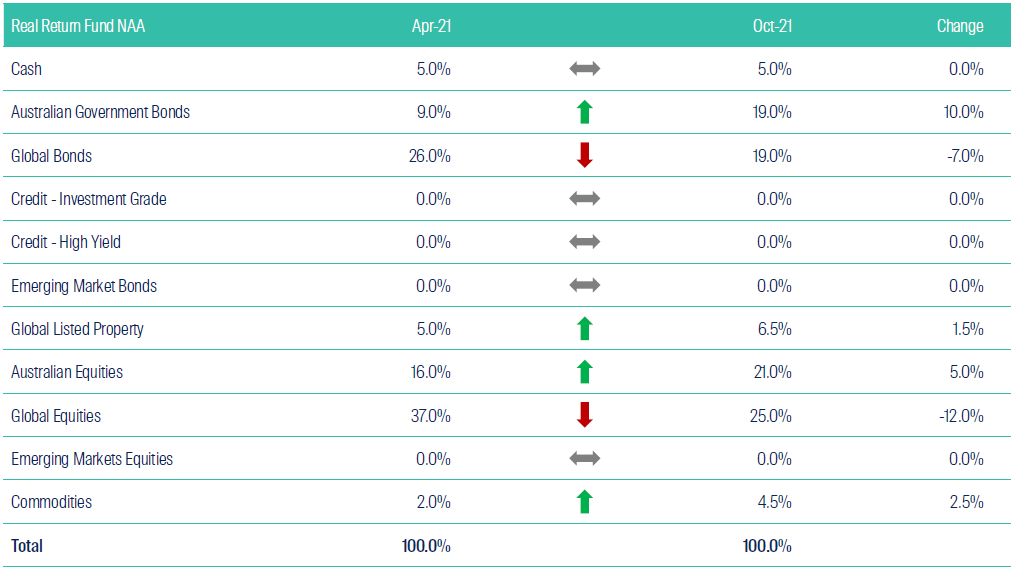

We recently reviewed the Neutral Asset Allocation (NAA) for the First Sentier Multi-Asset Real Return Fund; an exercise that is undertaken twice a year. This note summarises the key drivers of investment markets over the most recent six month period and outlines the changes made to the NAA following this most recent formal review.

It has been more than 18 months since the Covid-19 pandemic first began and although economic growth continues to recover with unemployment rates falling in most regions, inflation concerns are rising. Vaccine hesitancy, supply chain disruptions, and periodic virus outbreaks are all impacting growth rates and creating volatility across financial markets. It has been six months since our last Neutral Asset Allocation review (NAA) and we continue to closely monitor the policies and announcements coming from both governments and central banks alike as they continue to work toward a global recovery.

What exactly is the NAA review?

The first step in our investment process is to determine the economic outlook, both globally and for individual countries. Twice a year, we formally review existing assumptions and determine the likely long-term values for inflation, risk free rates, long-term bond yields, and earnings growth.

Using current valuations as a starting point, these determinations enable us to calculate expected returns for various asset types globally. In turn, this helps inform the most appropriate mix of investments (NAA) that have the highest likelihood of achieving the Fund’s long-term objectives.

Source: First Sentier Investors as at 31 October 2021

How do we determine the right mix of NAA (beta) and DAA (alpha)?

Based on our assumptions for the economic climate, and our expected returns, we can determine the likelihood of meeting the portfolio’s investment objective over the investment horizon. It is becoming increasingly likely that relying solely on the NAA in a constrained long only, unlevered environment will not be sufficient to meet the return objectives. This is where we use our DAA process to take into account shorter-term market dynamics which aims to deliver additional returns and abate portfolio risks, such as tail events. By adding an uncorrelated return source (alpha) we can improve the portfolio’s likelihood of meeting the investment objective.

The combination of NAA and DAA requires the consideration of the current allocations; as the extent to which active management may be used is managed through the portfolio’s risk budget to avoid unwanted additional risks. We consider both the tracking error (as well as other risk metrics) and the expected return, in assessing the portfolio’s ability to meet its investment objective. The ability to add scalable alpha to portfolios provides flexibility to deliver on the investment objective; even in a lower return environment.

In this lower return environment, by allowing the blending of alpha and beta strategies to be more dynamic within the framework described above, we still have the potential to deliver on our Fund’s investment objectives.

In the current low return environment it is critical to have the flexibility to blend beta and alpha to deliver a real return of 4.5% pa above inflation over rolling five year periods before fees and taxes. We believe our investment process and philosophy provides our clients the highest possibility of obtaining a real return, with the current outlook making our DAA paramount.

Key points

The setting of the economic climate involves deciding on where we think the global economy is moving, and then for each country we determine the likely long-term values for inflation, risk free rates, long-term bond yields and earnings growth. By taking current valuations as a starting point, this allows us to determine expected returns for global assets from this point forward.

- Overall, meaningful changes to the Neutral Asset Allocation have been made as our economic climate assumptions continue to evolve in response to the ongoing recovery from the Covid-19 crisis.

- We believe that although financial markets have stabilised from the sharper movements seen in 2020, there is still much risk to be mitigated. Our analysis suggests that most asset classes have slightly higher expected returns, driven by higher earnings and inflation.

- Our volatility expectations across most asset classes have not materially changed, with the exception of Commodities and Property. They are both aligned with the reopening of economies globally as can be seen with the recent higher market movements over the last six months.

- Early in 2021 we increased our inflation assumptions across all markets, along with higher cash rates and long-term bond yields to reflect the eventual tightening of central bank policy. These views have been retained in this most recent review.

- While earnings growth took a tumble over 2020, a pick up to more normalised earnings has already returned as Covid-19 vaccination rates have increased, allowing for the easing of lockdown measures.

- Portfolio positioning has focused on the balance between equities and bonds, with a focus on reducing the allocation to growth. We have decreased the allocation to global equities and re-allocated a portion of this to Australian equities. This is predominantly driven off the back of higher relative valuations offshore. Exposure to Global Listed Property and shorter-dated Australian Government Bonds has also been raised.

- Global property was introduced as a discrete allocation last year, due to its attractiveness from a valuation perspective relative to the strong and rapid rebound seen in equity markets more broadly. This review has seen a slight increase in property to participate in the recovery as restrictions are eased globally.

- Reducing allocations to equities, does see a marginal increase to fixed income exposures, however, what is not visible is that we have allocated these exposures to shorter-dated, rather than longer-dated bonds. This results in a lower duration exposure, 2.6 years down to 1.2 years, which will reduce the portfolio’s sensitivity and risk to rising yields.

- Rising rates will put pressure on equity valuations and with bonds less likely to provide diversification we have retained all the global equity exposures in foreign currencies, to provide a buffer in an environment where the Australian dollar falls.

- After reintroducing a Commodities exposure as part of the last NAA review, our analysis has seen this allocation increase from 2% to 4.5%. Exposure has also been diversified to include both precious metals and agricultural commodities, as well as industrial metals. These exposures provide inflation linkages to the ongoing supply constraint issues in the near term, or sustained demand pressures from a growing global economy over the long term.

- While market conditions still appear uncertain, this can also lead to opportunities. The risks presented by the current economic climate are always dealt with diligently and in line with the Fund’s investment philosophy and process.

- The Fund continues to strive for consistent returns above inflation, while aiming to minimise drawdowns and preserve investor capital.

- As a highly experienced team with over two decades' experience, the Multi-Asset Solutions team will continue to implement the Fund’s established and methodical Neutral Asset Allocation (NAA) investment process and then adjust positioning through the Dynamic Asset Allocation (DAA) process as opportunities arise.

Is the Covid-19 recovery at risk of losing momentum?

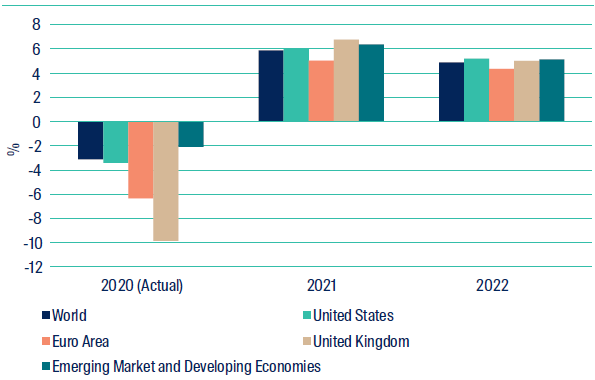

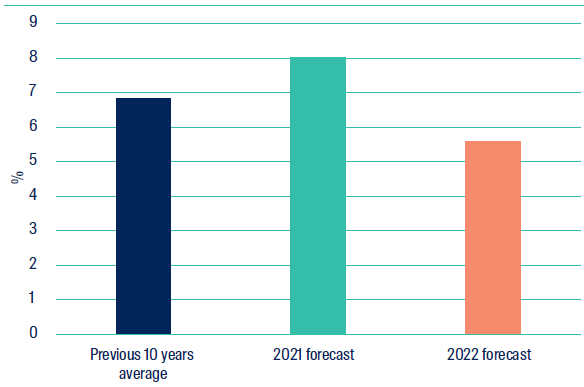

The global economy has continued to rebound from the Covid-19 pandemic and its associated disruptions. After subsequent lockdowns, the developed world has now seen a large proportion of people fully vaccinated against the virus, enabling mobility restrictions to be eased and economies to be gradually reopened. Over the past six months, management of the highly contagious Delta variant of the Covid-19 virus has gradually come under control — at least among developed markets — as vaccination rates have risen. With most businesses no longer operating under restrictions, economic activity has picked up, but the global supply chain disruptions are already beginning to hinder economic indicators. While these readings are anticipated to improve over time, in the short term, there are several themes at play that could provide ongoing volatility. In the US, GDP growth for the June quarter increased by 6.7% at an annualised rate but lowered to 2% for the September quarter, partly due to Hurricane Ida but also owing to widespread and intensifying supply-side distortions. A similar trend was evidenced by the UK’s GDP print for Q2, which had moved back into positive territory. This was, however, before the removal of restrictions but also before the supply-side constraints truly intensified. At the time of writing, consensus forecasts for UK Q3 GDP growth show a quarter-on-quarter decline, most likely reflecting ongoing supply issues. Euro Area quarterly growth readings have been moderate, with the region expanding by 2.2% in the September quarter. According to Eurostat, this was supported by strong domestic demand and exports, but was weighed down by supply chain constraints.

In addition to supply-side constraints, many parts of the world are still experiencing varying levels of vaccine hesitancy, despite ongoing outbreaks of Covid variants. While a ‘pandemic of the unvaccinated’ may continue for some time, this is going to result in an uneven recovery and will likely persist as a major theme over 2022. Although the removal of lockdown measures may allow people to return to work, a shortage in workers appears to be rippling through major markets. There are signs in the US that even after the generous unemployment benefits have dried up; some are still choosing not to return to work. Instead, there is now a structural mismatch of skills and jobs. The rate of unemployment is falling, but the rate of participation is not moving proportionately. In turn, labour shortages are placing upward pressure on wages, only adding to higher-than-expected inflation concerns. This issue is not unique to the US, with similar experiences occurring across the globe. In Australia, international borders have only just started to reopen after remaining closed for almost the entirety of the pandemic, significantly affecting immigration. If these issues are severely protracted, they could threaten global economic growth. Fortunately, with borders freshly opened and several months of lockdown finally at an end, the outlook for Australia is brightening. As valuations continue to increase offshore, the newfound freedom in Australia is likely to stimulate a surge in economic activity with the potential for equity market outperformance.

Figure 1: IMF Economic Growth Projections

Source: IMF as at 7 November 2021

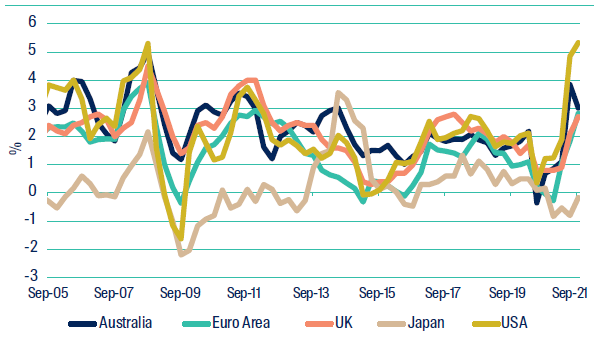

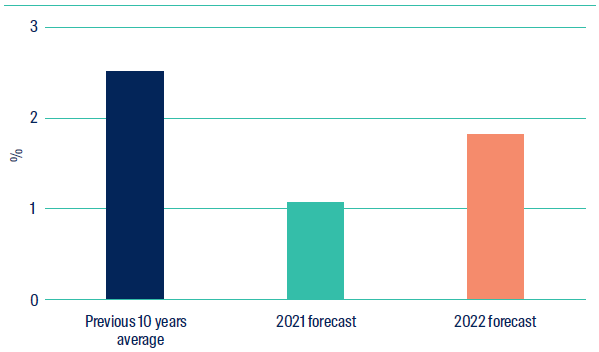

Is inflation becoming ‘persistently transitory’?

For most of this year, policymakers have stuck to their ‘transitory’ narrative, but inflation readings are not falling into line quite yet. In the Euro area, inflation increased to 4.1% year-on-year in October, which according to Eurostat, is the highest level since July 2008. While some of these increases could be attributed to pent-up demand after an extended period of lockdown measures, these pressures are now starting to bleed into consumer goods like food as well as energy, which is making policymakers wary. While the shortage of labour is placing upward pressure on wages, the global supply chain distortions and the energy crisis are also playing a part in rising prices. If protracted, these signs may indicate that higher-than-expected inflation may not be as transitory as policymakers may think. In fact, the supply chain strains had been building up prior to the outbreak although this only accentuated the damage to global logistics networks. While demand for goods plummeted in early 2020, the provision of fiscal stimulus managed to revive some of this, but by the end of the year, many supply chains were still struggling to operate as smoothly as they did beforehand. Fast forward to November 2021 and we have the added complexities such as the rising cost of shipping, represented by the Baltic Dry Index (which tracks the cost of shipping raw materials). The soaring cost of energy has also been front of mind for policymakers. European gas prices, represented by the Dutch Natural Gas Futures Index, have increased by 336% over the calendar year to 8 November 2021. In Spain, the government has announced in September that it would unveil emergency measures to cap prices as they have tripled since December 2020. While it has not yet hit the US as hard, gas prices have already risen by nearly 50% since the beginning of August and oil prices are trending higher.

While energy, food, and the specific industries most impacted by supply chain disruptions (like semiconductors and the downstream impact to sectors like autos) may indeed be ‘transitory’ in terms of seeing a reversion over the next several quarters or perhaps years, wage increases are typically ‘sticky’ which means once wage inflation picks up, it will likely persist. In other words, this ‘transitory’ or temporary spike in inflation may end up being uncomfortably high for a longer period of time, which would have major economic and financial market implications.

Figure 2: Inflation

Source: OECD as at 7 November 2021

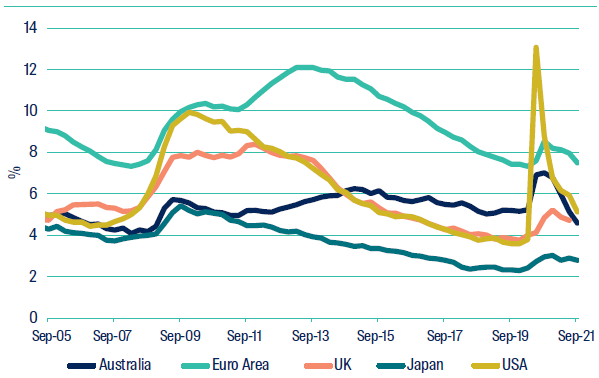

Figure 3: Unemployment

Source: OECD as at 7 November 2021

Central bank reaction function

It appears the great taper is underway and central bank are performing the ultimate balancing act by trying to hold the line on keeping loose policy (both conventional and unconventional) while watching inflation become uncomfortably high. As the transitory narrative becomes harder to sell, rhetoric from central bank policymakers has started to evolve. While central banks have indicated they are willing to let things ‘run hot’, it is evident now that the rising inflation concerns are pushing some markets to rapidly bring forward policy tightening — or at least an end to the loosening. Many central banks have already started making such plans, and where they have not, markets have started to price in actions in their absence. In fact, in some instances it appears that markets are beginning to lose patience with central banks and that if policymakers’ guidance does not align with market conditions, then markets may price in tightening without them.

In the US, the Federal Open Market Committee (FOMC) announced at its November meeting that it will taper its asset purchases starting in November 2021, with expectations of this to finalise by June 2022, instead of April 2022. At the same time, Federal Reserve Chair Jerome Powell stressed that increases to the official interest rate were not up for consideration yet. Even with this rhetoric, consensus forecasts still suggest the Federal Funds rate will increase in 2022, albeit with a shift to September from June due to the slower pace of asset purchase tapering. The FOMC indicated that separating the asset purchase and interest rate decisions is an effort to prevent a repeat of 2013’s ‘taper tantrum’, which sent yields on US 10-year Treasuries soaring and rapidly repricing risk assets lower.

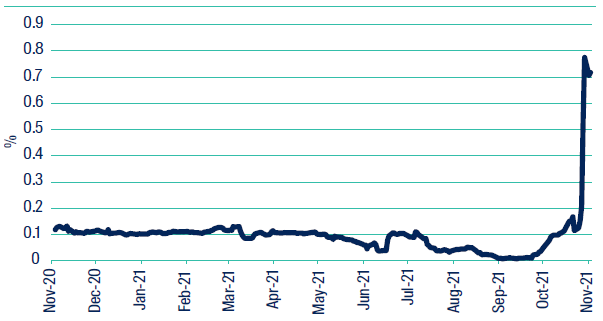

Similarly, inflation pressures have pushed Bank of England officials to entertain the idea of increasing UK interest rates sooner than originally expected. This has led market expectations to consider the possibility of an increase this year, or at least early next. In the UK, the official interest rate has been below 1% since 2009, and at the all-time low of 0.1% since March 2020. In Australia, consensus forecasts suggested official interest rates would increase in late 2022. After the Reserve Bank of Australia’s (RBA) November meeting, the expected timing of the first rate hike had been brought forward to April 2022, with further tightening anticipated thereafter. These expectations were reflected by a skyrocket in the 3-year Commonwealth Government bond yield, which rose by 91 basis points over the month of October. While policymakers still suggest rates will remain at low levels until 2024, this is an example of the RBA’s credibility coming into question as markets have decided to price in an outcome contrary to policymakers’ guidance.

Figure 4: Yield on the Australian Government April 2024 maturity bond

Source: Bloomberg as at 5 November 2021

Turbulent times in China

Alongside the global recovery, several headlines have been emerging from China, as recent government policies appear to be wreaking disruption within certain sectors with winners and losers being picked on a seemingly daily basis. While the country has managed to eke out positive GDP growth readings during 2021, the momentum and size of expansion has been limited compared to history. Several factors have been contributing to China’s slowdown.

To start with, China has had some of the harshest lockdown measures in the world and have persistently aimed for complete elimination of the Covid virus. While this approach has moderated slightly as vaccination rates have significantly increased, the most recent outbreak has seen cases of the Delta variant emerge in at least 16 of China’s 31 provinces by early November. With localised lockdown measures enacted, this could spell trouble for the nation’s full recovery if this spread continues or if measures are enduring. China is not immune to the global energy crisis either. In September, news arose that government officials had advised state-owned energy companies to secure energy supplies “at all costs”. As some residential areas began to face blackouts, some regions were advised to restrict power to the industrial sector, which will of course not bode well for production activity and growth. On the regulatory side, earlier in the year, headlines from China included talk of a government ‘crackdown’ on tech giants. While the focus was initially on Alibaba and its founder — Jack Ma — Beijing proceeded to crack down on more than 30 companies in its thriving technology sector. Prior to this, regulation on China’s tech sector was perceived to be relatively loose, which helped fuel the rapid rise of some of these companies. Since then, the regulator has intervened and even blocked mergers between some firms. It is safe to say, these extreme swings in policy have left investors wary. If this was not enough drama for investors, the Evergrande debt crisis certainly raised some alarms in September. Evergrande is one of China’s largest real estate developers, but in recent years, the company’s level of debt has ballooned, forcing it to warn investors about cash flow issues, with the risk of default. The real concern that ate away at investor risk sentiment was the risk of contagion through the country’s huge real estate sector, home prices as well as the economy. While it appeared that the large property developer was on the precipice of a default, it managed to pay its coupon but the company could still fall a long way from here. All of these factors have had a negative impact on economic activity, demonstrated by subdued purchasing managers’ index (PMI) readings coupled with the growing risk of ‘stagflation’ characteristics.

Figure 5: China - GDP Growth

Source: OECD, IMF as at 7 November 2021

Figure 6: China - Inflation

Source: OECD, IMF as at 7 November 2021

Outlook

As the global economy continues to rebound from the effects of the Covid-19 pandemic, concerns around supply shortages, inflation and easing of monetary policy settings have been rising. Lockdown measures globally continue to ease, enabling people to return to work and business activity to resume. With this, policymakers remain focussed on easing support measures, both through fiscal and monetary measures. While Asia and emerging markets had been lagging behind, the recent rising vaccination rates are enabling mobility to improve and economies to increasingly reopen.

Over the course of October, rhetoric around rising interest rates continued to evolve from the ‘transitory’ inflation expectations. While unemployment has seen a recent improvement in the US and the UK, the slight reduction in participation has pushed wage growth higher. The Bank of England’s new Chief Economist indicated that consumer price inflation could reach 5%, partly owing to the sharp increase in energy prices. If so, it would seem likely that a policy response would occur sooner rather than later. Similarly, in the US, with supply disruptions likely to persist in 2022, some investors are anticipating not just one, but two or three interest rate hikes before the end of 2022. Ultimately, as the recovery continues — accompanied by global supply chain disruptions — policymakers in major markets appear to be keeping a close eye on inflation to ensure it does not get out of hand, and markets are beginning to reflect this in pricing.

Economic growth remains robust, despite a loss of momentum across some European nations. In a majority of developed countries that have made significant progress in administering the Covid-19 vaccinations, flash PMIs have been showing improvements. Despite supply constraints, consumer demand continues to see a significant uplift. While the Q3 earnings season has demonstrated that equities may have further to run, a rising yield environment could cause an increase in caution among investors. While this may place pressure on equity valuations, solid corporate balance sheets, coupled with enormous levels of pent-up demand, will likely remain supportive.

With rates at multi-decade lows and rising inflation, the risks are to the upside in interest rates and the flexibility of objective-based strategies allows us to mitigate these risks relative to a static benchmarked approach to asset allocation.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

The product disclosure statement (PDS) or Information Memorandum (IM) (as applicable) for the First Sentier Multi-Asset Real Return Fund, ARSN 161 207 165 (Fund) issued by Colonial First State Investments Limited (ABN 98 002 348 352, AFSL 232468) (CFSIL), should be considered before deciding whether to acquire or hold units in the Fund(s). The PDS or IM are available from First Sentier Investors.

MUFG, FSI AIM, their respective affiliates and any service provider to the Fund do not guarantee the performance of the Fund or the repayment of capital by the Fund. Investments in the Fund are not deposits or other liabilities of MUFG, FSI AIM, their respective affiliates or any service providers to the Fund and investment-type products are subject to investment risk including loss of income and capital invested.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom