We firmly believe that active management is crucial when constructing a geared portfolio. A geared investment strategy can be considered a more complex strategy that borrows to invest, ultimately magnifying an investor’s exposure to rising or falling markets.

Active management allows the portfolio to be constructed and managed in a way that is uniquely accommodating of the gearing that sits behind the portfolio; that understands the heightened risks associated with gearing by selectively investing in companies without too much financial gearing and operating volatility themselves. By comparison a geared index fund must systematically accept the gearing and operating leverage of all market constituents whether appropriate or not.

First Sentier Investors continues to believe that quality companies with well-funded balance sheets, sound business models and with the ability to grow over time are the best candidates to be included in its geared portfolio regardless of their index weighting.

To reiterate – every investment decision you make has much higher stakes when you borrow to invest.

And First Sentier Investors has certainly seen the ‘ugly’ side of markets as manager of one of Australia’s largest and longest-running geared share strategy.

What perhaps characterises gearing to invest as complex and what ultimately is a less understood benefit of an actively managed geared portfolio, is the ability of a manager to meet margin calls in rapidly falling markets.

Ideally a manager retains the ability to meet debts triggered by falling share prices, while maintaining a somewhat consistent level of gearing through the drawdown event. This can be a challenging scenario to manage for individuals borrowing to invest through margin loans.

Liquidity is especially important when trading in volatile markets. Investors should be aware that share prices can be distorted in periods of rapid market deterioration.

Therefore, in rapidly falling markets it becomes vital to have access to liquidity, which we believe our portfolio achieves through only investing in the S&P/ASX 100 and this allows us to maintain a relatively constant level of leverage, at around 55 per cent.

Always be prepared for the flight to quality

In my experience, quality companies with healthy balance sheets and cashflows experience less share price volatility during drawdown events and consequently, their liquidity also remains more resilient. Many of these high-quality companies reside in the ASX100, which is where First Sentier Investors has focused its active stock selection for its geared share strategy.

I’ve certainly witnessed the importance holding a diversified portfolio of quality companies with strong balance sheets makes. I was the portfolio manager for one of Australia’s largest geared share strategy during the outsized Covid-19 pandemic drawdown event in early 2020. Whilst it was a challenging period, there was ample opportunity to liquidate portfolio holdings in order to meet the margin calls and pleasingly, there was the also the opportunity to buy positions in stocks that had been excessively sold down during this period.

Therefore, I cannot emphasise enough, the merits of investing in quality companies, not just for capturing growth in returns but also ensuring the resilience of the portfolio, and this is especially important in the case of a geared portfolio.

Be cautious of gearing an entire index

Investors should be wary of accepting higher risks and taking a whatever will be will be for a lower fee approach especially when borrowing to invest.

By actively managing a ASX100 portfolio we are able to avoid stocks that can become illiquid in falling markets and where this illiquidity can distort the share price. These are risks you accept when you gear an entire index.

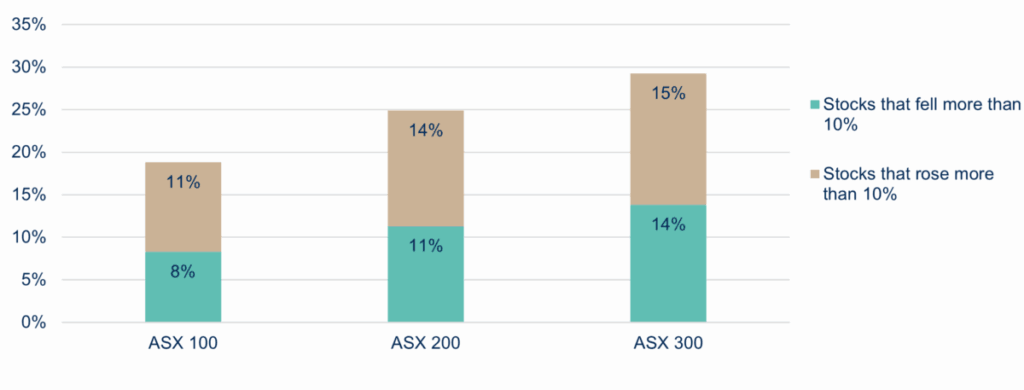

The ASX100 is also less volatile than its ASX200 and ASX300 counterparts. Shown below is the average number of stocks with monthly share price movements over 10 per cent over the past 15 years. While the ASX100 is less volatile than the broader market, this segment is still subject to significant share price movements. These movements (both up and down) are magnified when geared.

Large monthly share price movements across market segments

Source: Factset data from 31 July 2004 – 30 June 2024 (monthly returns). Equity securities are subject to change in value, and their values may be more volatile than those of other asset classes.

The perfect candidates for gearing

We believe Australia’s largest companies offer investors greater liquidity and lower volatility through market conditions. They also tend to offer higher dividend streams and franking credits than the broader market, representing an additional tax-effective income stream for investors.

We take an index aware approach to gearing. We only gear our best investment ideas selected from across the ASX100. We favour highly liquid, quality companies that we believe can consistently grow sales, cash flows and earnings – and this is often supported by a market leadership position.

Too much leverage can amplify losses

In addition to managing liquidity risks through stock selection, investors need to consider the gearing level that they are comfortable on the overall portfolio. Too much leverage can increase the risk an investor may be forced out of preferred stock positions to cover margin calls in rapidly falling markets. We aim to maintain gearing levels consistently between 50-60 per cent.

We believe that our focus on liquidity has seen the strategy remain resilient since it launched in 1997 whether through the dot com slump of the early 2000’s, the Global Financial Crisis or the Covid-19 pandemic market meltdown, while delivering quality outperformance over long time periods.

Low-cost access to one of Australia’s largest and longest-running geared strategies

First Sentier Investors is excited to celebrate the one-year anniversary of the First Sentier Geared Australian Share Fund.

This newly created vehicle couples the lowest investment management fee for an active geared strategy available on the market with competitive borrowing costs.

It draws on the same active stock selection, process and team as the strategy launched in 19971.

As the strategy borrows to invest, there is potential for significant losses in falling markets.

David Wilson is the Deputy Head of Australian Equities Growth and portfolio manager of First Sentier Investors’ Geared Australian Share strategy.

1 The strategy was launched in 1997. The First Sentier Geared Australian Share Fund was created in 2023.

First Sentier Geared Australian Share Fund Complex ETF (ASX: LEVR)

We provide an active geared exposure to the ASX 100, managed by one of Australia’s most experienced geared share managers. The fund is purpose built for gearing and focuses on a selection of high quality, growing companies.

Gearing is high risk and magnifies gains and losses.

Read our latest insights

Important information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors, 2024

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom