In this paper we outline why we believe there’s a case for making a structural allocation to credit markets within a diversified investment portfolio.

For some, this might involve a partial reallocation of capital from composite/diversified fixed income exposures in favour of credit investments. For others, it may involve reducing the size of existing investments in term deposits, or other cash-based strategies.

Many investors already have some indirect exposure to credit markets, through allocations to aggregate or composite-style fixed income funds. Most of these strategies are predominantly invested in government bonds, but can have smaller investments in credit markets too. Fewer investors have a direct, standalone allocation to corporate bonds or other credit securities. This is interesting considering credit securities can offer higher prospective returns than other defensive exposures, like government bonds and term deposits.

A permanent allocation to credit investments can make sense from a strategic asset allocation perspective. Independent research1 suggests there’s merit in carving out a permanent, standalone credit allocation within a diversified investment portfolio. For some, this might involve a partial reallocation of capital from composite/diversified fixed income exposures in favour of credit investments. For others, it may involve reducing the size of existing investments in term deposits, or other cash-based strategies.

It’s not possible to replicate the risk/return characteristics of corporate bonds by holding a combination of higher risk equities and lower risk government bonds. Over the long term, corporate bonds have achieved superior risk-adjusted performance than a combination of Treasuries and equity of the same companies. The outperformance is evident irrespective of what time period is measured, and also by rating, sector and geography2.

To underline the relative merits of the asset class, it’s worth observing historical credit spreads and default rates and, in turn, the return profile of credit securities versus comparable government securities.

Spreads and default rates

All credit securities carry some level of embedded default risk. To entice investors and to compensate them for this default risk, credit securities offer yields over and above the risk-free rate. This premium is known as the credit spread. The size of the spread fluctuates over time, influenced by the evolving level of perceived default risk. Credit spreads are important, as investors use them to determine corporate bond valuations.

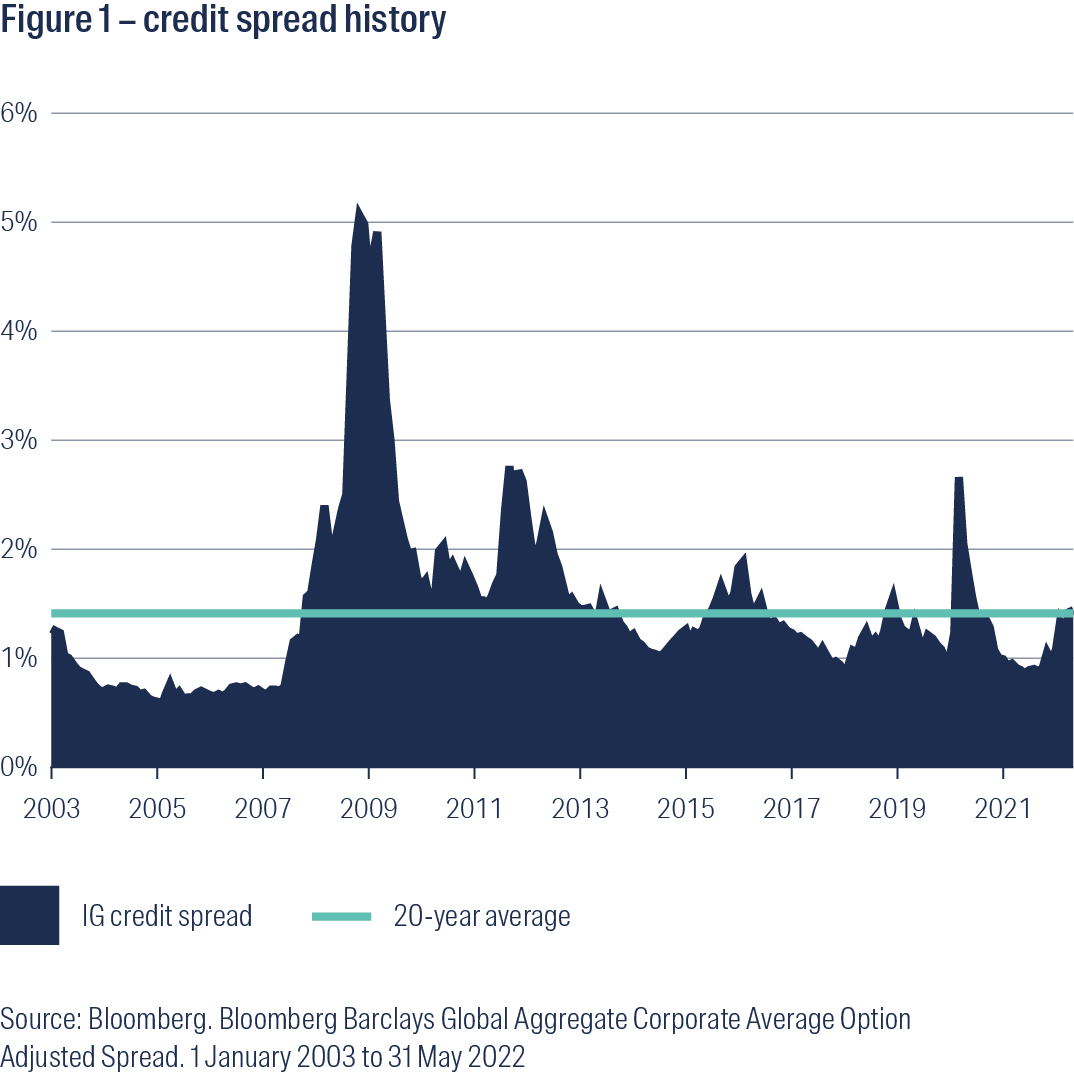

As shown in Figure 1, investment grade spreads have rarely dipped below 1% and have averaged 1.41% over the past 20 years. For the purposes of this paper we’re focusing on the investment grade corporate sub-sector, because our Global Credit strategies are predominantly invested in this part of the credit market.

The key question, therefore, is whether that 1.41% above risk-free rates is sufficient to compensate investors for the level of embedded default risk in credit securities. To answer it, we must look at default and recovery rates, and the potential for capital impairment.

The word ‘default’ is a rather scary one for investors; nobody likes the idea of losing money. According to Moody’s, however, the frequency and magnitude of defaults is less concerning than investors might think, at least in the investment grade sub-sector (default rates are higher in the more speculative, sub-investment grade sector).

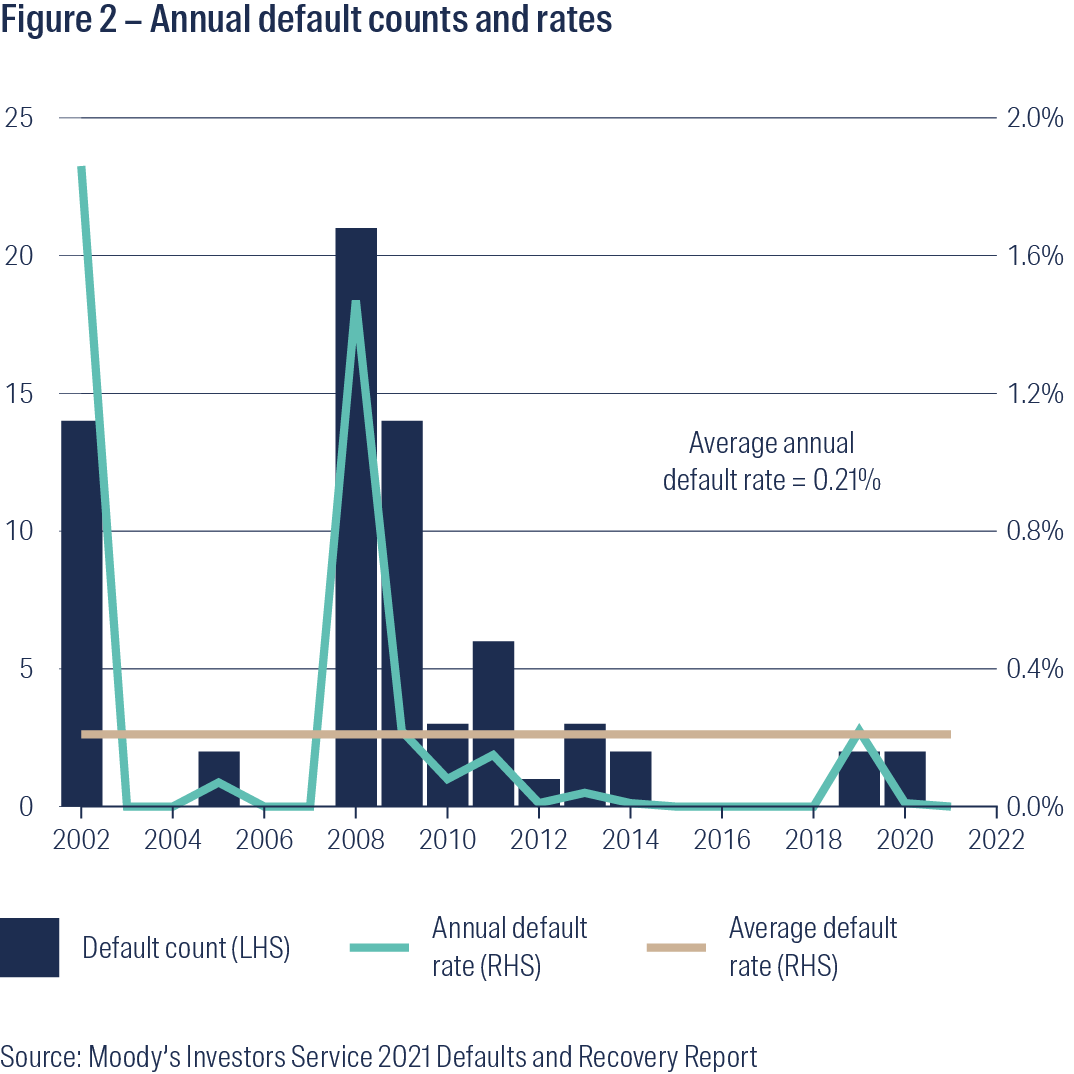

As shown in Figure 2 above, there were no defaults at all among investment grade corporate issuers in nine of the past 20 years. And in the period as a whole, the average default rate was just 0.21% pa on a volume-weighted basis3. Perhaps not quite so scary, after all.

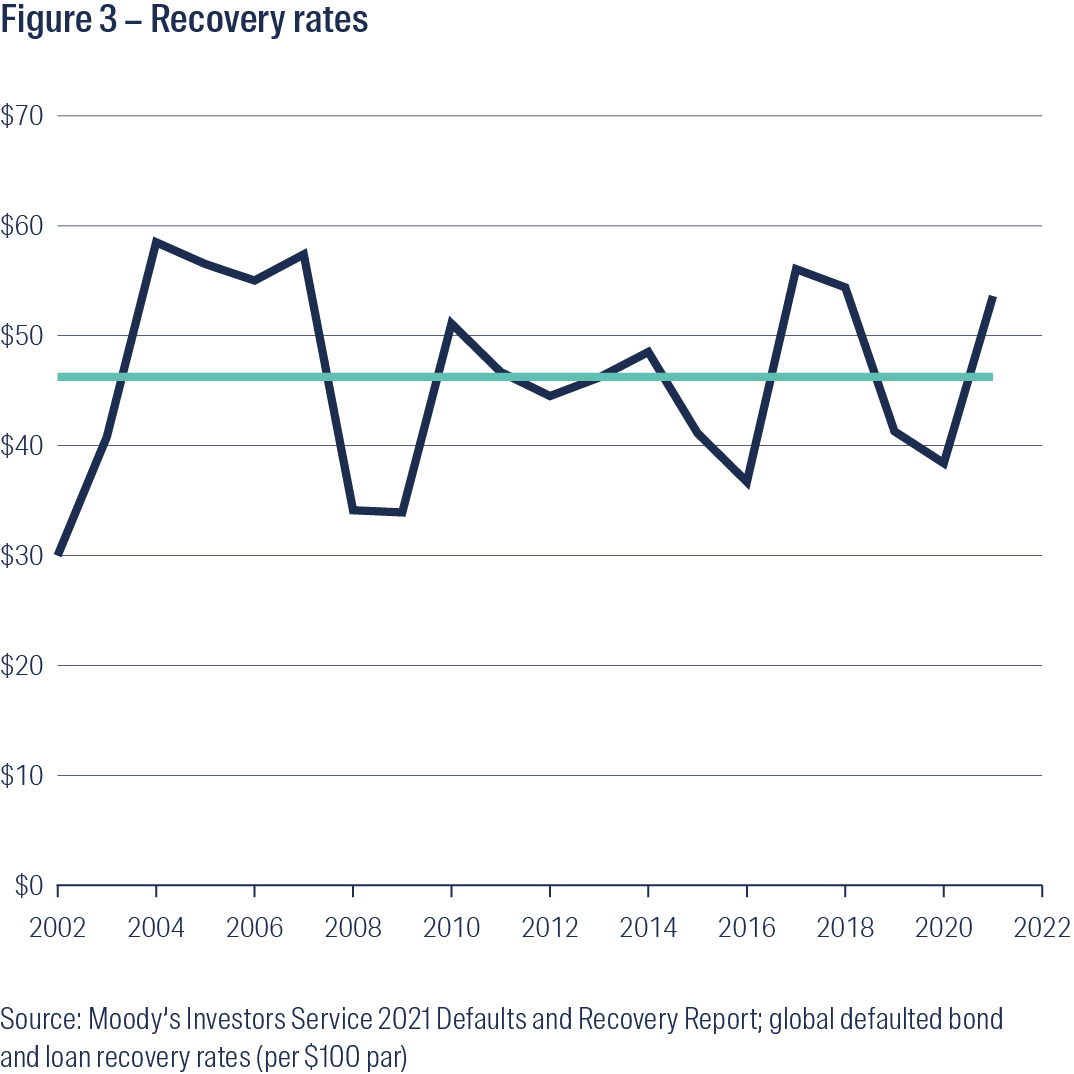

Moreover, investors can typically claw back some capital following an issuer default. As shown in Figure 3, investors have, on average, been able to recover 46 cents in the dollar from defaulting issuers over the past 20 years.

The actual cost of defaults is therefore around half of what headline default rates might indicate. The recoveries not only help preserve capital, but also support positive excess returns from credit over the full market cycle. This is an important distinction compared to equity markets; when a listed company becomes insolvent – also known as a default event – the equity is deemed to be worth zero.

Perhaps even more importantly, the frequency of defaults and the extent of capital impairment in global credit portfolios can be significantly lower than these market-wide indications suggest. Over the past 20 years, for example, our flagship Global Credit strategy has experienced just four defaults in the investment grade sub-sector, compared to 68 in the broader market universe. The impact of these defaults on performance has consequently been lower than for the broader market. This highlights the value of diligent credit research, and underlines the merit of active management in this asset class.

Excess returns

It’s also insightful to compare historic credit returns against comparable government bonds, to see the ‘excess return’ over and above risk-free rates. Exchange rate movements can conceivably contribute to return volatility from both credit and government bonds, although we have stripped out currency movements from the analysis as most credit investors fully hedge FX risk

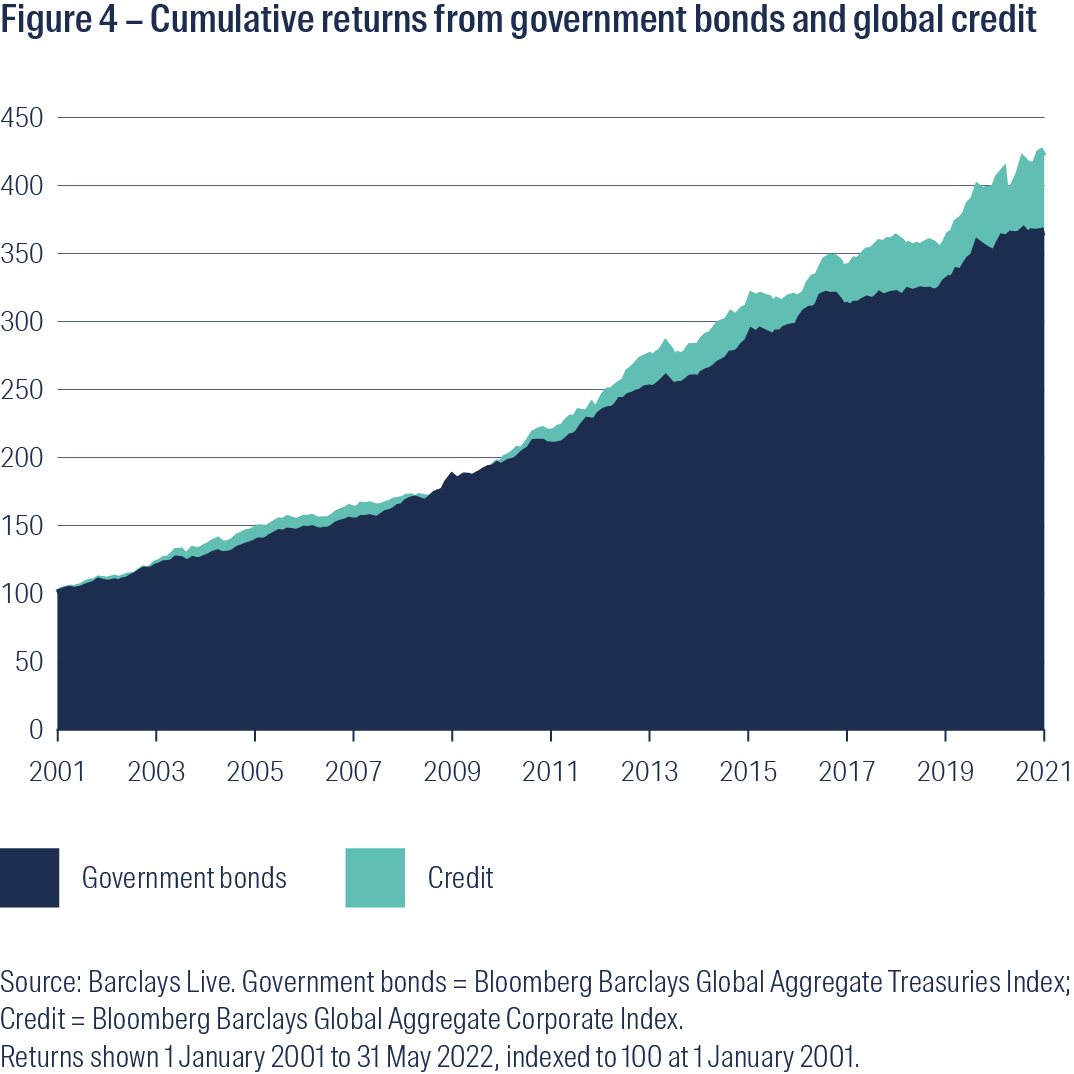

As shown in Figure 4, the excess return from credit – which includes the adverse influence of defaults – becomes more pronounced over time, with the benefit of compounding. Risk-averse investors with only government bonds in their fixed income allocations, or those favouring cash and term deposits with no exposure to bonds at all, are missing out on this potential outperformance.

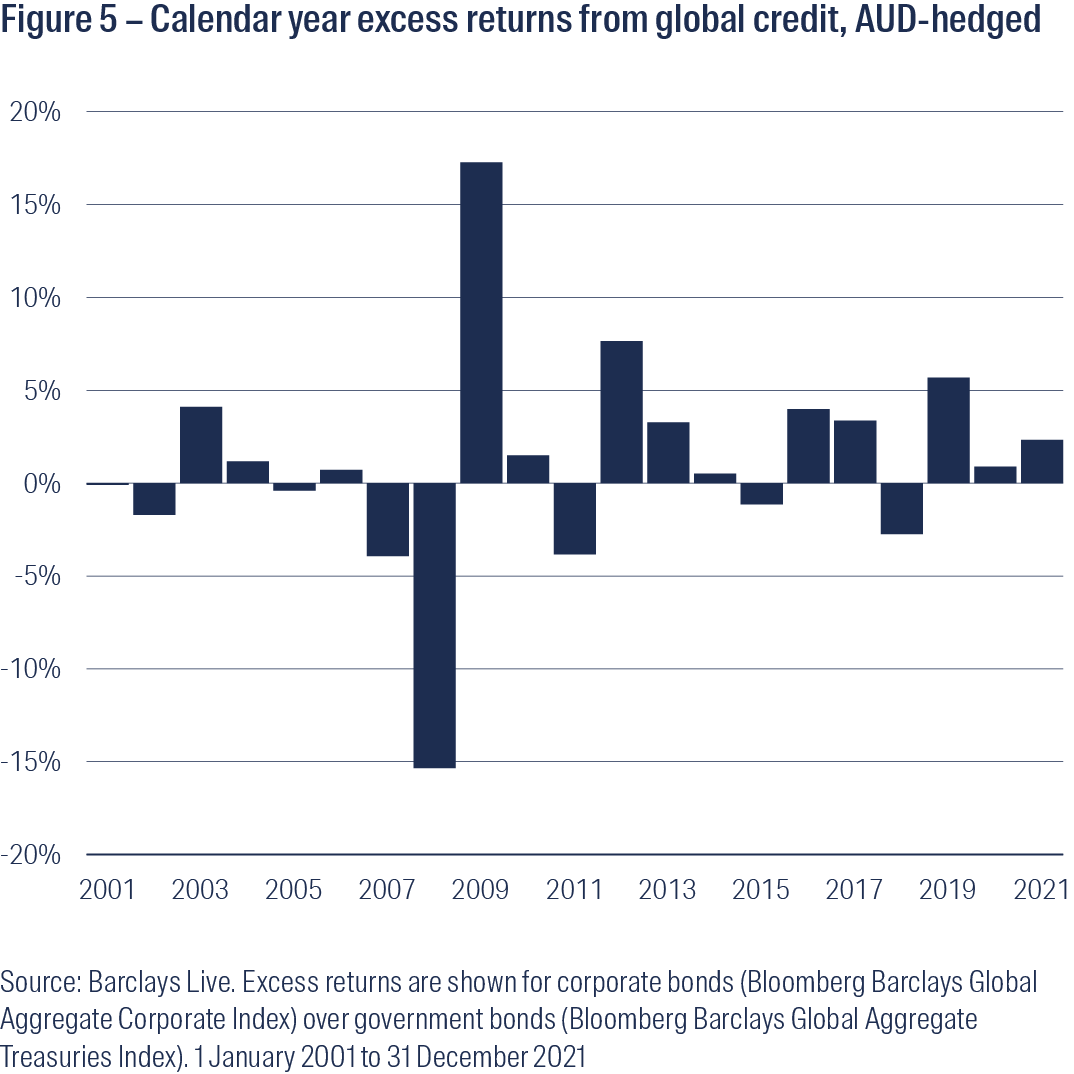

Whilst positive over time, the excess returns from credit markets are not uniform, and fluctuate over the cycle. Over the past 20 years, and as shown in Figure 5, excess returns have been negative around a third of the time; in seven of the past 20 years. This statistic may be disconcerting for investors, but it’s important to note that credit markets have always rebounded from temporary drawdowns. Ultimately, as long as issuers do not default, a combination of coupon income and the repayment of bond principal at maturity will generate positive returns, potentially over and above those from comparable government securities.

Most notably, excess returns exceeded 17% in 2009 following underperformance during the GFC. Similar themes have been seen since; excess returns were particularly strong in 2012 and 2019, for example, following weakness in the preceding years. These typically swift upturns in valuations reward investors who persevere with the asset class during periods of uncertainty, and can help credit markets generate potential positive excess returns over full market cycles.

The numbers are clear and compelling. Over the long term, credit markets have more than compensated investors for actual default risk. And the benefit of the credit spread means credit markets have been able to meaningfully outperform government bonds over time. We believe a structural allocation to credit markets can therefore meaningfully improve the risk/return profile of a diversified investment portfolio over the long term.

A separate question is whether now is a good time to make a new allocation to the credit market – or to maintain existing exposures – based on current valuations and where we are in the cycle. We have addressed this question in a separate research paper, Global Credit Outlook.

More than two decades of expertise

First Sentier Investors has been constructing credit funds for more than 20 years, so we have the expertise and know-how to manage investment risks over the full credit cycle. Whilst we are always looking for value-adding opportunities within the asset class, we believe First Sentier Investors is among the most conservative credit investors in the Australian peer group.

Ultimately, we are mindful that a credit allocation sits within the defensive component of most investors’ portfolios, and is intended to provide some offset to potential volatility in growth assets. Accordingly, capital preservation is of paramount importance in our Global Credit strategy.

We invest a lot of time and energy researching issuers and monitoring their performance, to help detect any early signs of stress. The intention is to remove deteriorating issuers from portfolios before valuations are meaningfully affected. Responsible investment considerations also form an important component of the research and investment processes. Environmental, Social and Governance risks and how they are being managed by issuers help influence the assignment of internal credit ratings, which in turn drive portfolio construction decisions.

Want to know more?

If you’re considering an allocation to Global Credit, speak to your account manager to see whether First Sentier Investors’ Global Credit strategies might be suitable for you.

Our over-arching credit investment philosophy has been largely unchanged for more than two decades and has stood the test of time. Our Global Credit strategies have performed broadly in line with expectations over full credit cycles, capturing the credit premium available whilst avoiding permanent capital impairment, i.e. defaults.

The Global Credit strategy offers:

- A proven and differentiated investment philosophy: Since credit market returns are asymmetric, we focus on avoiding the losers through rigorous credit analysis, combined with sophisticated portfolio construction that’s focused on diversification.

- Consistent long-term performance track record: Favourable risk-adjusted returns generated over multi-year time horizons*.

- Multi-dimensional credit research: A proven credit research process focusing on assessing credit risk and identifying deteriorating issuers early.

- Best-in-class ESG integration: ESG risk factors are an important consideration in the assignment of credit ratings on individual issuers, which in turn drive portfolio construction decisions.

*Past performance is not indicative of future performance.

1 Source: Barclays Quantitative Portfolio Strategies research: ‘Is Credit a Redundant Asset Class?’, January 2020

2 Source: Barclays Quantitative Portfolio Strategies research: ‘Is Credit a Redundant Asset Class?’, January 2020

3 Source: Moody’s Investors Service 2021 Defaults and Recovery Report

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material is directed at persons who are ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act). This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent permitted by law, no liability is accepted by MUFG, FSI AIM nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that FSI AIM believes to be accurate and reliable, however neither MUFG, FSI AIM nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of FSI AIM.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom