It is estimated that there are over 40 million victims of modern slavery globally, meaning that there are more people enslaved today than at any other time in history.

In order to meet the Sustainable Development Goal target of eradicating modern slavery by 2030, we need to be reducing the number of modern slavery victims by 10,000 people per day. Therefore, the First Sentier Investors investment teams were alarmed to learn in March this year from the Walk Free Foundation that modern slavery numbers were likely to increase as a result of the COVID-19 pandemic.

The Issue

We identified several areas of enhanced risk of modern slavery due to the COVID-19 pandemic, including:

- Industries experiencing high demand and short production timeframes as a result of the pandemic: e.g. the healthcare supplies industry has increased levels of risks as corners may be cut to meet demand.

- Traffickers and criminals responsible for modern slavery prey on vulnerability, which is something that we will see increase as COVID-19 affects industries globally. The ILO has provided some initial estimates that between 8.8 and 35 million additional people will be in working poverty worldwide for 2020 (their original estimate for 2020 projected a decline of 14 million people). Workers in industries such as the apparel industry have been negatively impacted as retailers cancel orders and delay payments. Many workers aren’t receiving legally mandated wages and aren’t entitled to benefits, so a major production slowdown will mean many more people are vulnerable to modern slavery.

- Victims of modern slavery work and live in conditions that place them at increased risk of contracting COVID-19 - and don’t have access to appropriate medical care if they do. Often a fear of being detained or deported keeps victims of modern slavery from reaching out to authorities. Victims are regularly forced to work through illness without access to healthcare, and to live with large numbers of people in unsanitary conditions. The combination of these living conditions and a reluctance to reach out to authorities, together with a lack of access to information, is deadly where COVID-19 is concerned.

Objectives

The purpose of the engagement is to:

- raise awareness of the heightened risks of modern slavery as a result of the pandemic amongst some of the most severely affected industries;

- encourage companies to take action where we felt their responses were inadequate;

- share examples of best practice; and

- deepen our own knowledge of modern slavery risks within our portfolios.

Process

In April 2020 the investment teams across FSI wrote to 27 companies across the healthcare supplies and apparel industries to ask how they are addressing modern slavery issues amidst the pandemic. The benefits included efficiencies for both investment teams and companies, cross-learning opportunities from the expertise across investment teams to increase our common understanding of this important issue and an ability to create more meaningful change.

We asked companies in the healthcare supplies industry to tell us how they are addressing the heightened risks as a result of the pandemic. In particular, we asked:

- Have they been restricted in their ability to conduct site visits and audits, and how are they managing this?

- Have they taken steps to ensure that workers within their operations/supply chains have access to and are able to practice World Health Organization guidance, and other recommendations, to limit the spread of the disease?

- Do these workers have access to paid sick leave if they are required to self-isolate or care for sick relatives?

We asked companies in the apparel industry:

- Are they taking steps to ensure workers in their supply chain are paid legally mandated wages and benefits?

- Have they set up or contributed to emergency relief funds or financial support packages?

- Does their exit plan include plans for resumption of orders and reinstatement of workers following the crisis?

Outcomes

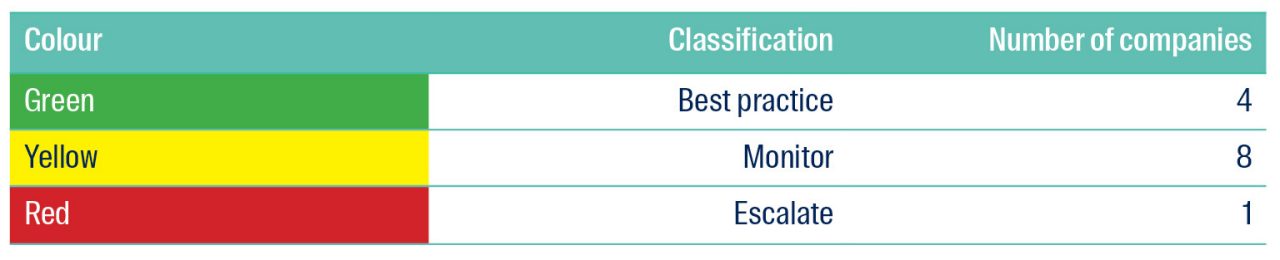

We received responses from 13 companies on our target list and went on to have meaningful conversations with many of them. We classified companies that responded under the following traffic light system:

Examples of best practice include:

- Commitments to pay for orders completed or in progress.

- Working with suppliers to ensure they are able to maintain business operations and support their staff; that staff have access to sick leave, protective equipment and information about health guidelines; and are well informed of how orders may ramp up as we emerge from lockdown.

- Engagement with governments, NGOs and UN agencies on providing emergency relief, job security and support for the most vulnerable people (eg. Migrant workers).

- Paying wages to suppliers' staff directly where they are unable to cover costs.

- Collaborating with other members of the industry and NGOs to support suppliers and their workers.

Examples of companies we are planning to monitor include:

- Those who have introduced various types of video or remote audits. Although there are no alternatives at this moment, we have agreed to follow up with these companies to see how effectively they are able to identify issues through video audits.

- Companies that did not seem to be fully aware of this issue and how it had become more severe as a result of the pandemic. Clearly, COVID-19 has impacted different supply chains in different ways, but for those companies where we did not feel there was a good awareness of the issue, we are following up with examples of best practice to share our learnings from this engagement.

This process identified a company that we feel is currently at high risk of modern slavery exposure. In accordance with the guidelines set out in our Modern Slavery Toolkit, we are escalating this issue directly with the company to ensure that there are processes in place to ensure remedy for any victim(s) and to prevent further issues going forward. Progress will be reported to FSI’s internal Global Investment Committee which oversees investment risks, including ESG related.

Future Engagement Activities

For the majority of companies we have engaged with, this is either the beginning or continuation of a broader conversation about modern slavery and labour exploitation. In particular, we are planning these follow up activities:

- We will share the outcomes and examples of best practice with all companies we have written to, particularly with companies designated as 'Monitor'.

- We will follow up with companies conducting audits remotely to assess how effective this has been and whether there is an increased risk of modern slavery as a result of the inability to conduct onsite audits for a period of time.

- We will follow up with the companies that did not respond. We appreciate it was difficult timing to engage with investors as the world entered into lockdown and supply chains globally were severely impacted in different ways. However, we want to ensure that companies are taking these issues seriously and will engage with them directly at a later date.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom