It’s hard not to react to what the markets are doing. It can be tempting to sell out of certain asset classes or follow the herd to the ‘next best thing’ but fortune favours the patient investor.

This has certainly been the case for value investors, who are experiencing a resurgence in the performance of value stocks.

Over the last decade, growth convincingly won the battle against value style investing, buoyed by central bank monetary easing and a low inflationary environment. Money was cheap and longer duration growth stocks rallied. In this period, value stocks averaged 7.13% returns per annum compared to growth stocks that yielded 11.08% 1.

However, over a near 50-year period, value has outperformed growth with the former averaging 11.24% per annum and the latter at 10.00%2 . For the long-term investor, the tides have again turned in favour of value, propelled by rising interest rates, persistent inflation and a raft of accelerating shifts in market dynamics.

While global value investors continue to rejoice the breaking drought, the question is now: will the recovery continue?

Straying the herd: the appeal of value investing

Value investors are like savvy bargain shoppers. Rather than chasing the investor herd towards the hottest stocks of the hour, whose popularity drives up the price, the value investor ‘buys low and sells high’. They stray from the herd to look for mispriced stocks to exploit undervalued gems overlooked by the rest of the market.

Value investors are not easily fooled by price – they know that ‘expensive’ does not necessarily translate to ‘quality’. Instead, they make judgments on the value and quality of a company by using metrics such as price-to-earnings (P/E) or price-to-book (P/B) ratios and looking at fundamental characteristics like the nature of the business, the quality of its management, its balance sheet and track record. Together, the quality of these characteristics tend to deliver stable earnings and reliable dividend streams.

This style of investing can appeal to investors with a lower appetite for risk as they are more likely to be investing in a cheaper and more stable, mature company.

Favourable conditions: inflation and subdued economic growth

While the scales are tipping in value’s favour, it remains to be seen whether a long reversal of fortune for the value style will continue. However, we are seeing two market conditions that tend to positively influence the performance of value stocks:

- Persistent inflation and rising interest rates look like they will remain for some time, increasing the cost of debt for companies. This will have a greater impact on ‘long duration’ companies who rely on longer-dated cash flows for their valuation compared to shorter duration companies. In other words, as the cost of money increases, these longer duration names – typically expensive growth stocks – are devalued and experience more sell-offs than shorter duration stocks, which are usually the cheaper value-style companies. In this scenario, value outperforms growth.

- Subdued economic growth expectations can mute a market’s propensity to make bets on growth projections and future positive cash flows. In this environment, expectations are less optimistic and investors become more sceptical of the ability for expensive growth companies to deliver stable, long-term growth, selling these off in favour of cheaper value companies with more certain short-term opportunities.

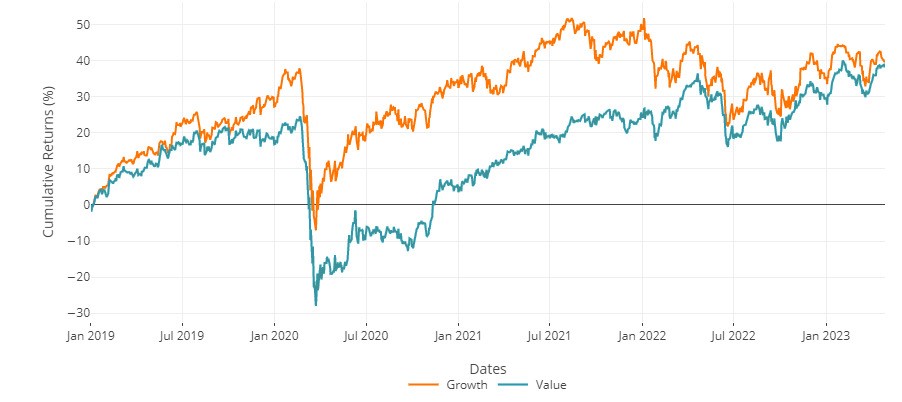

In combination, these two conditions have seen value prove to be more resilient, catching up with growth in both global and domestic markets, as the following two graphs show.

Chart 1: Recent performance of value and growth in global markets

Source: Factset; MSCI ACWI ex AU indices

Chart 2: Recent performance of value and growth in Australia

Source: Factset; S&P / ASX

Finding overlooked gems

In an uncertain environment, investors might think twice about following the popular opinion that expensive names will always offer better growth and higher quality than good value names.

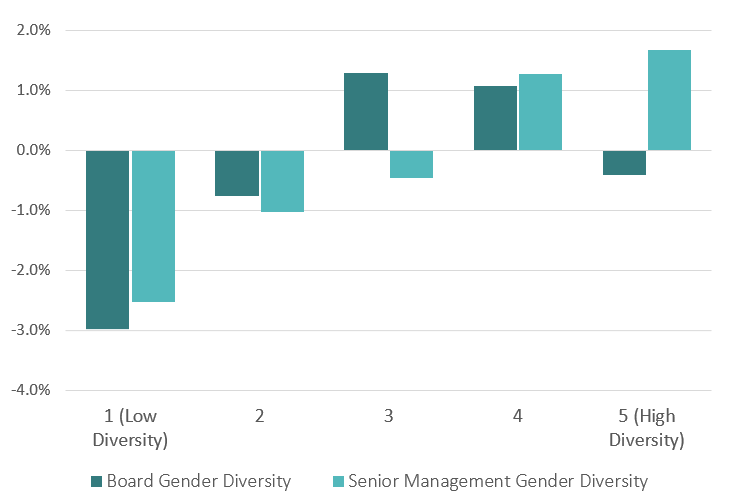

Instead of being lured by the promise of big riches, investors like Realindex look for signals that haven’t been priced in by the market, helping us to identify overlooked gems. For example, we undertook a study finding that gender diversity has not been fully priced by the market and boosting female representation in senior management teams results in higher profit margins and better company performance. Our analysis found there is a greater opportunity to generate alpha by identifying firms with more diverse senior management teams, than there is for diverse boards. This is possibly because the information on management is harder to source, and therefore attracts less focus. The conclusion we draw from the below graph is that investors who can identify and invest in companies with higher female representation in the C-Suite may boost their investment returns as well.

Chart 3: Relation between return and of gender diversity: Senior Management and the Board

Source: MSCI ACWI firms (2009-2021)

Slow and steady wins the race

In the world of investing, nothing is ever certain. The signs, however, show that while the hare has been in the lead for some time, it is the consistent and patient tortoise who is now making a comeback.

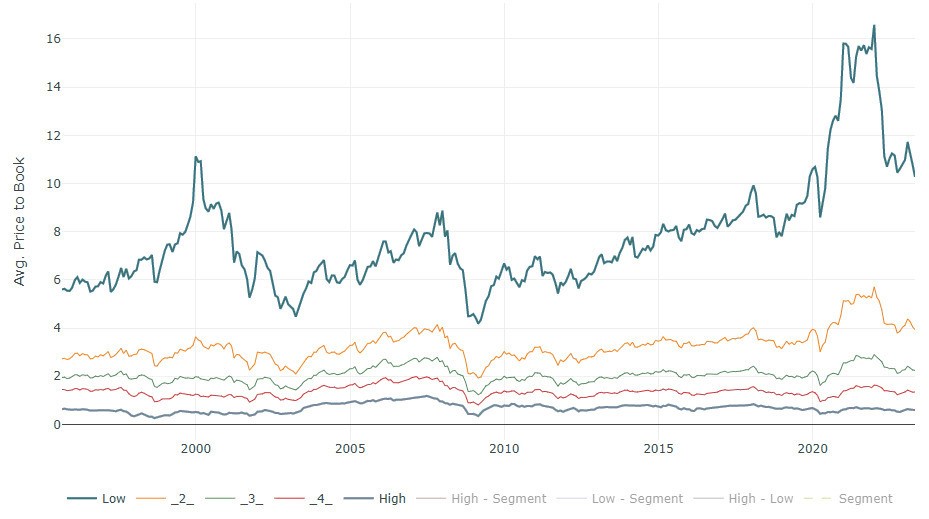

With valuation spreads between cheap and expensive names in global markets remaining wide relative to long-term averages, we are confident that value stocks still have room to perform.

Chart 4: Price-to-book spreads between cheap and expensive stocks

Source: MSCI ACWI ex AU

Value’s revival looks to be continuing for a while yet, favouring those investors who can uncover opportunities in the market’s blind spots.

1 According to the MSCI World Value and MSCI World Growth indices as at 28 April 2023. Returns in USD.

2 According to the MSCI World Value and MSCI World Growth indices as at 28 April 2023. Returns in USD.

Discover more

Important information

This material has been prepared and issued by First Sentier Investors (Australia) IM Ltd (ABN 89 114 194 311, AFSL 289017) (FSI AIM, Realindex), which forms part of First Sentier Investors, a global asset management business. First Sentier Investors is ultimately owned by Mitsubishi UFJ Financial Group, Inc (MUFG), a global financial group. A copy of the Financial Services Guide for FSI AIM is available from First Sentier Investors on its website.

This material contains general information only. It is not intended to provide you with financial product advice and does not take into account your objectives, financial situation or needs. Before making an investment decision you should consider, with a financial advisor, whether this information is appropriate in light of your investment needs, objectives and financial situation.

Any opinions expressed in this material are the opinions of the individual author at the time of publication only and are subject to change without notice. Such opinions: (i) are not a recommendation to hold, purchase or sell a particular financial product; (ii) may not include all of the information needed to make an investment decision in relation to such a financial product; and (iii) may substantially differ from other individual authors within First Sentier Investors.

To the extent this material contains any environmental, social and governance (ESG) related commitments or targets, such commitments or targets are current as at the date of publication and have been formulated by Realindex based on the Institutional Investors Group on Climate Change (IIGCC) Paris Aligned Investment Initiative framework. The commitments and targets are based on information and representations made to Realindex by portfolio companies (which may ultimately prove not be accurate), together with assumptions made by the relevant investment team in relation to future matters such as government policy implementation in ESG and other climate-related areas, enhanced future technology and the actions of portfolio companies (all of which are subject to change over time). As such, achievement of these commitments and targets depend on the ongoing accuracy of such information and representations as well as the realisation of such future matters. Any commitments and targets set out in this material are continuously reviewed by Realindex and subject to change without notice.

We have taken reasonable care to ensure that this material is accurate, current, and complete and fit for its intended purpose and audience as at the date of publication. To the extent this material contains any measurements or data related to ESG factors, these measurements or data are estimates based on information sourced by the relevant investment team from third parties including portfolio companies and such information may ultimately prove to be inaccurate. No assurance is given or liability accepted regarding the accuracy, validity or completeness of this material and we do not undertake to update it in future if circumstances change. No part of this material may be reproduced or transmitted in any form or by any means without the prior written consent of Realindex.

Any performance information has been calculated using exit prices after taking into account all ongoing fees and assuming reinvestment of distributions. No allowance has been made for taxation. Past performance is not indicative of future performance.

Copyright © First Sentier Investors, 2023

All rights reserved.

Get the right experience for you

Your location :  Australia

Australia

Australia & NZ

-

Australia

Australia -

New Zealand

New Zealand

Asia

-

Hong Kong (English)

Hong Kong (English) -

Hong Kong (Chinese)

Hong Kong (Chinese) -

Singapore

Singapore -

Japan

Japan

United Kingdom

United Kingdom