The ongoing coronavirus (COVID-19) outbreak has morphed from a health crisis to an economic crisis, forcing governments to balance keeping their people safe with limiting the severity of the economic downturn including a raft of extraordinary fiscal support measures. A by-product of this sizeable government spending is that S&P Global Ratings has changed its outlook for Australia’s AAA credit rating to ‘negative’, which indicates they are considering a downgrade.

After all, there are consequences to ramping up borrowing to pay for all the programs that have recently been put in place. As many credit ratings tie – both directly and indirectly - into Australia’s sovereign rating, a downgrade could have wide-ranging effects across the domestic fixed income market. In this post, our Australian fixed income team share their perspectives on the various knock-on impacts of a sovereign downgrade.

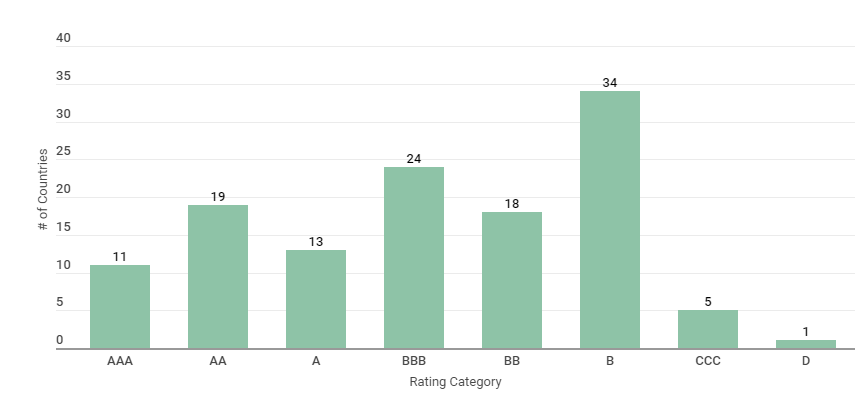

Number of countries per S&P credit rating bucket

Source: Trading Economics as at 17 April 2020

Ratings Overview and Key Issues

One of the Big Three credit ratings agencies, S&P, has recently changed Australia’s rating outlook to negative. The other two major agencies being Moody’s and Fitch have not yet made a similar move but remain on alert given the rapid pace of new developments. A negative outlook in this case means there is a one in three chance of a downgrade over the next two years if the government cannot control future budget deficits and the overall debt burden. As it stands, Australia is one of only eleven countries with this rating.

We believe this move from S&P is unsurprising as they signal to the market that they are being vigilant and that the balance of risks has clearly shifted to the downside. At this stage, however, they are willing to give Australia a degree of latitude in providing short-term stimulus measures during this crisis, due to the hard work they have done over preceding years building up a degree of credibility, with respect to their fiscal responsibility. The improvement in the external position, with Australia recording its first current account surplus in 44 years in the second quarter of 2019, also acts as a potential offset. This latitude however will only stretch so far. Should there be any hint that the structural deficit has declined to an unsustainable percentage of GDP, we suspect a downgrade would be relatively swift. In terms of the implications of a downgrade for the sovereign, the loss of the AAA rating would likely be immaterial with respect to investors’ views on the credit quality of Australia, and therefore we do not anticipate an increase to the current record low borrowing costs (or yields) should this occur. While there would be a loss of face politically, Australia would still be one of the few ‘very highly rated’ economies out there (likely AA+ or possibly AA) and a meaningful impact to demand for our paper would be unlikely.

Implications for Semi-Governments

Relativities of ratings of Semis will be affected by any downgrade of the sovereign rating. This reflects that it is very difficult for a State Government to be rated higher than the sovereign, so any AAA rated State would essentially automatically be downgraded to AA+ by S&P if Australia was downgraded by one notch. However, the lower rated States would likely not be similarly impacted, as they would not be rated above the sovereign. This would see the ratings of NSW, Victoria and ACT debt lowered to AA+, hence equalling the rating currently assigned by S&P to Queensland and Western Australia. The compression in relative ratings would likely place narrowing pressure between the bond yields of the currently AAA rated and non-AAA rated States. That said, the ongoing impact is expected to be minor as the ratings remain high relative to other fixed income investments. There is also the prospect that the currently AA+ rated States could be downgraded independently based on increased issuance requirements. This suggests that relative funding needs may continue to be the dominant influence of State ratings and Semi pricing.

Implications for Australian Banks

As with S&P’s outlook change on Australia’s sovereign rating a few years ago (which was subsequently reversed), a one-notch downgrade of Australia’s AAA rating would be expected to result in similar rating actions for the AAA-rated state governments and the Australian major banks as the sovereign represents a ‘ceiling’. In particular, a lower sovereign rating would reflect the agency’s view of a reduction in its capacity to support systemically important financial institutions in a timely manner if required. For this reason, the ratings outlook for the major banks also changed to negative from stable by S&P.

It is worth noting that while downside fiscal and economic risks as a result of the COVID-19 outbreak drove the negative outlook on the sovereign rating, it is less relevant to the overall ratings of the major banks. Interestingly, if the standalone credit strength of the major banks as assessed by S&P were downgraded by one-notch, as a result of the financial impact of the COVID-19 outbreak, this in itself would not result in a rating change of the banks if the sovereign retained its AAA-rating. In effect, the agency views the strength of government support as offsetting fundamental deterioration at the bank level. For this reason, we now see the Australian government as a key driver of the Aussie major banks’ credit ratings, and to a lesser extent spread movements, near-term.

Impact on the Australia vs. United States Government Bond Yield Spread

There are a number of factors that drive the yield differential between Australia and the United States including the country’s credit worthiness, absolute return levels, and the expected cyclical paths for each economy. Looking at each driver, we see roughly 60% of Australian government bonds outstanding are held by offshore investors although most of these are central banks. We may see a short-lived reaction of selling (i.e. higher yield) by some offshore investors, but we would expect Australian government bonds to remain a liquid asset class for central banks to continue holding.

This is a global pandemic, so the credit worthiness of all countries is likely to be somewhat impacted, cementing Australia’s top tier credit standing on the global stage. Central banks around the world have all moved interest rates to their “Effective Lower Bound.” This means that current interest rates in the US and Australia are both effectively 0.25% and Australia’s 10-year rate is only 15 basis points higher than the US. So on a relative basis, both short- and long-term rates in both countries offer a similar return to investors, and both central banks are providing significant support in the form of asset purchase programs or quantitative easing (QE). While the situation is highly dynamic, Australia currently appears to be in a better position in containing the virus, and if this can lead to a quicker re-open function of the economy, then Australia’s economy will begin to normalise before the US. Short-term rates may remain low for a long time, but this may help Australian 10-year bond yields stay elevated compared to the US.

Impact on Australian Inflation Expectations and Inflation-Linked Bonds

Australian breakeven inflation is defined as a spread between nominal government bonds and equivalent maturity inflation-linked bonds (ILBs). Hence the implications for an Australian sovereign downgrade described in the sovereign bond section are removed leaving inflation expectations as the residual factor exposed. Typically, a sovereign downgrade results in currency depreciation as investors’ confidence in investing in the country’s assets declines. Expectations of lower currency would boost the outlook for near term inflation and have a widening impact on breakeven inflation. The other potential implication is related to the foreign ownership of Australian government bonds. In the event of a sovereign rating downgrade, there is a possibility of offshore investors being required to reduce their allocations to Australian government bonds based rating guidelines or constraints in their mandates. Foreign investors currently hold around 30-35% of the inflation-linked government securities on issue compared with 55% ownership of nominal bonds. This composition potentially implies less selling of ILBs and a slight widening of Australian breakevens. Saying that, the forced selling scenario would be at the margin for a one notch downgrade from AAA to AA+, reflecting the lack of similarly high yielding AAA assets globally. Taken together, in our view the impact on Australian inflation expectations would likely be modest.

Implications for Trading/Dealing in Australian Fixed Income

Aside from some near term uncertainty, which might include wider bid/offer spreads for a short time (perhaps only intraday), we do not anticipate the Australian government bond market to be affected to the point where it impairs trading and market making. There is certainly a precedent to say that yields do not need to rise. For example the S&P rating downgrade of the US in 2011 saw yields fall sharply following the announcement.

The real action would be expected in the sub-sovereigns, especially as their ties to the sovereign increase. There are two main sectors at risk here – sub-sovereign governments such as States and the banking sector. Should the sovereign be downgraded and the ceiling for AAA-rated State governments be lowered, there could be a little horse trading between the various ratings, with bid/offer spreads widening sharply until there is more clarity, especially in the non-AAA bonds. Trading and liquidity might be more challenging in this environment. Similarly, for banks, spreads may widen and liquidity may diminish, but this would be expected only for a short time, as markets are aware that Australia’s banks are both well regulated, capitalised, and supported by both the government and the Reserve Bank of Australia.

Inversely, trading activity in the corporate bond market is heavily dependent on individual issuer credit ratings and is highly exposed to poor liquidity conditions. Corporates have no specific government reliance and are measured on the state of economy and how their respective business models apply to it. In an environment deemed weak enough to warrant a sovereign downgrade, dealing would remain more difficult with more limited liquidity and higher transaction costs in the form of wider bid-offer spreads.

Final thoughts

While the Australian Fixed Income team philosophically believes in the benefits of active management, we manage a variety of passive portfolios on behalf of clients. From the perspective of a passive investor, a sovereign rating downgrade can have meaningful implications on the composition of the underlying constituencies that make up a given index. This can occur via movement in the respective weightings of securities at both a sector and issuer level. Also, there may be impacts to the overall credit quality of the index as entire names may drop out of the benchmark to reflect the perceived credit quality after the downgrade has worked its way across various sectors. Hence the chief limitation of purely passive approaches – you accept the ‘market’ whatever that is defined to be. Therefore, opportunities for outperformance would likely arise as fixed income markets and investors adjust to a new regime and only an active approach could seek to exploit these.

Another related area we have focused on is with respect to mandate or fund guidelines and operational considerations to ensure there would be a seamless transition should we see a downgrade of Australia’s sovereign credit rating. For example, we need to ensure any internal portfolio constraints, which are systematically coded into our portfolio management and trading systems for both pre- and post-trade compliance, will not be triggered simply because Australia’s credit rating moves from AAA to AA+. However, much of this analysis has already been done across our business during prior periods such as the US AAA downgrade in 2011 and the more recent outlook change by S&P in 2017.

In conclusion, Australia is not the same global economic and monetary hegemony of the US, but we do have a freely floating, unencumbered currency like the US (and UK, and Japan, and Canada etc). Further, our government debt is denominated in our own currency. This is extremely important, because despite what S&P might indicate, we do not believe Australia is in any danger of not being able to pay its obligations. We think the country’s ability to honour debts at the national level is effectively the same whether the rating is AAA or A+ like Japan. The market understands this, and the recent reaction, or lack of reaction, to the negative guidance announcement from S&P highlights this. It is really all the knock-on effects of a downgrade that we have been and remain focused on.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom