COVID-19 has sent shockwaves through capital markets, and property securities have been no exception. The crisis has plunged the global economy into recession and has given rise to the remote work and learning thematic, while seemingly fasttracking the rise of e-commerce.

These well documented trends have rightly called into question the long-term outlook of office buildings and shopping malls, among other types of real estate, which has seen some investment industry pundits subsequently question whether property securities is still a prudent place to gain liquid exposure to real assets.

The answer is a profound ‘yes’.

In this piece, we explore how the global property securities universe is much more than just office buildings and shopping malls, offering active investors a plethora of compelling investment opportunities in the current environment.

Global Property Securities – much more than just shopping malls and CBD office buildings

Global listed real estate markets are extensive and highly diverse, offering investors a plethora of opportunities across a wide range of sub-sectors and regions. This enables the construction of diversified property-based portfolios that are dynamically positioned in the most attractive investments based on the prevailing market conditions.

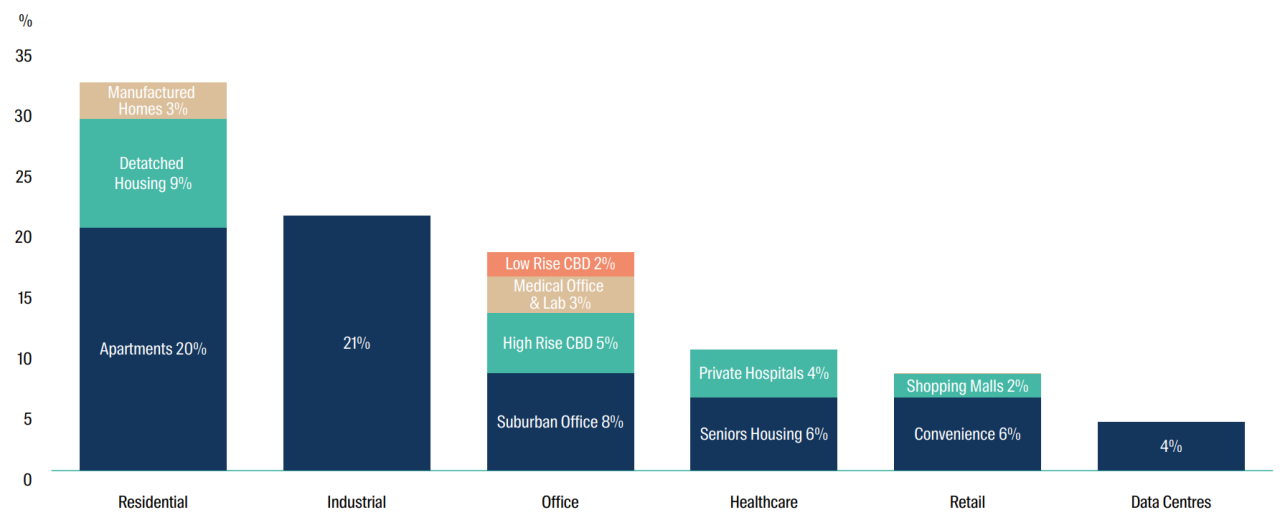

The modern global property securities sector is much more than just traditional real estate assets like office buildings and shopping malls, and offers investors an abundance of attractive opportunities across the A$1.9 trillion, ~650 constituent sector1, including residential assets, logistical warehousing, data centres and health care assets such as hospitals.

The eclectic opportunity set enables active investors to avoid distressed or structurally challenged parts of the economy, affecting real estate like shopping malls, CBD office buildings and hotels, among others, while capitalising on highly compelling opportunities by investing into the beneficiaries of the economic and thematic backdrop.

On the other hand, passive investors are very poorly placed in our view. By indiscriminately investing into the whole sector, including in landlords facing severe headwinds, passive funds have borne the full brunt of the pandemic and are likely to continue to experience significant challenges going forward.

Therefore, the widening disparity between property types and markets underpins the growing importance of having an actively managed exposure to the highly diverse global property securities sector.

How our strategy is positioned

Our global property strategy2 is actively positioned in a range of sub-sectors that we believe are very well placed to benefit from prominent structural tailwinds in the ‘new life’ post COVID-19. Our largest exposure is to residential assets, which have been very resilient amidst COVID-19, reporting robust rent collections and maintaining high levels of occupancy. These cash flow stable assets are poised to benefit from de-centralisation, as renters increasingly move from dense urban centres to less dense urban and suburban locations.

The defined long-term trend from home ownership to rental accommodation also supports further strong tenant demand on top of natural population growth. Our strategy has concentrations in apartments and detached housing in US coastal gateway cities and the Sun Belt, as well as London and Germany. We also have material exposure to logistical warehousing, with concentrations in the UK, the US and Japan. These modern buildings are experiencing extraordinarily strong levels of tenant demand as 3rd Party Logistics Providers (3PL’s), retailers, e-tailers and wholesalers invest large amounts of capital into modernising their supply chains.

Our strategy is also invested into modern “A” grade suburban and city-fringe office buildings, which should benefit from decentralisation and the flexible working dynamic, while CBD high rise buildings as a whole are likely to be a casualty of these trends. Our exposures to the office sub-sector are primarily in Tokyo, Western Europe and the West Coast of the US.

We are also invested into a number of healthcare assets in the US, including seniors housing, private hospitals, medical office buildings and bio-tech laboratories, which are well placed amidst the renewed attention on the ‘fitness for purpose’ of healthcare systems and ongoing demographic change, such as ageing populations.

Our portfolio has selective exposure to retail assets, including convenience and non-discretionary oriented shopping centres in the US, which are largely insulated from e-commerce headwinds and could in fact benefit from de-centralisation.

The strategy also has exposure to data centres in the US. These specialist assets are a beneficiary of the rapid take up of the internet globally, the rise in social media and e-commerce and the corporate migration to “cloud computing”. The emergence of the ‘work/study/play from home’ dynamic amidst COVID-19 has accelerated society’s adoption of digital technologies and internet usage continues to soar.

Delivering superior investor outcomes

An abundance of capital has flowed into low-cost passive global property exposures in the decade following the Global Financial Crisis, as the accommodative monetary environment created by central banks globally has seemingly caused a secular appreciation in asset prices. However, as the COVID-19 pandemic continues to impact financial markets and the real economy, the material drawbacks of passive investing and the benefits of active management have become increasingly clear. Our global property strategy has delivered investors above benchmark returns after fees, with lower levels of volatility, during COVID-19 and over the longer term. Importantly, we typically outperform our benchmark in down markets, which has resulted in the portfolio better preserving clients’ capital amidst market turbulence by recording less significant drawdowns3 as at 30 August 2020.

These outcomes are a consequence of our rigorous investment process, which aims to allocate capital efficiently, with an overarching emphasis on absolute and relative risk, through detailed screening, bottom-up fundamental research and stock selection, coupled with disciplined, benchmark-unaware portfolio construction. We also have the flexibility to take a conviction-based approach where pricing anomalies warrant, such as when stocks are materially oversold amidst market dislocations.

The result is a well-diversified portfolio of 35 - 80 securities, which gives investors liquid exposure to attractively valued, high quality real estate, with an overriding emphasis on asset and balance sheet quality.

This is starkly different to how passive strategies are managed, which effectively ‘buy and hold’ the entire sector in an indiscriminate manner. The inherent lack of stock-selection associated with passive funds means that capital is allocated partly towards securities that could own low quality assets, trade at unappealing valuations, face material structural or cyclical headwinds, have weak fundamentals or stressed balance sheets and could be exposed to unacceptable amounts of risk.

On the other hand, because our experienced investment team continually monitors our investible universe for risks and opportunities, our strategy is able to be positioned dynamically during rapidly changing market conditions, meaning we only invest into truly compelling investment opportunities at any given point in time. By utilising this dynamic investment approach, we believe that our strategy is best placed to preserve and grow clients’ capital through the cycle.

1 Source: FactSet and First Sentier Investors as at 31 August 2020. The total market value is based on the total market capitalisation of the FTSE EPRA NAREIT Developed Index, while the constituent count is based on our internal modelling of our total screened universe.

2 Source: First Sentier Investors as at 31 August 2020. Exposures reflect the Colonial First State Wholesale Global Property Securities Fund.

3 Over the last 10 years, the maximum drawdown of the Colonial First State Wholesale Global Property Securities Fund was -23.2%, while the maximum drawdown of the FTSE EPRA NAREIT Developed Index (AUD Hedged) was -29.4%. Source: Mercer as at 31 August 2020.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom