As an adviser you’d be familiar with longstanding theoretical discussions about markets and how best to understand them, whether it’s how momentum investing works (or doesn’t), various contrarian approaches, recognising, anticipating or responding to different types of volatility, the role (or not) of correlation… and the list goes on.

One theory that’s less widely discussed but which may have upsides for investing, in particular for advisers whose clients are seeking alpha, is Prospect Theory.

A general working knowledge of this theory has potential to add to the mix of considerations you might apply to help support your clients in achieving their individual investment goals. Specifically, it may be worth exploring when it comes to understanding and managing some of the behavioural biases you might encounter among your clients and indeed, in your own decision making.

Some real-life examples

Broadly, Prospect Theory considers the attitude of individuals towards gains and losses, and posits that these attitudes and resulting behaviours are not always rational. In simple terms, Prospect Theory holds that we tend to overweight low probability events, underweight high probability events and are more averse to loss than gain.

It’s named as such because it tries to capture how people evaluate the various options or “prospects” that they encounter.

- Insurance: A prime example can be seen in the way insurance works. We are willing to pay insurance premiums for highly unlikely events such as a house fire, effectively switching a low probability large loss for a certain smaller loss, that is, the insurance premium. At the same time, we are less likely to purchase insurance for higher probability lower loss events, like loss or damage to a mobile phone.1

- Gambling: With gambling, the theory can also be seen at work in cases where gamblers are willing to bet on zero or negative expected value games in casinos. Here, the example is of a gambler who loses $500, compared to a gambler who has won $200. The losing gambler is more likely to take on another $500 gamble “to make up the loss” than the winning gambler.2 Once again, losses matter more than gains.

Prospect Theory, financial markets and the disposition effect

Prospect theory was first defined by Tversky and Kahneman3 in a paper in 1979. They ran a simple experiment to demonstrate this, proposing two different situations to a group of research subjects. The situations separately considered the attitude of individuals towards gains and losses.

In the first situation (gains), each person was notionally given $1000, and could choose one of two options:

A 50% chance of gaining $1000, 50% chance of gaining $0

B 100% chance of gaining $500

Note that the expected gain is $500 in both cases. A huge majority of the sample chose B.

In the second situation (losses), each person was notionally given $2000, and could choose one of two options:

C 50% chance of losing $1000, 50% chance of losing $0

D 100% chance of losing $500

Note that the expected loss is $500 in both cases. However, now a majority of the sample chose C.

In other words, individuals prefer certainty in gains even if there is a chance of higher returns but are prepared to take a chance to mitigate losses, even if they might potentially be worse off. That is, the concern of a loss is greater (per dollar) than the equivalent elation of a gain. In an investment sense: investors are more loss-averse than they are gain-seeking.

In the context of financial markets, similar behaviour has been observed. This is known as the disposition effect, or the tendency of investors to sell winners too early and hold on to losers too long. A significant body of research has helped advance our understanding, refinement and application of the disposition effect. In RQI’s thinking as summarised in this paper, some of the notable work referenced is by Shefrin and Statman,4 and Barberis, Mukherjee and Wang,5 among others.

When it comes to impacts on trading and its impacts on buy / sell behaviour, the disposition effect is expressed by Shefrin and Statman6 as follows: “Investors are “predisposed” to sell winners too early and to sell losers too late”.

To summarise, even if the probability of the next price change is equally likely to be up and down, we will choose to sell if the price has already risen but not sell if it has fallen. In this way, prospect theory appears to describe the disposition effect as it has been observed.

Induced mispricing creates opportunities

As intimated above, Prospect Theory and the disposition effect show that investor behaviour can be both irrational and reasonably predictable. From a market viewpoint, a key implication of this fact is that the inherent behavioural biases which drive the disposition effect appear to induce mispricing.

Understanding and forecasting mispricing in the markets is of course something of a holy grail for investors and investment managers, especially when alpha is the goal. By offering a potential additional predictive lens on the market, the disposition effect may well offer opportunities that can advantage canny investment managers who understand the right data and know how to meaningfully apply it.

Examples of such opportunities might include:

- Tilting towards stocks which have a low prospect theory value (meaning that sellers have potentially withdrawn) as they are likely to have higher returns.

- Tilting away from stocks which have a high prospect theory value (meaning that selling has been accelerated) as they are likely to have lower returns.

This idea has some close positive correspondence with price reversal strategies like value and against models like momentum.7 However, empirically tested alpha seems strong and resilient to the impact of other common factors.

Delving deeper: formularising the theory

Of course, while the general concept of Prospect Theory and the disposition effect itself seems straightforward enough, its useful application in a universe of endless variables is less so.

As we’ve already indicated, there has been extensive and detailed work to help formularise some of those variables in a way that aids their practical application in investing, and especially in generating alpha.

Again, broadly and at a very high level, some of the work conducted to date offers a way forward for those interested in going beyond the theoretical to explore the potential for achieving above benchmark investment gains.

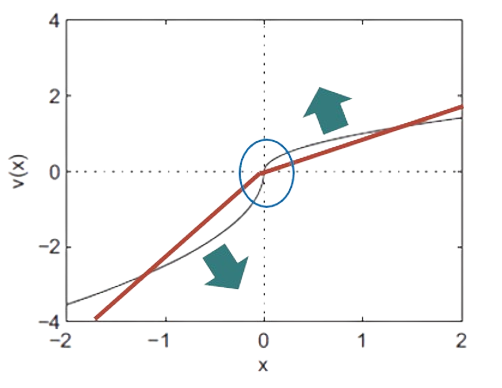

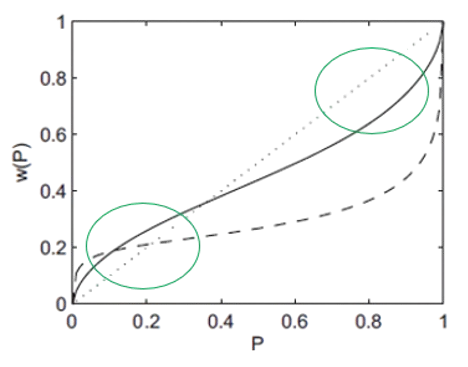

This includes landing on a consistent, mathematically sound process that may help predict the outcome of the disposition effect in particular situations. Here, we show how this may be achieved, beginning with a two-stage process known as editing (or representation) and evaluation.

1. Editing (or representation): where the set of possible options is considered and a reference point against which likely future outcomes can be compared is selected. This might be current state, or an average entry price, for example. This is also the stage where we assign likely probabilities to those outcomes.

In effect, we represent our understanding of the payoff as a set of outcomes and their probabilities as we understand them and put them into a formula.

2. Evaluation: this is where we look at the data we have gathered and decide how we might interpret or value it. We might, at this stage, decide that we are more concerned about losses than gains and where we aim to calculate the payoffs or losses, we might achieve following a choice.

We then apply the individual factors we have extracted for the client or scenario in the editing and evaluation process; that is, the level of loss aversion and the relevant probabilities against the reference point we have decided on. In effect, as a mathematical equation it is empirical, moving us beyond theory into meaningful practice.

Where now for advisers seeking more?

While there is further work to be done, evidence to date suggests that for advisers, having an awareness of Prospect Theory and the disposition effect, how they may be put together in meaningful ways and ultimately, operationalised within their practices, has potential to become an important part of the advice picture.

As always, deep fact-finding and an understanding of clients’ true preferences and needs are the drivers here. Armed with this very specific knowledge, as an adviser you are then best positioned to seek the investment approaches that best mesh with the relevant profiles and thus offer your clients the best prospects of achieving their investment goals.

1 https://thedecisionlab.com/biases/loss-aversion

2 Barberis (2011) NBER working paper, “A Model of Casino Gambling”.

3 Kahneman and Tversky (1979), Econometrica, “Prospect Theory: An Analysis of Decision under Risk”.

4 Shefrin and Statman (1985), Journal of Finance, “The Disposition to Sell Winners Too Early and Ride Losers Too Long: Theory and Evidence”

5 Barberis, Mukherjee and Wang (2016), Review of Financial Studies, “Prospect Theory and Stock Returns: An Empirical Test”

6 ibid.

7 Value investing focuses on assets that are undervalued relative to their intrinsic value whereas momentum investing capitalises on established market trends and invests in securities that are on their way up.

Read our latest insights

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM, RQI Investors), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website. Our investment team operates under the trading name of RQI Investors which is part of the First Sentier Investors Group.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication.

No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of RQI Investors.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors, 2024

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom