The Novel Coronavirus (COVID-19) pandemic has seen most financial assets sell-off across the board, including securities in the traditionally defensive listed property sector, as investors grapple with how the drastic government and central bank responses to the crisis will augur for property landlords in the shorter term.

How is the property sector placed?

The unprecedented virus containment measures implemented by governments globally have led to widespread expectations of a forthcoming global recession. This has understandably caused property securities investors to shift their minds back to the experience of the Global Financial Crisis (GFC) of 2007-08. In this period, a number of distressed property companies collapsed under the burden of their shorter-term debt obligations as asset valuations moderated and debt markets closed, which made it very difficult to refinance expiring facilities.

There are undoubtedly some significant near-term headwinds facing the cash flows of certain listed property sub-sectors. However, without downplaying the severity of the current health and economic crisis, things are very different this time around, as the sector entered this crisis in much better shape than it was preceding the GFC. Boards and management teams have largely learned from the lessons of the past and in the years following the GFC have resisted the temptation of cheap credit and shored up their balance sheets considerably through equity raisings and asset sales.

As such, we believe the sector is well positioned, with stronger balance sheets than in the past, which gives companies an important capital buffer to help them weather the unforeseen headwinds that have emerged during this crisis. Furthermore, while there is limited transactional evidence to date, we do not expect significant declines in many private market valuations, and have not yet witnessed any forced asset sales or extensive capital raisings arising from distress like those seen in the GFC.

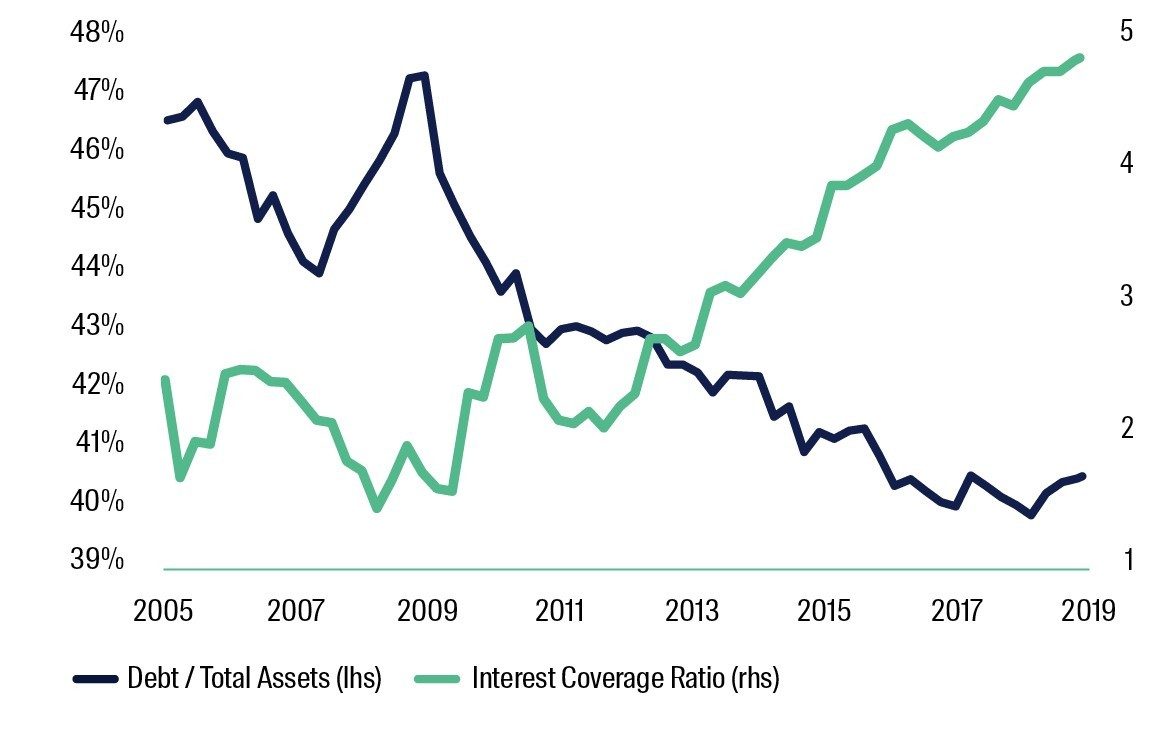

The robust capital position of the sector is clear when assessing how its level of indebtedness has fallen over time. The Gearing (Debt / Total Assets) Ratio of the sector has decreased significantly in the last decade to 40%, while the sector’s Interest Coverage Ratio has more than doubled to 4.7x in this period. This indicates that the sector is much better placed from a solvency perspective than it was preceding the GFC.

Sector leverage - last 15 years

Source: FactSet from 31 March 2005 to 30 April 2020. Sector refers to the FTSE EPRA/NAREIT Developed Index.

Chart reflects a quarterly time series except for the most recent data point.

Interest Coverage Ratio refers to EBITDA / Interest Expense.

How is our strategy positioned?

At First Sentier Investors, the rigorous stock selection process utilised by our Global Property Securities team has an overarching emphasis on capital preservation. We only invest into high quality urban infill assets, through REITs and companies that are in a financially strong position with robust balance sheets, substantial liquidity and minimal near-term refinancing risk.

Our exposures are currently well within their debt covenant limits, have fully funded their near term commitments and generally have ample access to credit facilities. Moreover, the REITs and companies we invest into predominately finance their debt books with unsecured debt, meaning their assets cannot be seized by lenders in the worst-case scenario of insolvency.

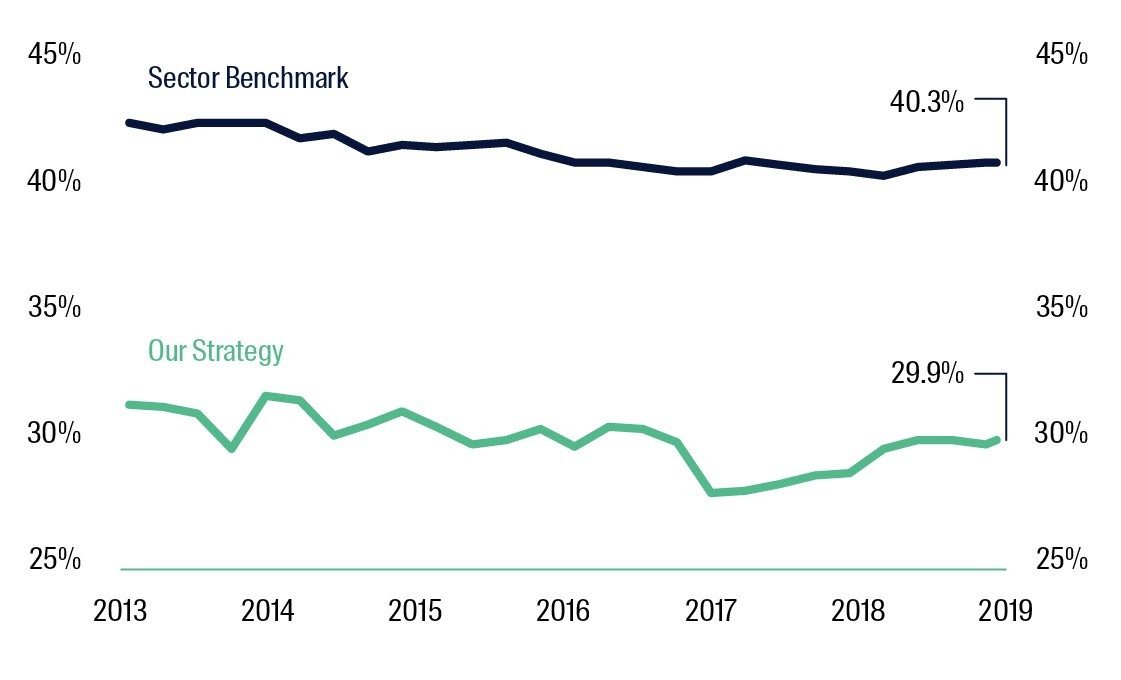

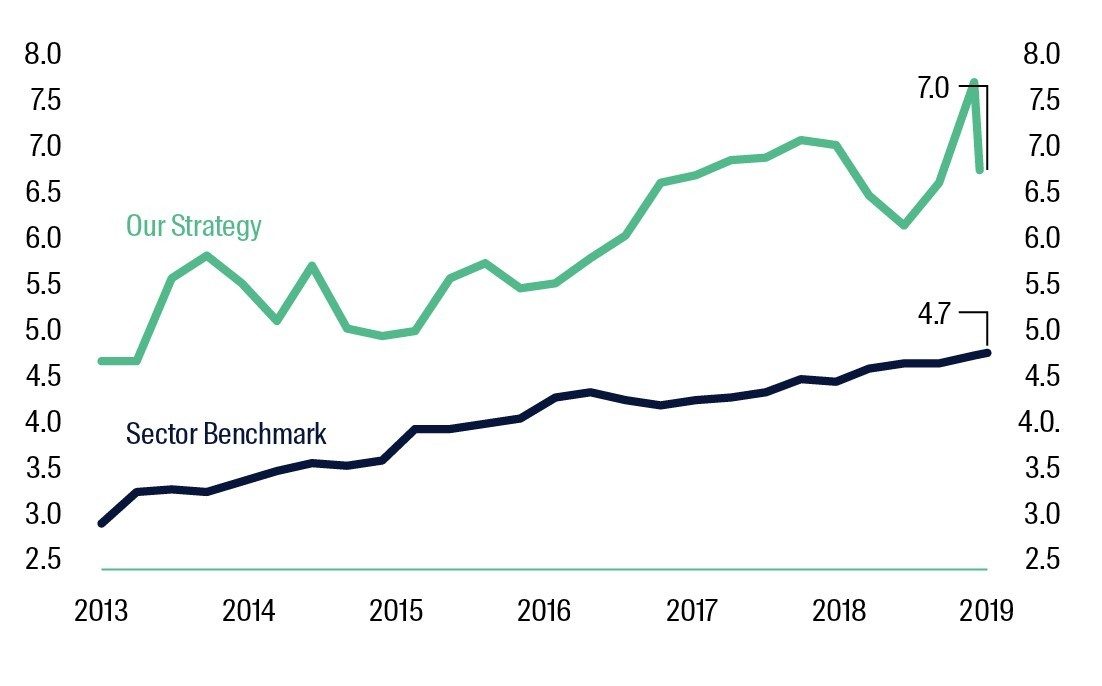

The far-reaching impacts of this pandemic could not possibly have been envisaged earlier this year. However, due to our prudent investment process, our strategy entered this crisis in a markedly stronger positon than the broader sector, with a considerably lower level of gearing and a much higher rate of interest coverage.

Gearing - Debt / Total Assets

Chart depicts the Debt / Total Assets Ratio of the Colonial First State Wholesale Global Property Securities Fund and the FTSE EPRA/NAREIT Developed Index. Chart reflects a quarterly time series except for the most recent data point. Source: First Sentier Investors and FactSet from 31 December 2013 to 30 April 2020.

Interest Coverage Ratio

Chart depicts the Interest Coverage Ratio (EBITDA / Interest Expense) of the Colonial First State Wholesale Global Property Securities Fund and the FTSE EPRA/NAREIT Developed Index. Chart reflects a quarterly time series except for the most recent data point. Source: First Sentier Investors and FactSet from 31 December 2013 to 30 April 2020.

The securities held in our strategy also have minimal refinancing requirements over the next 3 years and have an average debt maturity of 7.0 years, curtailing the risk that the portfolio could be materially impacted by dysfunctional credit markets. Irrespective of this, we have witnessed a lot of refinancing during this crisis, which indicates to us that credit markets are still very much open for quality property companies with strong balance sheets.

Moreover, not only is our focus on top quality assets owned by landlords with robust balance sheets, but on top of this, our largest exposures are to the sectors that are expected to be relatively resilient throughout this crisis, including residential assets, office buildings, logistical warehousing, data centres, self-storage facilities and healthcare assets such as hospitals.

Outlook

While the COVID-19 situation is continually evolving, at First Sentier Investors we are confident in the strength of the global property securities sector, and to a greater extent, the strength of our strategy.

We believe that many securities in the listed property sector have been materially oversold, as the extent of the re-pricing does not reflect the long economic lives of many of these assets, which are typically underpinned by secure, long-dated and recurring cash flows.

This ultimately gives investors with a long-term horizon the opportunity to invest into high quality businesses at material discounts to their intrinsic valuations - many of which will make it through this crisis and deliver solid returns for many years to come.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom