The existence of “zombie” firms is a dangerous and growing problem in the global economy. These are companies that would normally have gone bankrupt or been restructured but have been kept alive by sympathetic credit policy and interest rates which are artificially and extraordinarily low.

Figure 1: Zombie Firms. No, not actual zombies; zombie companies of course. 2

One clear definition comes from Warren Hogan, Industry Professor at University of Technology Sydney3:

“A zombie firm is one that is still operating but is essentially bankrupt, with little-to-no

prospects of future profits or growth. If interest rates were at normal levels, the firm

would not be able to meet its interest payments and would exit the market."

The definition is roughly the same from other sources. For example, Wikipedia’s definition is4:

“…a zombie company is a company that needs bailouts in order to operate,

or an indebted company that is able to repay the interest on its debts

but not repay the principal."

And finally, in an academic paper, Banerjee and Hofmann (2018) state that zombie firms are5:

“…firms that are unable to cover debt servicing costs from current profits

over an extended period."

The definition of zombie firms as those which struggle to service debt obligations maybe be too simple a way to characterise them, but it is a place to start. That said, firms which reinvest in their businesses through Research and Development (R&D) and increasing brand value should have a better chance of survival than those who do not. It may also be that many firms will simply slow down their economic activity, wait out a difficult period (like hibernation) and then re-emerge. Airlines (like Boeing) would be good examples of this type of firm. They might raise equity capital as well, to reduce their debt load, in this re-emergence. The subtleties of this split between hibernation and zombie behaviour is beyond the scope of this paper, but future work will endeavour to address it.

A second consideration is the impact of zombie firms on the operation and balance sheets of banks. It is indeed banks that are creating (or at least implementing) the conditions which support zombie behaviour, so we could reasonably expect growth in bad and doubtful debts and a deterioration in the quality of bank capital to be a result of this action. Again, we leave this for future work.

The popular press has been awash with discussion of zombie firms recently. Examples include: Australian retailers6, global airports and car companies (for example, KLM, Renault, Boeing)7, a “crisis” in Australia on the withdrawal of Covid-related financial support8, as a result of the Australian JobKeeper scheme9, the impact of bailout funding10 and the broad rules supporting capitalism itself11.

Economists and strategists are also becoming very worried about the impact the growth of these firms is having. We are joining these voices, and this paper outlines four main conclusions we have drawn on the issue:

- It represents an inefficient allocation of capital

- It will depress future economic growth

- We will possibly see a future wave of defaults

- It may help to explain the underperformance of value over the last 10-12 years

Three Key Questions

The key questions we want to address here are:

- How we can define a zombie firm from financial data

- Why zombie firms have arisen

- Financial, social and economic implications

Creative Destruction and Monetary Policy

An important explanation of this issue stems from the work of Austrian economist Joseph Schumpeter12. He speaks of “creative destruction”, which can be applied here as follows: strong firms drive weak firms out of a market where resources are scarce. These stronger firms “create” better productivity and prosperity and “destroy” economic processes and firms that cannot compete. Often these firms are smaller, younger firms, perhaps even start-ups, for whom access to debt capital is an essential source of growth. If access is reduced in favour of less efficient firms, or even those near default, then the creative destruction process is impaired.

This theory is repeatedly brought up in economic circles when discussing the zombie firm issue. As an example, Bindsell and Schaaf (2020)13 note that the existence of low interest rates leads “unproductive, highly indebted businesses to .. bind scarce resources - capital and labour - which could be employed more productively elsewhere.” This has the effect of stopping the positive benefits of competition and so slowing the process of creative destruction. These authors argue that monetary policy changes will not fix this, instead they suggest five combined solutions:

- Stronger economic growth (which is not really a solution, more a desire)

- Implementing structural reforms

- Removing entry barriers for young firms

- Improving bank supervision

- More effective and harmonised insolvency law for winding up ailing firms

The argument against monetary policy as a solution goes as follows. Lower interest rates and a relaxed credit policy should be stimulatory for economic growth. However, this has to be conditioned on the quality of the borrower. If the borrower is high quality and will use the debt to increase productivity and profit, then the expected stimulatory behaviour follows. However, if the borrower is lower quality, or the loan is made to prevent default, then the capital is misallocated and the result is lower efficiency and productivity.

We have also seen a secondary driver of this effect. The most productive and efficient firms, especially those in the tech sector, have little need for debt capital. Their profitability funds their expansion and reduces the need for debt. The supply of debt capital is therefore directed disproportionately towards lower return on equity (ROE), lower quality firms, or is not allocated at all.

The impact of the GFC

The term “zombie firm” was coined pre Global Financial Crisis (GFC), probably by Edward Kane from Boston University, when discussing the forbearance policy of the FSLIC (Federal Savings and Loan Insurance Corporation) in dealing with economic insolvencies in S&Ls in the late 1980s14. More recently, Caballero, Hoshi and Kashyap (2008)(CHK08)15 use the term, referring to the period in Japan during the 1990s when Japanese banks were forced by regulators to “evergreen” loans - that is, to rollover the loans to corporates which were zombies, and so the loans would never be repaid. These practices have been loosely classified by Kane and by CHK08 as “forbearance lending” - inefficient or near default firms were supported but not pushed to make themselves more efficient or more profitable.

Post the GFC, this artificial life was extended globally, with quantitative easing, artificially low interest rates and avoidance of corporate default and bankruptcy (bailouts, especially in the banking sector). This process was intended to keep credit flowing, firms operating and the population in reasonable levels of employment, until economic growth returned and the life support could be switched off.

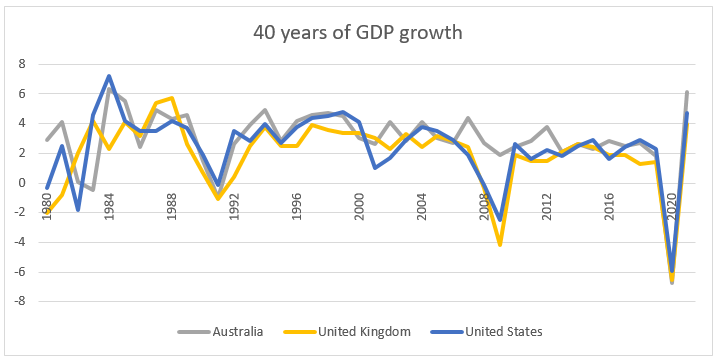

While a seemingly good policy to avoid an economic meltdown following the GFC, there have been unintended consequences. The low interest rate environment and low default risk allowed the global economy to bounce strongly out of the GFC, propelling perhaps artificially strong economic growth and reduced productivity. While lower in the last decade than the preceding two, the chart below shows annual GDP growth for Australia (grey), UK (yellow) and USA (blue) over time16:

Figure 2: 40 Years of GDP Growth. Source: IMF Datamapper. Data as at April 2020.

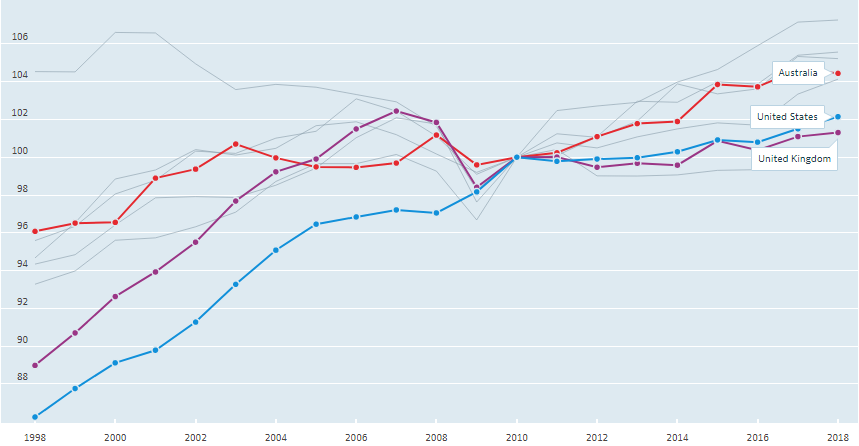

However, despite strong economic growth, productivity in most of the G7 nations was down following the GFC, and has become a major concern17. Low productivity growth implies lower long term standard of living. The chart below shows multifactor (also known as total factor) productivity (across labour, capital, energy, materials and services) for Australia, UK and USA, rebased to 100 at 201018. Clearly, productivity growth post GFC has been low in the US and UK, despite economic growth being high:

Figure 3: Productivity growth rebased to 2010. Data: OECD (2020), Multifactor productivity (indicator). Data as at December 2018.

It is difficult to see where this productivity problem might be solved. Much stock is placed in the potential for ongoing technological breakthroughs, like artificial intelligence or quantum computing. But without such a step change, and without proper allocation of capital to more productive ends, productivity could continue to be insipid.

There have been attempts to reduce this monetary life support after the GFC, but they were either taken badly, resulting in market dislocations like the taper tantrum of 2013, or considered to be too politically difficult. The policy was largely kept running, perhaps longer than it should, during this period of strong growth. Withdrawal of this lifeline could have a disastrous effect on the businesses themselves but also on industries which extrapolate this activity too far. The investment management industry is one such case in point.

We can perhaps summarise this period as follows:

- There has been an extended period of artificially low interest rates and sympathetic credit policy.

- This has created a class of “zombie” firms

- Debt capital is potentially being misallocated towards less productive targets

- This has stimulated a rapid recovery to GDP but without productivity gains.

The COVID effect

The global pandemic we are now experiencing has extended the cycle of low interest rates for the foreseeable future. Among other implications, this means further support for zombie firms, and a prolonged period of (necessary) support for firms and industries in financial difficulty.

There is no question that huge financial stimulus, relaxed credit default policy and low interest rates are necessary to soften the blow to the economy. However, the process of creative-destruction is somewhat suspended, and this has implications for the economy and financial markets in ways which will play out for many years to come.

Questions we need to ask from here:

- For how long will the current monetary policy and lax credit policy now be in place?

- Do we expect to see bankruptcies anyway? Can they be managed?

- Can the stimulatory policy we are currently seeing be directed towards stimulating the economy without allowing a wave of defaults?

Zombie Evolution and Growth

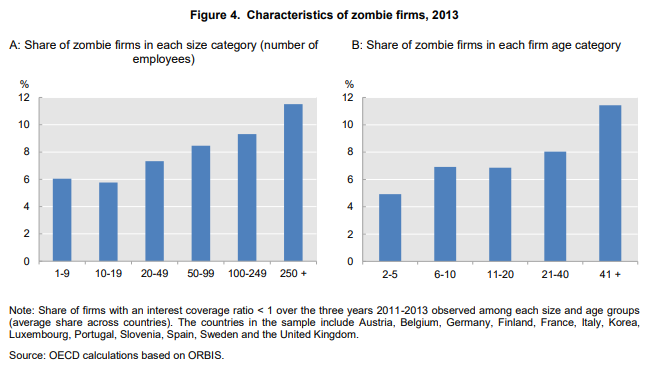

A recent paper by Adalet McGowan, Andrews and Millot (2017)19 helps to address the question: What do zombie firms look like? The basic characteristics seem to be low interest coverage and firm age and size. Younger, smaller firms which are not profitable may simply be early in their life cycle. Simply using interest cover less than 1 for three consecutive years, the authors show strong firm age and size biases: older and larger firms have lower zombie membership. The chart below from their paper shows this:

Figure 4: Characteristics of Zombie Firms in 2013

This paper then assesses and measures the growth of such firms since the mid-2000s and details their potential economic impact. They define zombie firms as those that are more than 10 years old and have had an interest coverage ratio of less than 1 for three consecutive years. It is clear from their work that the proportion of zombie firms has increased and that they have attracted capital that might otherwise have been to more productive use. Issues such as increased barriers to entry and suppression of existing healthy firms are evident.

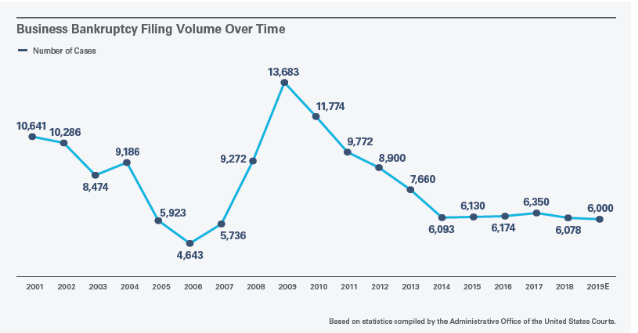

Zombie firms can alter their zombie state by one of two means; increasing profitability and recovering, or exiting via bankruptcy. Neither appears to be happening. As Frank Borman, a US astronaut and businessman, once said: “Capitalism without bankruptcy is like Christianity without hell.”20 We have entered a world where bankruptcy is becoming increasingly rare - at or near an all-time low in history. The chart below21 is US bankruptcies by number since 2001 (that is, companies that have filed for bankruptcy protection under Chapter 11 of the US Bankruptcy Code):

Source: JDSUPRA, “Restructuring Market Trends”, Data as at December 2018.

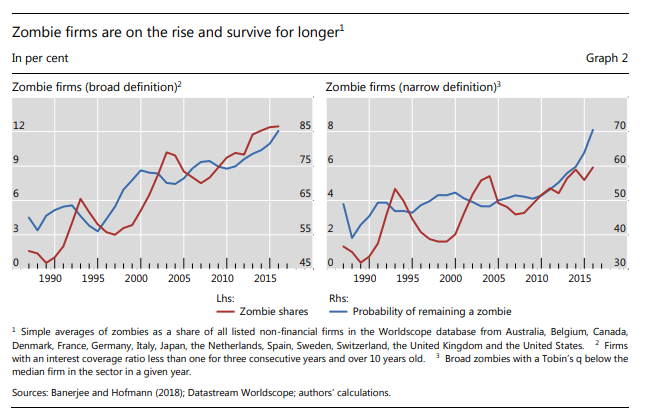

At the same time, the proportion of zombie firms has risen, and they remain zombies for longer. The chart below comes from Banerjee and Hofmann (2018)22, using data from 14 developed countries (including Australia). The first (broad) zombie definition is a firm which is more than 10 years old and has had an interest cover of less than 1 for three consecutive years. The second (narrow) definition adds the requirement that Tobin’s q (ratio of asset market value to book value) to be below the sector median for the year. The chart below shows the proportion of zombie firms in their universe, starting in 1985 and running up until 2016. Note that by taking the simple average, they up-weight the impact of small and microcap names:

Figure 6: Percentage and persistence of zombies

The proportion of zombie firms has grown quite steadily, with some fluctuations, from near zero in 1990 to almost 12% (using definition 1) and almost 6% (using definition 2). In other words, using definition 1 - in 2016, one firm in eight qualified as a zombie. Further, zombie firms are now more likely to remain zombie firms than ever before. Even using definition 2, 70% of zombie firms in 2015 were still in that state in 2016.

A more recent study by the same authors (Banerjee and Hofmann (2020) 23 digs much deeper into the characteristics of zombie firms, with a slightly different definition. This second paper requires zombie firms to have a Tobin’s q below the sector median, have two years with interest cover below 1 but also to be preceded by a two year period when interest cover is above 1. Note that they drop the firm age requirement. They again find that the percentage of zombie firms is increasing, and that they are smaller, less productive and spend less on physical and intangible capital than other firms.

It is worth noting now that our results (in the next paper in this series) contrast somewhat with those of Banerjee and Hofmann (2018 and 2020). That is, we do not find the trend in Developed Markets zombie firm percentage - our results show that the percentage of zombies is fairly stable at about 6%. This is different in Australia and in Emerging Markets as well, where the proportion of zombies is higher but still more stable.

The main difference seems to be the universes we choose. Our universe is much more large cap focussed, reflecting the better investability of the firms in the sample. Our sample has approximately 13000 of the largest stocks in developed markets, across 24 countries (not including Australia, which we break out separately). Compare this with the number of more than 32000 quoted in the Banerjee and Hofmann papers, across only 14 countries, including Australia. There is clearly a very long small cap tail in their papers.24

Whether or not the proportion of zombie firms is increasing, it is still a significant concern that they exist at all.

Side Note: It’s not just equities

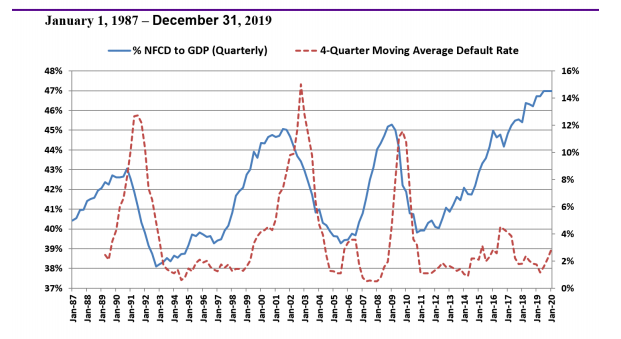

Of course this has been a company effect, not just an equity effect. Altman (2020) discusses the impact of Covid on likely default rates in high yield bonds25. He especially focuses on default and recovery rates for the non-financial corporate debt market in the US. If default rates are large, as we might expect significant knock-on effects on economic growth and the availability of credit.

The chart below from Altman’s paper shows the percentage of non-financial corporate debt in the US as a percentage of GDP (left hand axis, all time high at about 47%) against the default rate (right hand side, very low at around 3%). The artificially low default rate, potentially due to the growing collection of zombie firms, is very concerning - if default rates spike, the impact of high yield debt in the US could be very significant.

Source: Altman, E (2020), “Covid-19 and the Credit Cycle”

Long Term Value Underperformance

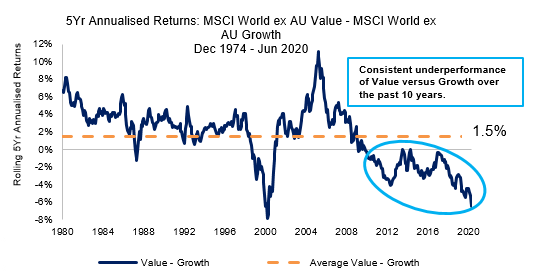

A less obvious conclusion might be that this low interest rate/lax credit policy has been in force largely since the GFC, around 2008 and 2009, and has continued to the present day - and COVID may force this policy to continue.

This coincides almost exactly26 with the period when value has continually underperformed growth. The chart below shows a five year rolling average of value performance compared to growth in the MSCI ACWI ex Australia universe:

Figure 8: Five year rolling value v growth: MSCI World ex AU

Source: Realindex, Factset. Data as at June 2020.

The two principal components of post GFC monetary and credit policy have been:

- Low interest rates

- Forbearance (i.e. lax credit policy)

We already know that low interest rates will inflate long term cash flows, making growth firms look more valuable when compared to value firms. Can we also conclude that some of the long term underperformance of value is due to forbearance as well? Could the inefficient allocation of capital be preventing value firms from a mean reversion upwards, while at the same time locking zombie firms in so they cannot go bankrupt and be restructured?

Two key papers here are Fama and French (2006)27 and Lev and Srivastava (2019)28. Fama and French (2006) show that, historically, returns to value strategies over growth strategies are driven by a combination of two factors:

- Style migration (up out of value and down out of growth)

- Return excess to value in non-migrating stocks

We will concentrate on the first of these. Fama and French (2006) argue that two factors will erode the benefits of growth firms over time: competition and a limited set of growth options. These firms will eventually migrate downwards, reducing any premium earned by growth names. At the same time, value companies restructure and their profitability improves, so they will migrate upwards, earning a premium for value names.

Lev and Srivistava (2019) show that this effect has reduced significantly over time, increasing the stickiness of value or growth stocks to these categories. In effect, this lack of migration has helped to create the extended period of underperformance of value.

We would contend that the existence and growth of the class of zombie firms has been a major contributor to this lack of migration, in particular the upwards migration of value stocks. The allocation of capital to these firms has meant that they (a) stay as zombies and so stick in the value category and (b) prevent capital being provided to firms that might actually migrate (the living).

Conclusions

As noted above, there are probably four conclusions we can draw here. The low interest rates and lax credit policy since the GFC (and now continuing after COVID) have artificially supported firms that might otherwise have gone bankrupt. Many of these firms will never recover, but are being prevented from this bankruptcy - zombie firms, the “undead”. It appears that this:

- Represents an inefficient allocation of capital

- Will depress future economic growth

- Will see a future wave of defaults

- May help to explain the underperformance of value over the last 10 to 12 years

We have two future papers in the works. The first looks at zombie stocks using Realindex data sets, to attempt to replicate and better understand the phenomenon. A second paper will look into how a quality overlay can act as a “zombie-repellent”, and how the Realindex investment process captures this idea.

1 One of the strangest yet most interesting book titles of the last decade or so has to be “Pride and Prejudice and Zombies” (2009) by Seth Grahame-Smith. It is loosely based on the classic Jane Austen novel “Pride and Prejudice” (1813), which depicts life, marriage and education during the so called “Regency Era” in Britain at the start of the 19th century. The idea of the newer book is to track the basic story of the older book, but to add modern fiction themes of action, zombie plagues and senseless gore and violence. A film was also made in 2016. None of this actually matters to our discussion in this paper except that we echo its title, with thanks.↩

2 From https://marketbusinessnews.com/financial-glossary/zombie-company/↩

3 W. Hogan, Australian Financial Review (May 29, 2019): https://www.afr.com/policy/economy/the-low-interest-trap-of-inequality-and-zombie-firms-20190529-p51sev↩

4 https://en.wikipedia.org/wiki/Zombie_company↩

5 Banerjee and Hofmann (2018), “The rise of zombie firms: causes and consequences”, Bank of International Settlements.↩

6 https://www.afr.com/property/commercial/zombie-apocalypse-coming-for-melbourne-retailers-20200731-p55hbg↩

7 https://thegoldeninvestor.com/2020/06/17/governments-should-stop-supporting-non-viable-companies/↩

8 https://www.smh.com.au/politics/federal/thousands-of-zombie-firms-set-to-march-into-september-reckoning-20200612-p5522b.html↩

9 https://www.news.com.au/finance/economy/australian-economy/jobkeeper-scheme-backfires-creates-zombie-businesses/news-story/3aa27510db26a89fe5f5a7c413e80261↩

10 https://theconversation.com/attack-of-zombie-companies-dont-let-them-eat-bailouts-that-are-vital-to-restore-the-economy-139177↩

11 https://www.wsj.com/articles/the-rescues-ruining-capitalism-11595603720↩

12 Schumpeter, Joseph A. (1942). Capitalism, Socialism and Democracy. Schumpeter used this idea to predict the demise of capitalism, following the work of Marx↩

13 https://voxeu.org/content/zombification-real-not-monetary-phenomenon-exorcising-bogeyman-low-interest-rates↩

14 Kane E. (1987): “Dangers of Capital Forbearance: The Case of the FSLIC and”Zombie" S&Ls“, Contemporary Economic Policy↩

15 Caballero, R, T Hoshi and A Kashyap (2008): “Zombie lending and depressed restructuring in Japan”, American Economic Review, vol 98, no 5, pp 1943-77.↩

16 https://www.imf.org/external/datamapper/NGDP_RPCH@WEO/AUS/GBR/USA↩

17 See for example https://www.focus-economics.com/blog/why-is-productivity-growth-so-low-23-economic-experts-weigh-in and https://voxeu.org/article/tight-monetary-policy-not-answer-weak-productivity-growth↩

18 https://data.oecd.org/lprdty/multifactor-productivity.htm↩

19 Adalet McGowan, M, D Andrews and V Millot (2017): “The walking dead: zombie firms and productivity performance in OECD countries”, OECD Economics Department Working Papers, no 1372.↩

20 The Growing Bankruptcy Brigade, TIME magazine (18 October 1982)↩

21 from https://www.jdsupra.com/legalnews/restructuring-market-trends-93876/↩

22 Banerjee and Hofmann (2018), “The rise of zombie firms: causes and consequences”, Bank of International Settlements.↩

23 Banerjee and Hofmann (2020), “Corporate zombies: Anatomy and Life Cycle”, Bank of International Settlements.↩

24 See the next paper in this Realinsights series for more detail↩

25 Altman, E (2020), “COVID-19 and the Credit Cycle”↩

26 Coincidences may be just that, but imagine a world without them.↩

27 Fama and French (2006), “Migration”, Financial Analysts Journal. In fact, FF use this process to explain both the HML (value) factor return and the SMB (small cap) factor return.↩

28 Lev and Srivastava (2019), “Explaining the Recent Failure of Value Investing

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author is a related body corporate of First Sentier Investors Realindex Pty Ltd (ABN 24 133 312 017, AFSL 335381) (Realindex). Both the Author and Realindex form part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author, Realindex nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, Realindex nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

In Australia, ‘Colonial’, ‘CFS’ and ‘Colonial First State’ are trade marks of Colonial Holding Company Limited and ‘Colonial First State Investments’ is a trade mark of the Commonwealth Bank of Australia and all of these trade marks are used by First Sentier Investors under licence.

Total returns shown for the Fund(s) have been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is no indication of future performance.

Copyright © First Sentier Investors (Australia) Services Pty Limited

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom