Investors with patient capital play a crucial role in financing innovative companies and bringing their long-term vision to life. But projects need to line up multiple stakeholders to succeed, and it can take years for the stars to align between regulators, governments, investors and market sentiment. Once they do, however, the outcomes can be truly stellar.

Our investment philosophy is to identify small, growing businesses in which we co-invest, helping them achieve their goals, while aiming to deliver long-term returns to investors.

Two companies we have invested in illustrate the importance of long-term partnerships with emerging companies, and the impact that investors can have when they allocate capital to innovative ‘green’ projects.

Genex Power (ASX: GNX)

Genex is focused on renewable energy generation and storage. Its flagship project, the Kidston Clean Energy Hub, combines an operating 50 megawatts (MW) solar project, a 250MW pumped storage hydro project (in construction), and a 150MW wind project (in development)1.

Using a decommissioned gold mine, Kidston is the first pumped hydro project in Australia for 40 years and unlocks the renewable generation potential of North Queensland. Genex has been on an important journey in recent years, securing funding from equity investors, the Northern Australia Infrastructure Facility, the Australian Renewable Energy Agency, the Clean Energy Finance Corporation, and green (sustainability-focused) bonds from major banks2.

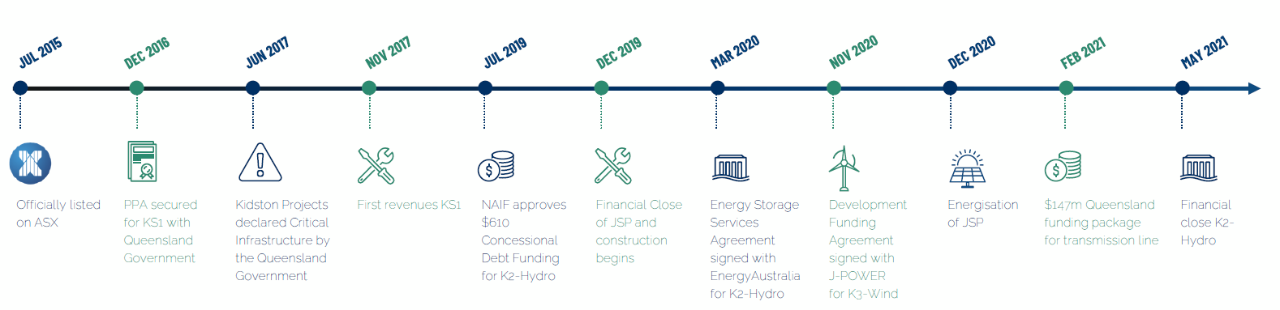

The process to secure these funding sources has not been a linear one. As a long-term investor, we’ve had to ‘keep the faith’ at various points in the Kidston project’s development. While this has been testing for both management and investors, the project reached final close in May 2021 and construction has commenced in April 2021 – rewarding our patience over the last few years.

Chart 1: Timeline of Genex milestones, Source: company presentation May 2021

With this greater certainty, the share price has become more stable and we believe the company has significant upside thanks to its diverse revenue streams, innovative technology and strong investor backing.

Ecograf (ASX: EGR)

EcoGraf is building a vertically integrated ‘HF-free’ battery anode material business, supporting the global transition to clean energy and e-mobility. The problem with the current lithium-ion battery production supply chain is that it’s 100% reliant on China, and the natural graphite required is energy-intensive to produce, and uses a toxic hydrofluoric (HF) acid to process it.

This is a concern for the Electric Vehicles (EV) industry, as there is a disconnect between the ‘clean, green’ goals of EV customers, and the processes required to power their vehicles. With analysts predicting growth of over 700% in demand for natural graphite by 2025 (source: BloombergNEF, June 2021), improving the environmental footprint of the industry is an urgent challenge.

EcoGraf has responded by creating a state-of-the-art processing facility in Western Australia to manufacture graphite products for export. It uses a superior, environmentally responsible, HF-free technology to produce high performance battery anode material. Not only does this remove the supply chain risks associated with processing graphite in China, it removes a toxic manufacturing process for an industry (EV production) that is seeking to improve environmental outcomes.

We have been invested in Ecograf since 2016, as we recognised the potential of this technology to disrupt the battery production market and solve a growing problem of relying on China for battery anode materials. As the largest shareholder, we were early believers in this technology - but it now sits at the intersection of major global trends, including:

- US President Biden’s plan to electrify the US Federal Government’s vehicle fleet and roll out 500,000 EV charging stations nationally.

- The EU Commission’s new regulations on batteries which mandate more environmentally responsible carbon footprints, sourcing, traceability and recycling.

- Unprecedented investment in new European battery capacity to meet the needs of up to 10 million electric vehicles being produced per year.

- Deteriorating trade relations between China, US and Australia, making both investment research and supply chain tracing difficult in that country3.

Ecograf is now in advanced planning stages for its processing plant in Kwinana, WA, after more than four years of intensive test work and process design. It has secured both Federal and State Government support for the construction of the plant.

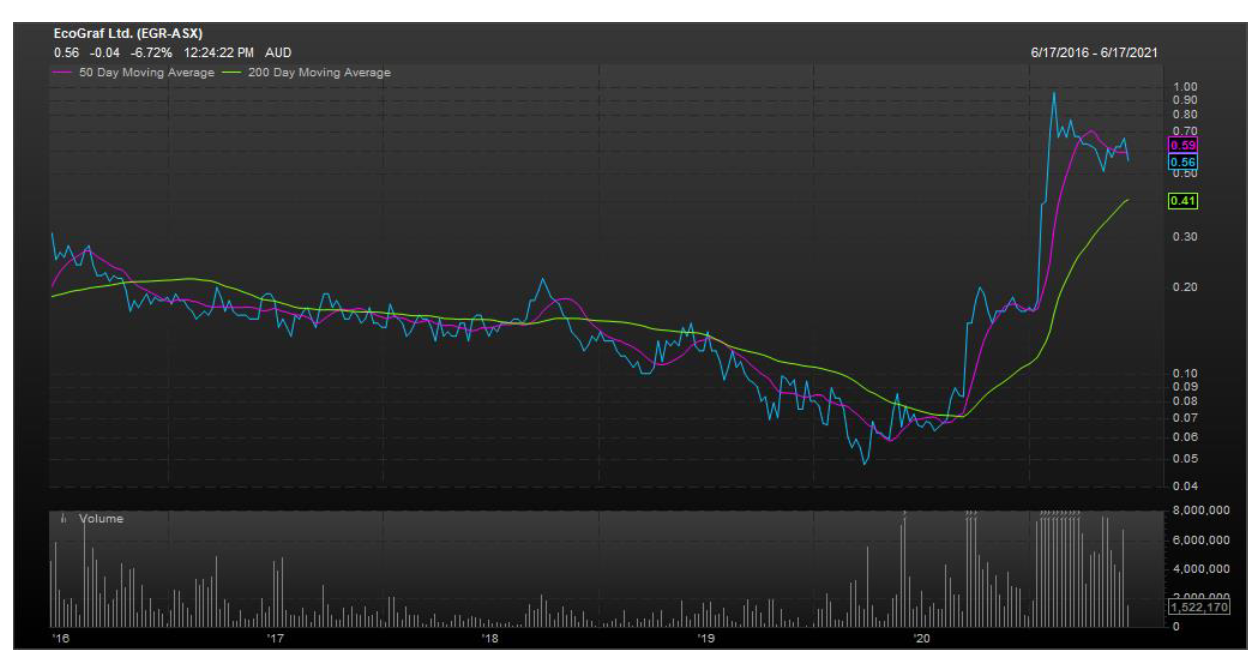

In the time we’ve been invested in Ecograf, the share price has been trading below our assessment of fair value. However, with market dynamics converging towards a boom in EVs and other battery-powered devices, investors have recognised the company’s significant potential. The share price has risen more than ten-fold since the beginning of 2020.

Chart 2: Ecograf share price, Source: Bloomberg June 2021

Being a small-cap investor sometimes means believing in a thesis while waiting for the market to catch up. In the case of Ecograf, we were always convinced of the importance of this technology and its role in the global battery industry. Now that the Kwinana project has been significantly de-risked, we are pleased to see positive market sentiment building around Ecograf and its investment performance reflecting this bright future.

1 Source: Company presentation, May 2021

2 Source: Company presentation, May 2021

3 All data sourced from Ecograf company presentation, June 2021

Any stock mentioned does not constitute any offer or inducement to enter into any investment activity.

Important Information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (Author). The Author forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for the Author is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation. Any opinions expressed in this material are the opinions of the Author only and are subject to change without notice. Such opinions are not a recommendation to hold, purchase or sell a particular financial product and may not include all of the information needed to make an investment decision in relation to such a financial product.

To the extent permitted by law, no liability is accepted by MUFG, the Author nor their affiliates for any loss or damage as a result of any reliance on this material. This material contains, or is based upon, information that the Author believes to be accurate and reliable, however neither the Author, MUFG, nor their respective affiliates offer any warranty that it contains no factual errors. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of the Author.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom