The small and mid-cap companies space gives investors access to some of the higher-growth technology, healthcare and renewable energy opportunities available in Australia. This investment universe is outside the top 50 listed stocks on the ASX, which has traditionally been dominated by the big banks and the large resource companies.

Across all investment opportunities in the small and mid-cap universe, identifying growing, innovative companies requires a focus on those with sustainable competitive advantages, and with established barriers to entry. Breville is a great example, an engineering-led innovator in the small domestic appliances. Their targeted investment in new product development and a scalable supply chain has led to phenomenal growth in the US and Europe.

Business models with annuity style, predictable earnings like Software as a Service (SaaS), or those with high levels of contracted revenue are particularly attractive, and often trade at high multiples given the ability for these companies to confidently reinvest in growth.

Valuation is of course important, but it is equally important to consider the global market opportunity available, particularly for those businesses with established high barriers to entry and relatively low penetration rates in target markets.

Given the highly diversified nature of the small and mid-cap indices, portfolios can be constructed that are preferentially weighted towards these attractive, long-term growth opportunities.

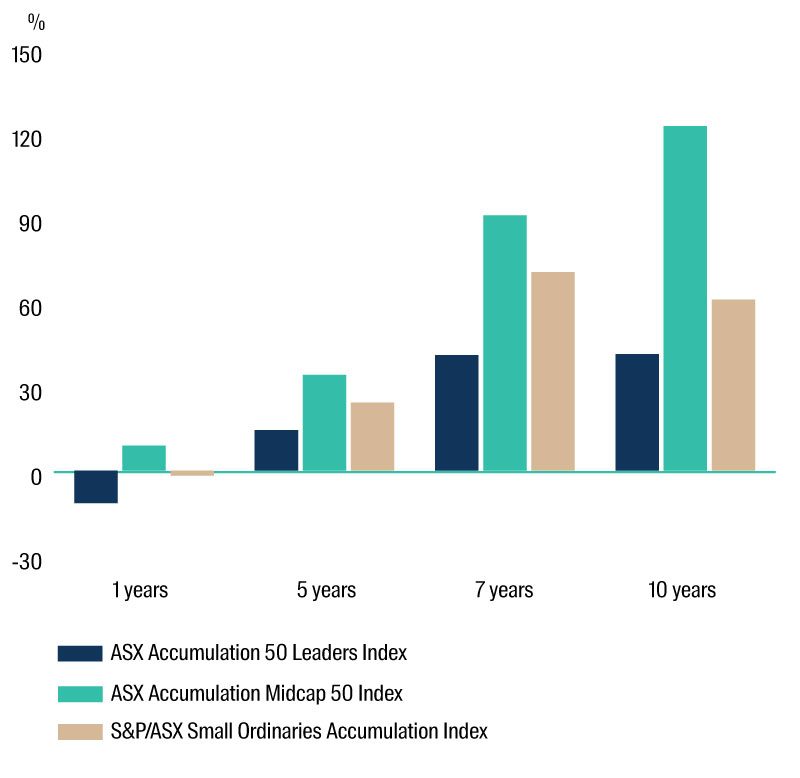

As illustrated in the chart below, Australia’s small and mid-cap indices have historically provided better total returns vs Australia’s top 50 listed stocks, which have been dominated by the big banks, despite their fully franked dividends.

Annualised index returns over 1, 3, 5 and 7 years

Source: Bloomberg. Data shows annualised total returns to 31 October 2020. Past performance is not an indicator of future performance.

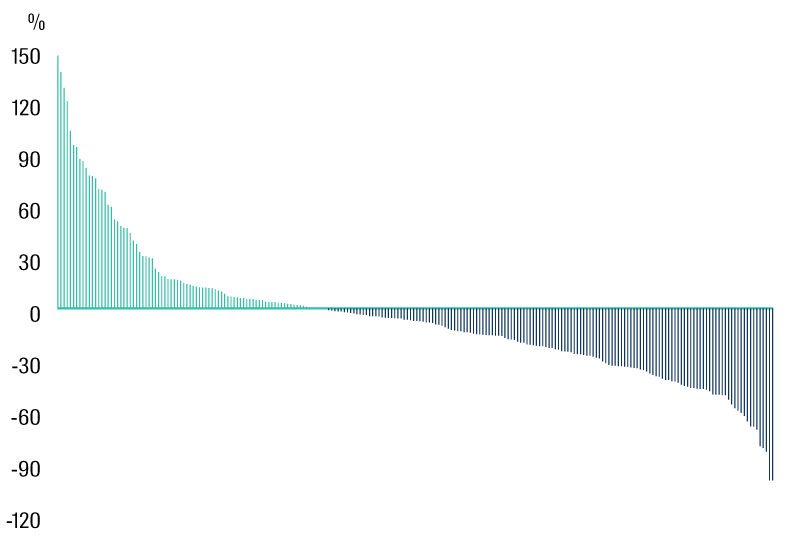

For investors interested in exploring these options, there are numerous actively managed funds that specialise in small-caps and, to a lesser extent, in mid-caps. Active management is important in the small-caps space, as illustrated below, the negative returns from low-quality companies can often erode the value created from more successful businesses. This means attempts to mitigate risk by diversifying across the index, for example via passive investments or low active share, may not lead to optimal risk/return outcomes.

Wide dispersion of small company one year returns

Source: FactSet. Data shows one year to 30 September 2020 total returns of constituents of S&P/ASX Small Ordinaries Index. Kogan.com (+240%) not shown. Past performance is not an indicator of future performance.

Small companies tend to be less well researched and understood than their large-cap counterparts. This provides the opportunity for skilled small cap active managers to identify - through research, resources and experience - companies that have the potential to be future leaders, and companies that have the propensity to fail.

An important characteristic of the small and mid-cap universe is the improved sector diversification it offers investors. Most apparent is the reduced exposure to the Financials sector, which comprises almost a third of the ASX Top 50, yet only a tenth of the small-cap and mid-cap universes. In addition, the small and mid-cap space is where you’ll find exposure to Australia’s burgeoning IT sector, where it comprises almost 20% of the S&P/ASX Midcap 50 Index, but less than 1% of the S&P/ASX Top 50 Index. Mid-caps also provide relatively more exposure than the Top 50 Index to the Communication Services, Consumer Discretionary, Industrials, Materials and Utilities sectors.

The small and mid-cap universe, although not dominated by high growth innovative companies, is where you will find the highest proliferation and exposure to high growth global trends and the future leaders of the new decade.

And to finish, we can’t put it better than the CEO of Breville, Jim Clayton, who has done such an outstanding job transitioning Breville into a global innovation power house, “If you don’t take risks to innovate, you’re toast.”

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom