgrid, June 2023

4 Source: Ansell Strategic, April 2023

5 Source: Commonwealth Bank of Australia 2023 Annual Report

Disclaimer

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

The Information Memorandum (IM) for the First Sentier Sustainable Debt Fund (Fund), issued by First Sentier Investors (Australia) RE Ltd (ABN 13 006 464 428, AFSL 240550) , should be considered before deciding whether to acquire or hold units in the Fund(s). The IM is available from First Sentier Investors.

MUFG, FSI AIM, their respective affiliates and any service provider to the Fund do not guarantee the performance of the Fund or the repayment of capital by the Fund. Investments in the Fund are not deposits or other liabilities of MUFG, FSI AIM, their respective affiliates or any service providers to the Fund and investment-type products are subject to investment risk including loss of income and capital invested.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent this material contains any environmental, social and governance (ESG) related commitments or targets, such commitments or targets are current as at the date of publication and have been formulated by the relevant investment team in accordance with either internally developed proprietary frameworks or are otherwise based on the Institutional Investors Group on Climate Change (IIGCC) Paris Aligned Investment Initiative framework. The commitments and targets are based on information and representations made to the relevant investment teams by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of these commitments and targets depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. Any commitments and targets set out in this material are continuously reviewed by the relevant investment teams and subject to change without notice.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. To the extent this material contains any measurements or data related to ESG factors, these measurements or data are estimates based on information sourced by the relevant investment team from third parties including portfolio companies and such information may ultimately prove to be inaccurate. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors, 2023

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom