We’re almost halfway down the 2021 track, and while it’s been well and truly over a year since Covid-19 began wreaking havoc, the road ahead is windy. We expect divergence in asset performance as regions continue to travel at varying paces. Our Multi-Asset Solutions team share how they have adjusted their asset allocation for markets ahead.

Key points

The setting of the economic climate involves deciding on where we think the global economy is moving, and then for each country we determine the likely long-term values for inflation, risk free rates, long-term bond yields and earnings growth. By taking current valuations as a starting point, this allows us to determine expected returns for global assets from this point forward.

- Overall, substantial changes to the neutral asset allocation have been made as our economic climate assumptions evolve in response to the ongoing Covid-19 crisis.

- We believe that although financial markets have mostly stabilised, there is still much risk to be mitigated as the recovery continues. Our analysis also suggests that most asset classes have slightly higher expected returns.

- We have maintained our inflation assumptions low across all markets, along with lower cash rates and long-term yields to reflect the significant action taken by central banks. These supportive settings are expected to remain in place for most regions until a meaningful recovery is made.

- While earnings growth took a tumble over 2020, a pick up to more normalised earnings has already returned as the Covid-19 vaccination continues widespread distribution, allowing for the easing of lockdown measures.

- Portfolio positioning has focused on the balance between equities and bonds, with a focus on increasing the allocation to growth. Not only have we increased our allocation to global equities but we have introduced an allocation to Global Listed Property. As part of our tilt towards growth assets, we have reduced the allocation to both domestic and global bonds. We have also removed the allocation to high yield as the tightening of spreads has made this asset class less attractive.

- While we have been cautious on commodities for a while, as part of this review we have made a small reintroduction to commodities, tilted toward precious metals.

- While market conditions still appear uncertain, this can also lead to opportunities. The risks presented by the current economic climate are always dealt with diligently and in line with the Fund’s investment philosophy and process.

- The Fund continues to strive for consistent returns above inflation while aiming to minimise drawdowns and preserve investor capital.

- As a highly experienced team with over two decades' experience, the Multi-Asset Solutions team will continue to implement the Fund’s established and methodical Neutral Asset Allocation (NAA) investment process and then amend positioning through the Dynamic Asset Allocation (DAA) process as opportunities arise.

We recently reviewed the Neutral Asset Allocation (NAA) for the First Sentier Multi-Asset Real Return Fund; an exercise that is undertaken twice a year. This note summarises the key drivers of investment markets over the most recent six month period and outlines the changes made to the NAA following this most recent formal review.

We’re almost halfway through 2021 and while it’s been well and truly more than a year since the Covid-19 pandemic first began to wreak havoc, the recovery is still a work in progress. It’s been six months since our last Neutral Asset Allocation review (NAA) and we continue to closely monitor the policies and announcements coming from both governments and central banks alike as they continue to work toward a global recovery.

We’re still on the road to recovery

The recovery is coming along at varying paces across regions. This differentiation between countries and regions is one of our key themes and will likely see diverging asset performance in the period ahead.

Overall, much of the developed world appears to be effectively managing the spread of the virus through widespread vaccination, allowing continued easing of lockdown measures. Promisingly, in the US as at the end of April 2021, the vaccination program is well under way with 44% of Americans having received their first jab according to the Bloomberg Covid-19 vaccine tracker. Likewise, the UK has provided at least one dose to 51% of adults, however, next door in Europe, the take up is still lagging behind. Across emerging markets however, the race between the virus and the vaccine remains tight as the spread of the virus has not meaningfully decelerated and in some places it continues to reach frighteningly high levels. By the end of April, the number of infections as well as deaths was growing exponentially in India, with hospitals unable to cope and lacking resources including oxygen. Brazil is coming in closely behind, as the virus continues

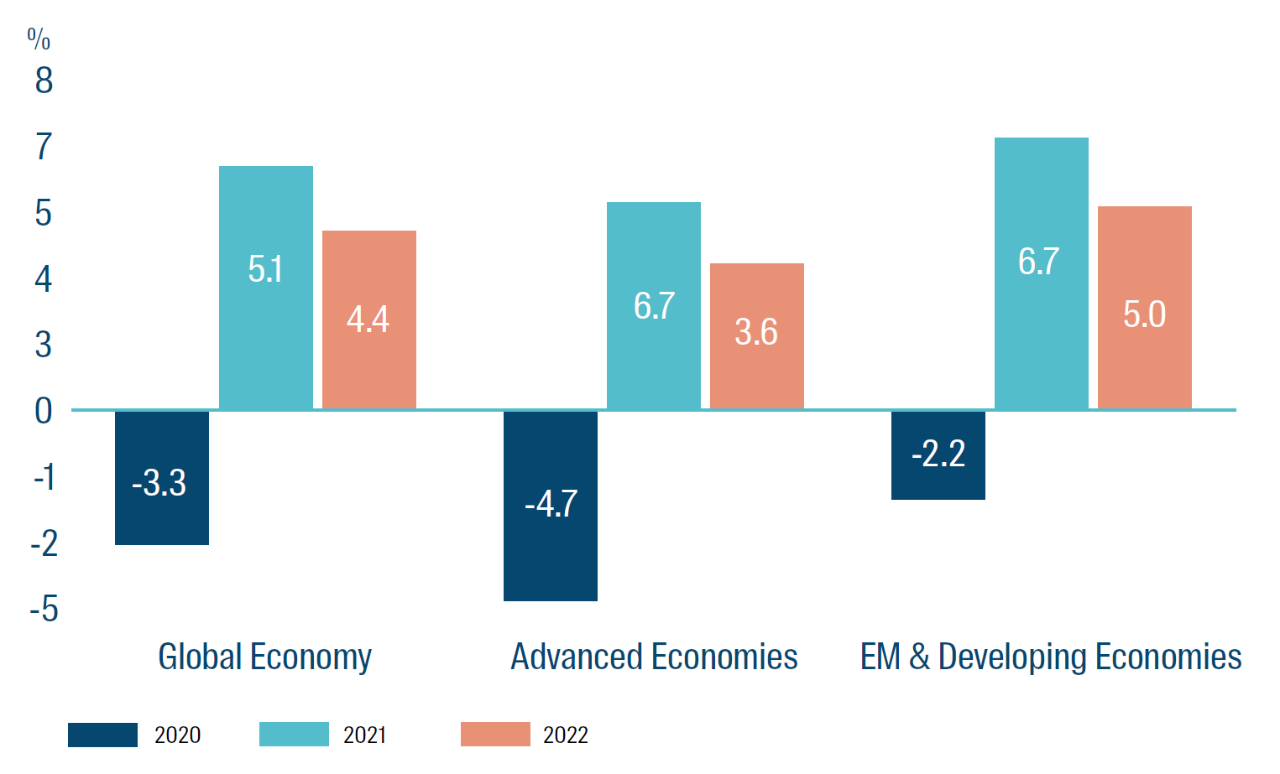

to rapidly spread throughout the country. Despite this, growth across emerging markets and developing economies contracted less than advanced economies and is expected to expand faster over 2021 and 2022 according to the International Monetary Fund’s April 2021 World Economic Outlook paper. Global growth is forecasted at 6% over 2021. This has been stronger than the previous readings made last year for the same period. In their paper however, they do acknowledge that emerging and developing economies are expected to suffer more medium and longer term scarring than advanced economies will. The key

concern emerging now however appears to be finding the right balance between stimulus (both monetary and fiscal) without triggering higher than expected or desired inflation. Although central bank officials do not appear phased by this prospect, it remains a topic of contention as economies are still trying to recover.

Figure 1: Global growth projections - April 2021

Source: International Monetary Fund, 30 April 2021

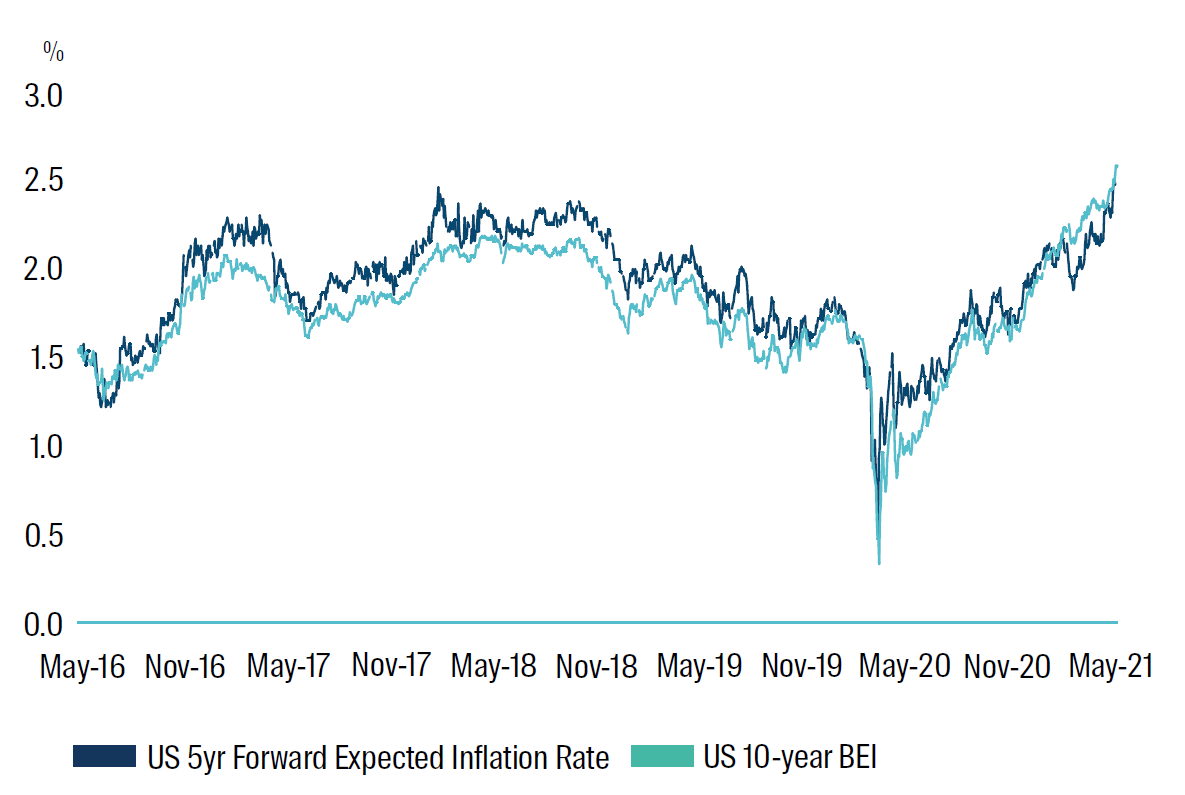

Figure 2: US Inflation

Source: Federal Reserve Bank of St Louis, 13 May 2021

Is inflation making a comeback?

Over 2021 so far, reflation has dominated headlines several times, accompanied by bond yields which soared earlier in the year, from their record lows of 2020. Effectively, there has been a tug of war between the prospect of inflation and the rollout of extra fiscal and monetary policy measures which are typically known to be inflationary. Central banks have also committed to letting economies ‘run hot’ to ensure inflation structurally moves in line with longer term goals. Of course, in the period immediately post the Covid-19 pandemic, the issuance of support measures was effective, if not essential, but as several countries have begun to make a somewhat ‘roaring’ recovery, the concerns around higher than expected inflation are surfacing. While most policymakers remain adamant that easy monetary policy settings will remain in place until a full recovery is in sight, signs of inflation have indeed been emerging, along with concerns that policymakers may ultimately be behind the curve.

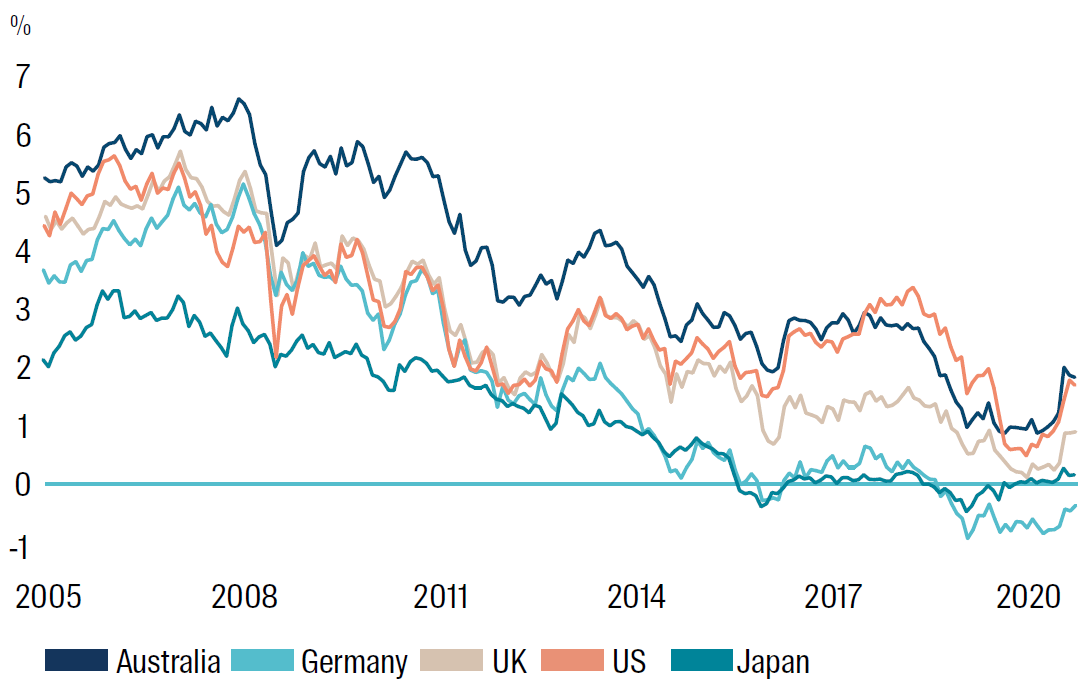

The rise in prices has unsurprisingly been accompanied by rising bond yields. US Treasury yields sat at 0.5% in August 2020 but jumped to 1.75% by the third week of March. This prompted slight panic throughout capital markets, primarily anxious that borrowing costs will rapidly increase, despite the ongoing pandemic. Similar moves were seen in other markets too, with Australian benchmark 10-year yields rising by a sizable 78bps over the month of February. By the end of April, yields had cooled off but the ultra-low yields of 2020 might not be seen again for some time. Overall, yields remain at modest levels at the end of April, with German 10-year bund yields still sitting in negative territory but with forecasters anticipating a positive yield by the end of the year.

In the Eurozone, prices increased by 0.9% in March over the previous month. Most alarmingly, in the US, the annual inflation rate printed in April recorded 4.2%, from 2.6% in March. Not only was this much higher than consensus expectations (by 0.8% higher) but this level of inflation has not been seen since 2008. Prior to this reading, US Fed Chair Powell’s commentary had remained in line with his previous statements and insisted that any incoming reflation would be transitory and return to the 2% target over the coming year. The central bank intends to keep rates low and held this stance at the meeting at the end of April. As illustrated in Figure 2: US Inflation; the 5 year forward expected inflation rate was 2.38% as at 12 May 2021, according to the US Federal Reserve. Meanwhile, the 10-year breakeven inflation rate – which is derived from the 10 year nominal Treasury yield and the 10-year Treasury Inflation-Protected Securities yield sat at 2.54% on the same date. While both of these indicators are above the 2% target, Fed Chair Powell has reiterated that this is an average inflation target and the Fed is comfortable in allowing increases over the shorter term. On the flipside, the Canadian central bank Governor announced during April that the bank would be slowing the pace of its bond purchases, however, this incited little market reaction.

Figure 3: 10-year Government bond yields

Source: Bloomberg as at 30 April 2021

More government support to come

Despite potential inflation woes, fiscal stimulus programs are still providing much needed support to economies from the pandemic fallout and a complete dry up is not yet on the cards. In the US, President Biden’s victory, followed by the Democratic clean sweep obtained in the January Georgia runoff elections, has allowed Biden to enact some of his further stimulus plans. The House of Representatives has already approved the American Rescue Plan – worth almost 8.8 per cent of 2020 GDP – to bolster the public health response and provide further support to families, communities and businesses. Part of the proposed spending includes an enormous US$2.25 trillion infrastructure plan as well as an education and childcare plan amounting to US$1.8 trillion. These measures however have already incited apprehension among politicians (particularly Republicans) around higher than expected inflation and are even more cautious that this could blow up an already overheating economy. On the monetary front, communications from the Federal Reserve (the ‘Fed’) maintain that rates will remain low until meaningful improvements are made – however long it may take! Overall, the low cost of borrowing and announcements of additional stimulus in the US should bode well for an uptick in economic activity over the coming years.

Over in Australia, the race against the virus and the vaccine is not as severe, as the spread of the virus has remained under control for several months now. As a result, while fiscal stimulus measures are still in place in the form of expenditure and revenue measures, some of the programs like the JobKeeper payments have ceased as business activity levels continue to improve. According to the Reserve Bank of Australia’s (RBA) forecast, GDP growth for the year ended December 2021 is expected at 3.5 per cent. While the reduction in fiscal measures should hopefully not impede this growth from occurring, it is of some comfort that the RBA intends to keep monetary policy settings loose for as long as needed.

Where to for Equities now?

Global equity markets continue to claw back the losses faced last year with several indices having reached new highs. While speculation arose over 2020 that the longest bull market in history was on its last legs … several months’ later shows it still has some life to give. Though market volatility continues to ebb and flow, adequate expected returns could still be generated from this asset class, particularly as many countries strengthen their management of the Covid-19 spread. Inflation concerns have also played a part in creating some additional volatility across equity markets, prompting sell offs. These concerns have however been debunked by policymakers, particularly in the US, who foresee any near term inflation being temporary.

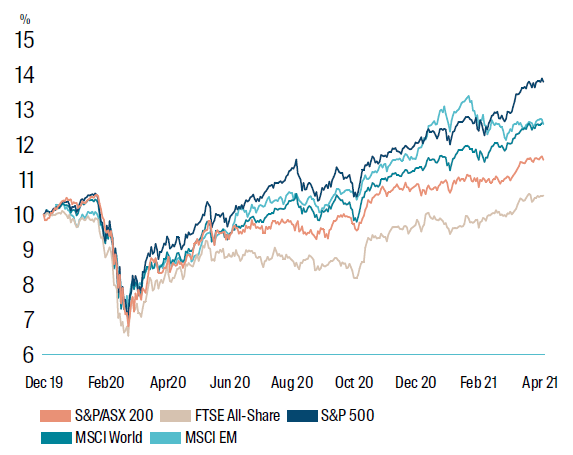

The vaccine rollout as well as fiscal stimulus have sparked a shakeup between growth and value style stocks, supported by improving consumer sentiment. Rising bond yields as well as increased commodity prices have also contributed to this value rotation, supporting the financial and mining sectors especially. From the calendar year to date, the S&P 500 returned 11.8%, closing 30 April at an all-time high of 4,211 points due to pleasing earnings results from big tech companies like Apple and Facebook over Q1. Year to date, the MSCI World Index returned 9.3%, with small cap stocks outperforming large caps. Over the same period, even in the Eurozone, despite a shortage of supply and associated delays with the vaccine rollout in the region, the MSCI Europe ex-UK index is up 10.7%. Japanese equities represented by the Nikkei 225 has increased by 5% since 31 December 2020, while infections remain sizable and vaccination rates remain low in the lead up to the postponed Tokyo Olympics. While emerging markets have generated decent returns in recent months, the recent surge in Covid-19 infections has disrupted the region’s lead. Although the MSCI Emerging Markets Index was left lagging in year-to-date April 2021 terms, the region is expected to be supported by an anticipated weakening of the US dollar and attractive valuations.

Figure 4: Global equity market returns

Source: Bloomberg as at 30 April 2021

The road ahead

The pandemic remains far from over, as not so gentle reminders continue to re-emerge like the surge of Covid-19 infections faced by countries like Brazil and in particular, India. While the impact of the overwhelming increase in cases in these regions may take some time to be accounted for, global equity markets so far have remained resilient against most stock market volatility. While Q1 2021 earnings results from several sectors and companies recorded pleasing results, not every industry is out of the pandemic-affected woods yet and a divergent recovery – across all sectors and regions – remains firmly on the table. The rate of vaccinations is also differing among countries, with the US and UK leading the way, allowing further easing of lockdowns and enabling increased economic activity. Nonetheless, as the recovery continues to unfold, this will present varying opportunities across equity markets.

While reflation and rising bond yields may have spooked investors in recent months, minutes from the latest Fed meeting confirmed that US policymakers are comfortable allowing Treasury yields to rise, with no imminent plan for yield curve control. Further commentary suggests US officials are not bothered by anticipated inflation spikes, and will remain patient before making changes despite breakeven inflation rates reaching multi-year highs. As Chairman Powell reiterated, ‘the recovery is far from complete, so we will continue to provide the economy the support that it needs for as long as it takes’ - comforting words for both companies and investors alike.

The path to recovery is still playing out and some more bumps in the road could be expected. Fortunately, indicators from vaccine rollout programs have been encouraging so far but economic activity still remains subdued, particularly as it pertains to international travel and tourism. Further, as we have seen in the first four months of the year, volatility could strike at any moment as it has done so with both the equity and bond markets. Similar themes are likely to continue as the recovery will be divergent among sectors and regions.

Equities

The portfolio’s neutral allocation to global equities has increased meaningfully by 10%, while the allocation to Australian equities has reduced by 2% as part of the April 2021 review. While we still remain cautious as the Covid-19 pandemic recovery continues – and remains highly divergent across regions – we have seen resilience across equity markets with particular support coming from fiscal and monetary policy measures. The vaccination programs – articularly in the US and the UK – have also been progressing smoothly which bodes well for further easing of lockdown measures. Several sectors, however, are still lagging behind, particularly as international borders remain shut, negatively impacting tourism, travel and associated industries. Between 31 December 2020 and 30 April 2021 the S&P/ASX 100 Accumulation Index has risen by 6.88%, while the MSCI World Index increased by 9.25%, both in local currency. On the whole, we are positive on risk assets given their resilience in the continuing global recovery.

Bonds and cash

Central bank officials have maintained that accommodative policy settings are here to stay until a firmer recovery is made, and while both global and domestic bond yields higher up the curve have increased in the last few months, there is still substantial room to move. While exposure to defensive assets such as Australian government bonds and cash can be beneficial during times of uncertainty, as conditions continue to improve we expect a search for yield to resume in earnest. As a result, we have reduced the overall allocation to fixed income, lowering the exposure to both Global and Australian Government bonds. While the overall exposure to bonds has decreased, based on the relative risk and return outlook we have shortened the tenor of our Australian bonds allocation meanwhile we have lengthened the tenor for our global bonds exposure. We have also sold off and closed our positions in high yield corporate bonds as spreads have become too tight, leading the risk and return of the asset class to lose attractiveness. On the cash front, we have maintained this level at 5% as we believe cash is still king for liquidity purposes.

Global Listed Property

Global real estate markets have remained optimistic, supported by the strong economic recovery so far this year. The move to introduce a neutral allocation to listed global property is in line with the overall increase in growth assets within the portfolio, funded by reducing the allocation to bonds. Further, the listed property asset class retains some defensive characteristics compared to just increasing exposure to corporate shares. Adding this new asset class to the neutral asset allocation is also part of the continual evolution of the portfolio and processes to ensure the portfolio meets its objective.

Commodities

As part of this review, we are re-introducing the neutral allocation to commodities and in particular industrial metals, which are pro-cyclical and therefore will benefit from higher growth and inflation. As part of the implementation of our Responsible Investment exclusions, we researched the effect of excluding energy commodities and in this found that industrial metals are even more pro-cyclical than energy, despite common assumptions that energy commodities are the natural pro-growth trade.

As our risk and return expectations for these asset classes continue to evolve, we remain cautious in our NAA and will rely on our Dynamic Asset Allocation (DAA) signals to exploit shorter-term opportunities. While the increase in equities can be viewed as adding risk into the portfolio, the exposure to high yield credit has been removed entirely, helping to partially offset the risk at a portfolio level.

What exactly is the NAA review?

The first step in our investment process is to determine the economic outlook, both globally and for individual countries. Twice a year, we formally review existing assumptions and determine the likely long-term values for inflation, risk free rates, long-term bond yields, and earnings growth.

Using current valuations as a starting point, these determinations enable us to calculate expected returns for various asset types globally. In turn, this helps inform the most appropriate mix of investments (NAA) that have the highest likelihood of achieving the Fund’s long-term objectives.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

This material is directed at persons who are professional, sophisticated or ‘wholesale clients’ (as defined under the Corporations Act 2001 (Cth) (Corporations Act)) and has not been prepared for and is not intended for persons who are ‘retail clients’ (as defined under the Corporations Act).

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

The product disclosure statement (PDS) or Information Memorandum (IM) (as applicable) for the First Sentier Multi-Asset Real Return Fund, ARSN 161 207 165 (Fund) issued by Colonial First State Investments Limited (ABN 98 002 348 352, AFSL 232468) (CFSIL), should be considered before deciding whether to acquire or hold units in the Fund(s). The PDS or IM are available from First Sentier Investors. CFSIL is a subsidiary of the Commonwealth Bank of Australia (Bank). First Sentier Investors was acquired by MUFG on 2 August 2019 and is now financially and legally independent from the Bank.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom