The world is on the cusp of a revolution in low-carbon technologies, and they are set to reshape many of our supply chains.

The not-so-humble battery sits at the heart of this shift: the growth of electric vehicles (EVs), and renewable power generation/storage, will increase demand for a range of raw materials.

It’s estimated that the global EV stock will reach 245 million vehicles by 2030 – more than 30 times above today’s level1.

Installed wind capacity is expected to rise almost fourfold in the same period, from around 700 gigawatts today, to around 2000 gigawatts in 20302.

However, a rapid ramp-up of such technologies will require a concurrent increase in the materials used in them. Significant investments in mining and technology will be required to meet the needs of the burgeoning battery market.

This article outlines the key materials required for battery production, and their related investment opportunities.

Lithium

It’s the metal that everyone is talking about. Australia is extremely well positioned to supply into this market and has a number of projects across the board among large companies such as IGO and Mineral Resources, as well as a lot of smaller companies that are trying to also establish a position in this space.

Lithium is the prerequisite metal for all batteries that are used in electric vehicles. As shown in the chart below, it is clear that future demand is massively outstripping the supply that’s coming on. Most lithium processing companies are in China, and they’ll tell you that the curve is nearing vertical in terms of the demand that they are seeing come through.

Chart 1: Lithium supply and demand balance

Source: UBS, Battery Raw Materials, 4 March 2021.

There are two sources of supply for the lithium that goes into a battery; brine, or hard rock called spodumene.

Brines are usually found in South America, in the form of an underground salt that can be dissolved and then taken up to the surface and spread out into an evaporation pond to leave lithium chloride which is converted to lithium carbonate. Everything can go wrong, because it is an open-air chemical reaction exposed to the elements. Because of this, and due to the lesser energy density that this type of material provides, brine is not considered a preferable source of lithium to be used in the batteries.

Spodumene is what we have here in Australia. Spodumene is a hard rock and is found mostly where iron ore is found, for example in the Pilbara region. Spodumene is even harder than iron ore and is very difficult to break. A concentrate is formed by crushing and separating the ore, and Australia has become very good at this over the years. For example Mineral Resources is a world leader, crushing and concentrating spodumene to 6% lithium, which is the optimal concentrate of this ore that can then be converted into lithium sulphate and then lithium hydroxide and lithium carbonate. Spodumene is where the supply and investment is going. The capital intensity has been coming down, and the ability to reliably concentrate it has improved dramatically.

Nickel

The best batteries in the world have very high nickel content. Tesla and its EV peers want the best batteries, and this is what is going to drive demand. Nickel is favourably exposed to demand from electric vehicles due to nickel use in battery cathodes, and a trend towards using more nickel and less cobalt in cathodes.

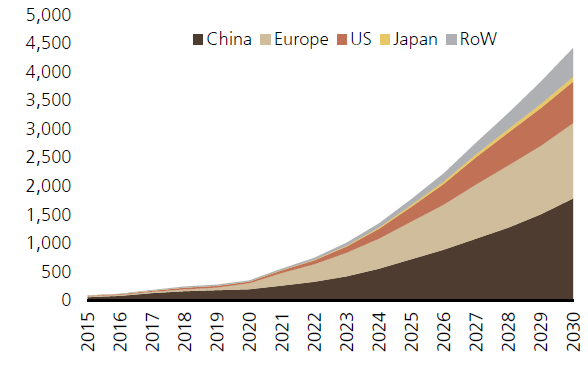

As shown in the chart below, currently nickel is predominantly used in stainless steel and other steel alloys. However demand for nickel is increasingly going to come from EV batteries.

Chart 2: Nickel demand forecast (kpta)

Source: UBS, Battery Raw Materials, 4 March 2021.

There are two nickel ore types; laterite ores and sulphide ores. Demand for nickel sulphide is going to be very high, compared to laterite ores, because a sulphide can be converted to a nickel sulphate for batteries at a relatively low financial and environmental cost. To meet future high demand, nickel sulphide is going to be the precursor material that is going to go into batteries.

Copper

Copper supply is declining. It is becoming increasingly difficult to mine, with new discoveries typically being lower grade, deeper underground, or in regions such as the Democratic Republic of Congo which, from an ESG perspective, are unviable. These factors combine to make copper one of the few commodities that increasingly rare to find in the earth’s crust in an economic way.

EVs rely on the movement of electrons, and there is no material known that is better than transmitting electrons than copper. Therefore EVs are going to have a lot more copper, along with the charging stations and the electricity grids which support them. Therefore copper demand for EVs and supporting infrastructure, along with the copper price, is expected to be very strong.

As shown in the chart below, by 2030 copper consumption in electric vehicles is expected to represent 4.4Mt of copper demand or approximately 13% of total demand. At face value, this is modest demand growth compared to the markets of lithium, nickel, rare earths or graphite. But EVs serve to accelerate demand growth towards around 3% p.a., which is above the long term historic trend of 2.4% CAGR (1976-2019)3.

Chart 3: Copper demand from Electric Vehicles (ktpa)

Source: UBS, Battery Raw Materials, 4 March 2021.

Rare Earth (RE) refers to a group transition metals that have magnetic, nuclear and electrical properties. Their name refers to their rare occurrence in economically viable concentrations, rather than scarcity. Neodymium (Nd) and Praseodymium (Pr), or NdPr, are two rare earth elements that face a step change in demand from forecast EV sales because they are the strongest type of permanent magnet, used in high performance applications such as electric motors and wind turbine generators. Currently, permanent magnets represent the largest end-use for rare earth elements, at around 30% of demand.

China has the best deposit in the world, with the second largest deposit in the world being in Australia; a highly strategic asset owned by ASX-listed Lynas Corporation.

Current demand for NdPr is less than 40,000 tonnes per year, but this is forecast to reach over 100,000 tonnes by 2030. Supply projections suggest producers will be unable to keep up with this demand4.

Chart 4: NdPr demand and supply projections (tpa)

Source: UBS, Battery Raw Materials, 4 March 2021.

Investment opportunities in Australia

We believe that Australian companies are well-placed to benefit from the growing demand for batteries and EVs, with a number of established companies already operating in the sector, including:

IGO Hard rock spodumene (lithium), nickel sulphide copper

Mineral Resources Hard rock spodumene producer (lithium)

Pilbara Minerals Hard rock spodumene producer (lithium)

Syrah Resources Graphite

Oz Minerals Copper, undeveloped nickel sulphide

Sandfire Copper

Western Areas Nickel sulphide

Lynas Rare Earths

Iluka Potential Rare Earths producer

The Federal Government is focused on fostering a resilient commodity supply chain. It has developed a roadmap for critical minerals processing and manufacturing, with the goal of becoming as regional hub for the sector over the coming decade5.

The Australian Small and Mid Cap Companies team continues to monitor the opportunities in this sector, in particular leading companies that are positioned to benefit from the fundamental changes the next decade will bring as a result of the growing demand for electric motors and battery technology.

Note: any stocks mentioned in the material are for general information only and do not constitute an investment recommendation.

1 Global EV Outlook 2020 https://www.iea.org/reports/global-ev-outlook-2020

2 Source: IRENA, CGAU

3 Source: Wood Mackenzie, Company Filings, UBSe, August 2021

4 Source: UBSe, Company Filings

5 https://www.industry.gov.au/data-and-publications/resources-technology-and-critical-minerals-processing-national-manufacturing-priority-road-map

Note: any stocks mentioned in the material are for general information only and do not constitute an investment recommendation.

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM. Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Pursuant to this article UBS Securities Australia Ltd ("UBS") grants First Sentier Investors ("Client") a royalty free, non-exclusive and non-transferable license to use charts from UBS’ March 2021 Report Battery Raw Materials – EVs Shifting into Overdrive: can supply keep pace? (the "UBS Material") in a newsletter it provides solely to investors (the “Investors”) in a fund or funds managed or advised by the Client (the “Purpose”) subject to and on the terms of this article. Client acknowledges ownership by UBS of all intellectual property and proprietary rights in the UBS Material, whether registered or unregistered, legal or beneficial. Client also agrees to display the following copyright notice indicating that UBS is the owner of the copyright in the UBS Material, "Source: Battery Raw Materials – EVs Shifting into Overdrive: can supply keep pace? © UBS 2021. All rights reserved. Reproduced with permission. May not be forwarded or otherwise distributed." Client agrees to ensure the Investors acknowledge and agree to the terms of this article. Client shall be responsible to UBS for any breach by Investor of such terms or of the intellectual property and proprietary rights in the UBS Material. UBS EXPRESSLY EXCLUDES ANY AND ALL WARRANTIES OF ANY KIND WITH RESPECT TO THE UBS MATERIAL. THE UBS MATERIAL IS LICENSED "AS IS" AND "AS AVAILABLE" WITHOUT REPRESENTATIONS OR WARRANTIES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, IMPLIED WARRANTIES OF TITLE, ACCURACY OR FITNESS FOR A PARTICULAR PURPOSE) AND CLIENT ASSUMES THE ENTIRE AND SOLE RISK OF ITS USE AND RELIANCE THEREON. Client is not permitted to assign, sublicense, transfer or otherwise dispose of all or any of its s rights or obligations under this article.

Use of the UBS Material will constitute acceptance of the terms of this article. The disclaimer and other terms applicable to the UBS Material as set out in Battery Raw Materials – EVs Shifting into Overdrive: can supply keep pace? continue to apply save as varied by this article solely in order to fulfil the Purpose.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom