Given the unimaginable extent of the dividend cuts across the market, equity income investors must explore new ways to generate sufficient income. Here’s how to design a retirement income strategy that can potentially deliver reliable, consistent income through a multitude of market scenarios.

Step 1: Step back from just thinking about dividend yields

For a large number of investors, their equity income strategy is based on identifying the most attractive high dividend yield names to invest in.

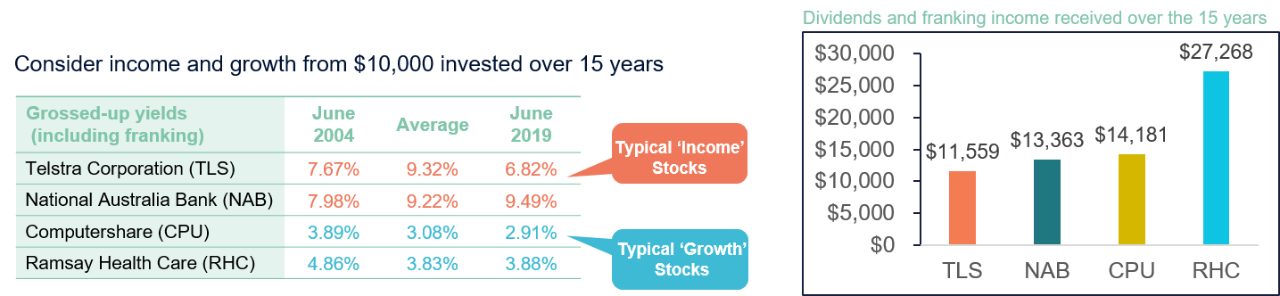

Most income investors will only invest in high dividend yielding stocks like Telstra and National Australia Bank. They may be attractive in the short term, but are these stocks effective at providing income over time? Which of the following four stocks do you think delivered the highest income on a $10,000 investment between June 2004 and June 2019?

Sources: First Sentier Investors, Factset, IRESS. 65 stocks from the current S&P/ASX100 have the required 15 year price and dividend history. Forecast yield data calculated from the following year’s total dividend divided by the start of year stock price. Total income and capital over 15 years calculated assuming $10,000 is invested in June 2004. Any fund or stock mentioned in this presentation does not constitute any offer or inducement to enter into any investment activity.

Look at the difference between yield and long-term income. Investors in the low yield stocks would have received significantly more income than those in high yield names. Investors need to look beyond dividend yields for better income and total return opportunities.

Step 2: Think about income as a dollar concept, not a percentage (yield)

We often see the terms yield and income used interchangeably when describing investment strategies. When developing retirement income plans, the discussion with the client is in dollars. Yet we switch to percentages when thinking about investment strategies. Focusing on yield, which is simply the dividend income as a percentage of the current share price, is a classic example of this change. But as you can see from the higher income delivered by Computershare and Ramsay Healthcare, they couldn’t be further apart. Thinking about dividend income on a ‘yield’ basis can deliver poor income on a ‘dollar’ basis over the long term.

Step 3: Adopt a long-term mindset when thinking about income

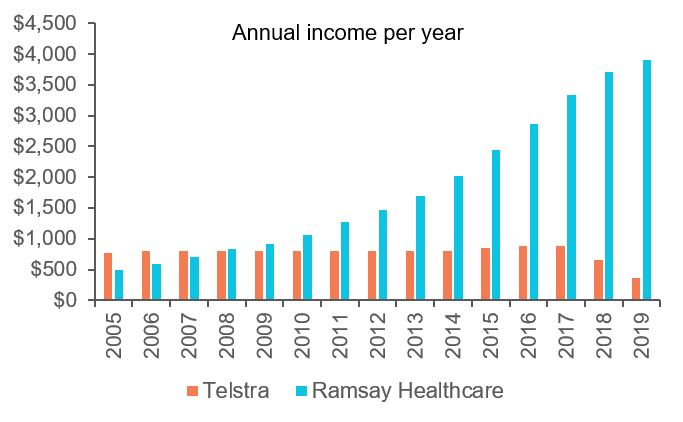

In the early years, stocks with higher yields will generate more income. But in the long term, it’s a very different story. For stocks like Ramsay Healthcare, Computershare, and countless others, the low yield has been paid on a share price that has been growing over time.

Sources: First Sentier Investors, Factset, IRESS. 65 stocks from the current S&P/ASX100 have the required 15 year price and dividend history. Forecast yield data calculated from the following year’s total dividend divided by the start of year stock price. Total income and capital over 15 years calculated assuming $10,000 is invested in June 2004. Any fund or stock mentioned in this presentation does not constitute any offer or inducement to enter into any investment activity.

These companies reinvested in their business rather than just paying out high dividends in the early years. Over time, companies that can achieve higher earnings per share typically deliver stronger share price appreciation – and a higher dividend per share growth. This results in potentially higher income – and total return – for the investor over time. This is the key to generating sustainable, long-term income.

Step 4: Embrace a total return focus

By thinking long term and understanding that longer term earnings growth will underpin long-term dividend income, investors can embrace a total return approach to selecting stocks in their portfolio. Just think how powerful that is. A total return approach provides the flexibility to be invested in the right stocks, at the right time, at the right price during different market conditions. This approach can seek to deliver a diversified portfolio that can weather a multitude of market conditions and avoid the concentration problems experienced by many equity income strategies. This means your conservative equity income investors can continue to access the best investment ideas across the share market, even when there is a need for income.

Step 5: Understand the role options can play in your equity income strategy

What if your clients want more income now? A carefully implemented options strategy can be used to balance short term income needs with the generation of long term total returns – and be delivered with smoother returns through the market cycle. In addition to the two traditional streams of income generated from dividends and franking credits, an options strategy can exploit share price volatility to generate a third stream of income called option premium income. This additional stream generates potentially higher income when the market is experiencing elevated volatility – particularly through the tougher periods where companies are forced to cut dividends. These three sources of income provide opportunities to generate above market income distributions through various market conditions.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom